Update SJC gold price

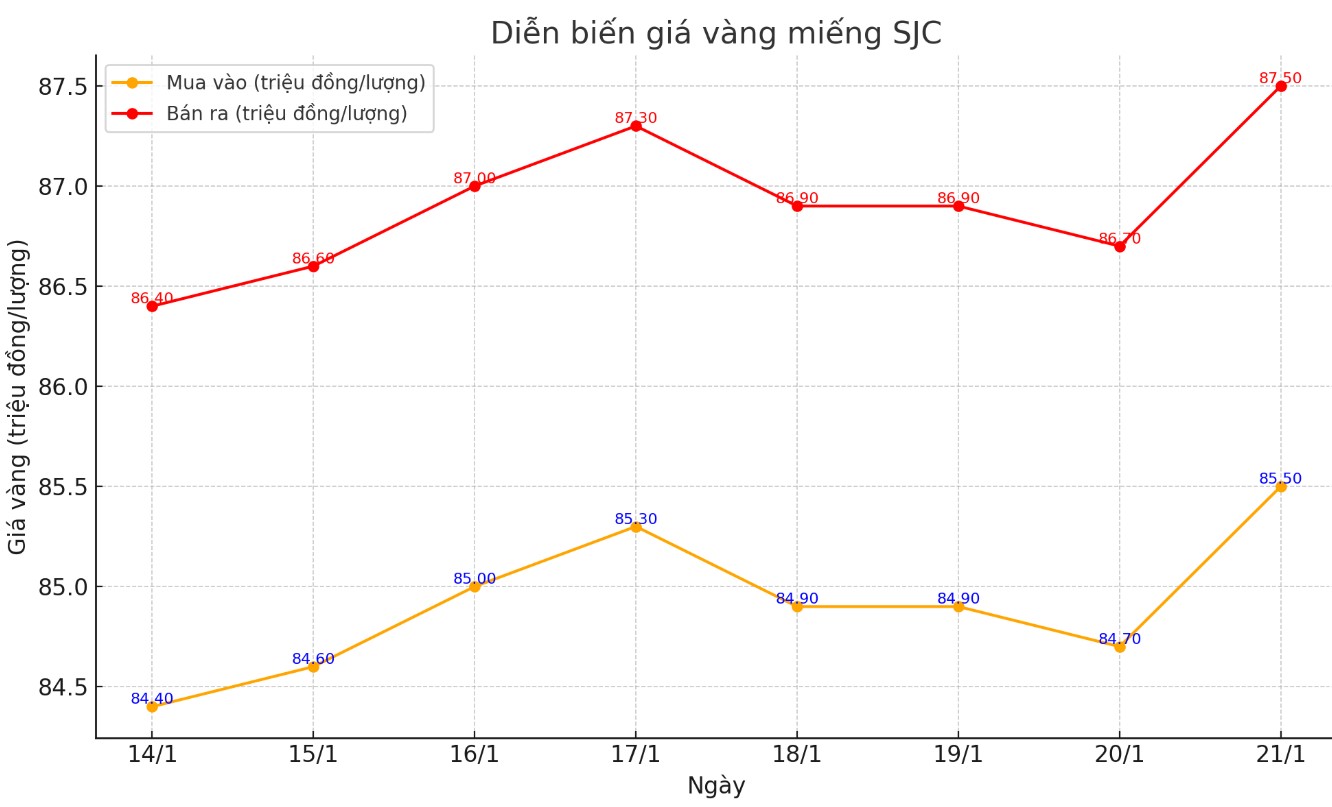

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND85.5-87.5 million/tael (buy - sell); an increase of VND600,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 85.5-87.5 million VND/tael (buy - sell); an increase of 600,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 85.5-87.5 million VND/tael (buy - sell); increased 600,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

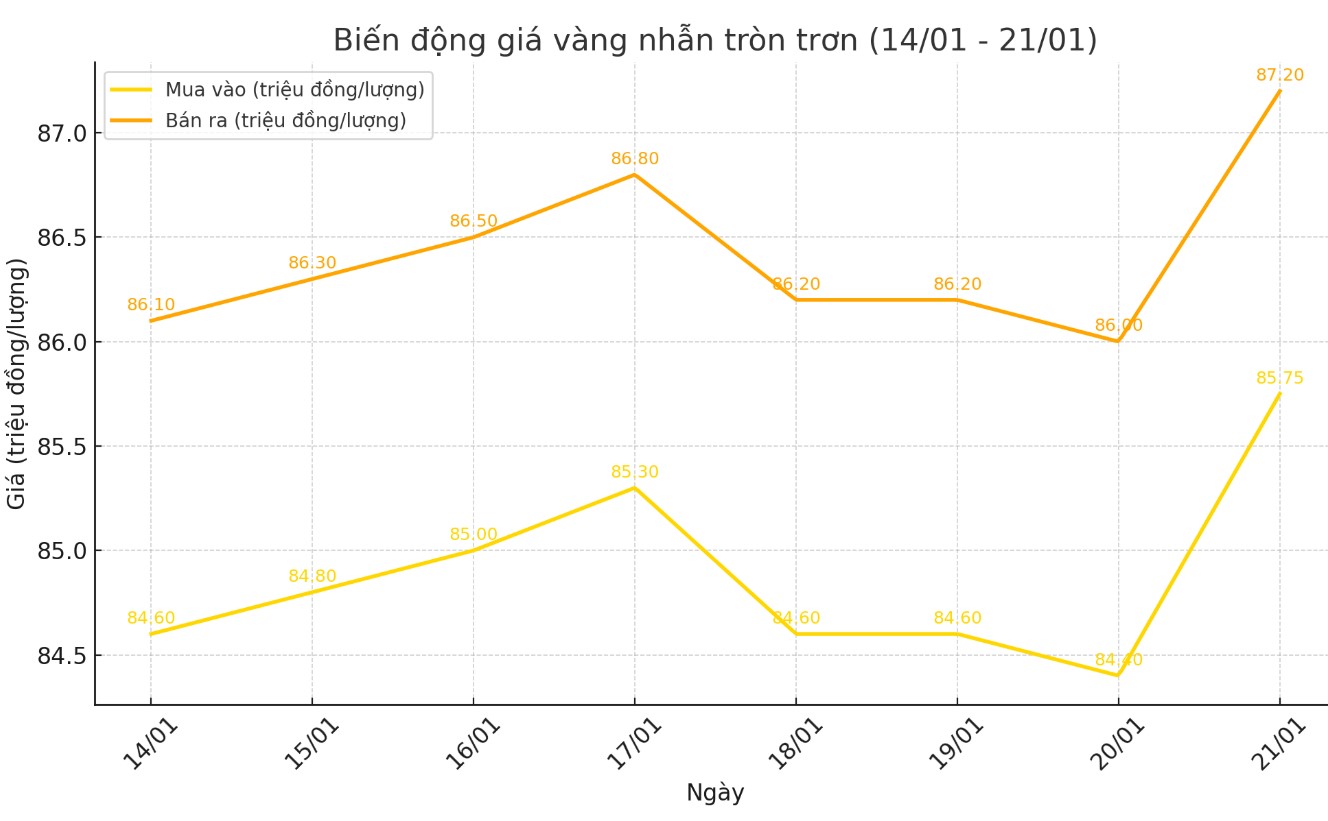

As of 6:30 p.m. today, the listed price of round gold rings was at VND85.75-87.20 million/tael (buy - sell); an increase of VND1.75 million/tael for both buying and VND1.2 million/tael for selling compared to the close of yesterday's trading session.

Bao Tin Minh Chau listed the price of gold rings at 85.5-87.45 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for buying and 600,000 VND/tael for selling compared to the closing price of yesterday's trading session.

World gold price

As of 6:30 p.m., the world gold price listed on Kitco was at 2,720.1 USD/ounce, up 11.6 USD/ounce compared to the same time of the previous session.

Gold Price Forecast

World gold prices increased in the context of the USD index decreasing. Recorded at 6:30 p.m. on January 21, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.585 points (down 0.57%).

Gold prices rose as US President Donald Trump is likely to delay imposing tariffs. According to the Wall Street Journal, Mr. Trump issued a presidential memorandum directing federal agencies to investigate trade deficits and address unfair trade and currency policies from other countries. However, the directive does not include imposing new tariffs on the first day of his inauguration, which many countries have feared.

Some analysts have attributed the rise in gold and silver prices to disruptions in the global supply chain as the precious metals are moved from London to New York. Donald Trump’s tariff threats have created huge volatility in the futures and physical asset swaps market, as banks have moved large amounts of metals to the US to avoid the risk of potential tariffs.

Investing in a diverse range of commodities is expected to continue to pay dividends in 2025 as a hedge against inflation and economic volatility, with gold and silver expected to outperform other commodities.

Despite the optimistic outlook for 2025, Ole Hansen, head of commodity strategy at Saxo Bank, forecasts gold prices to rise to $2,900 an ounce this year, representing a 7% increase from current levels. Hansen stressed that gold will continue to be an important safe-haven asset throughout 2025.

He also sees greater potential for silver, with a forecast of $38 an ounce, up nearly 30%. Hansen added that the outlook is biased to the upside.

See more news related to gold prices HERE...