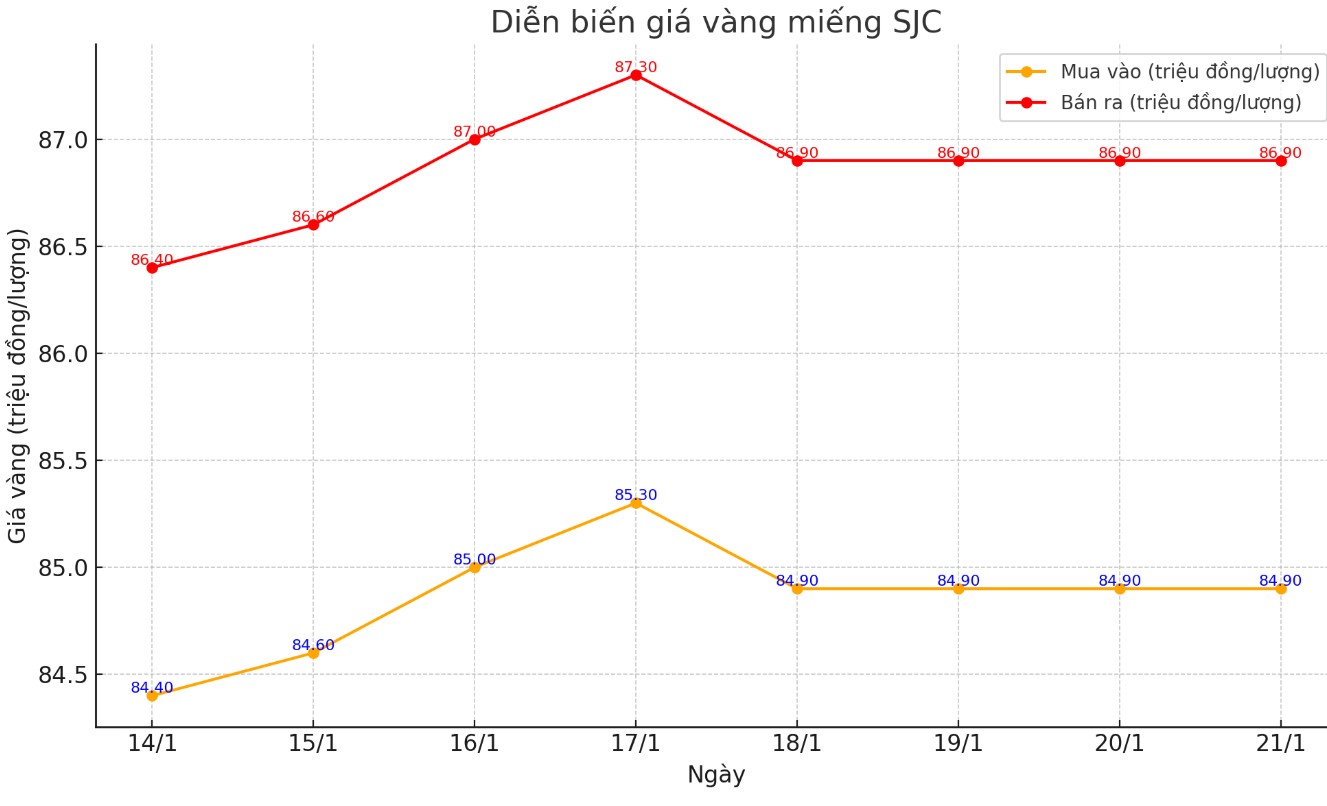

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND85.5-87.5 million/tael (buy - sell); an increase of VND600,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 85.5-87.5 million VND/tael (buy - sell); an increase of 600,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 85.5-87.5 million VND/tael (buy - sell); increased 600,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

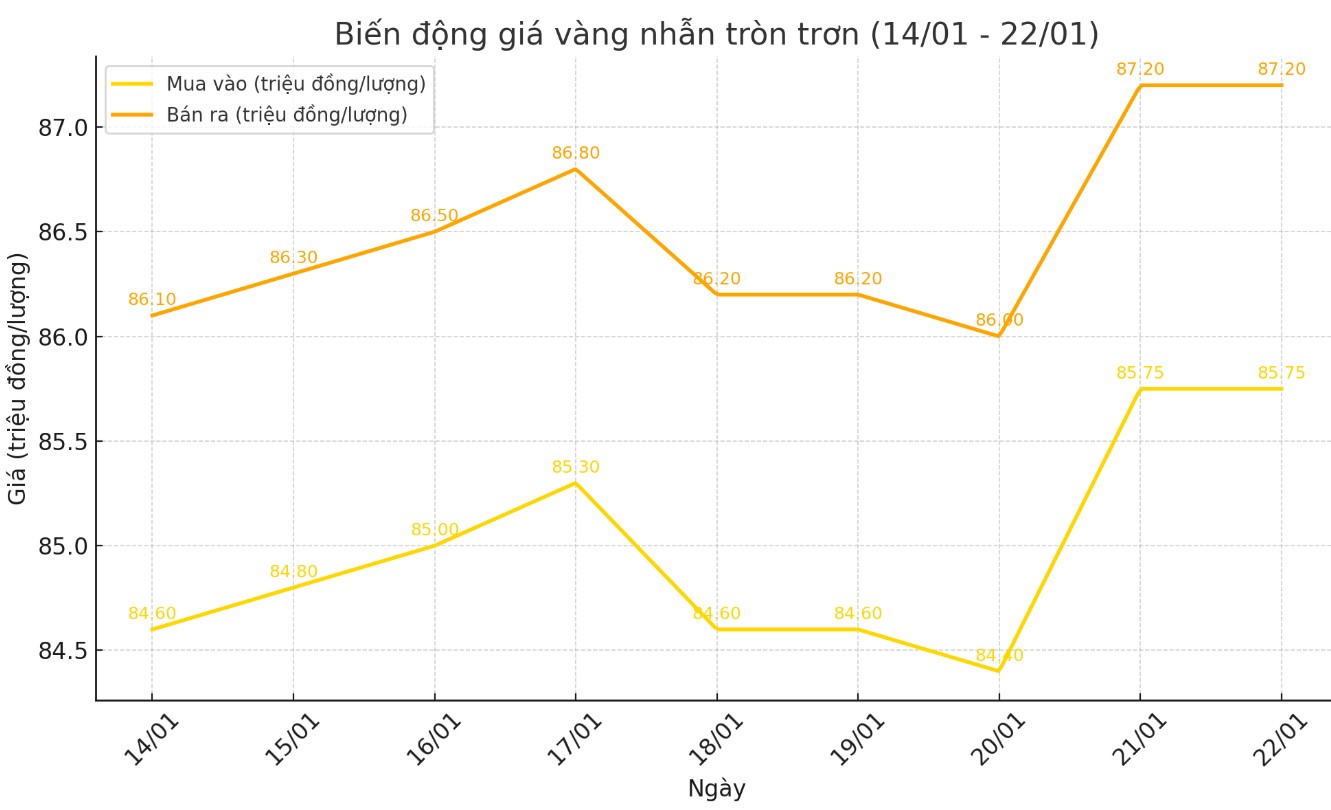

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.75-87.20 million VND/tael (buy - sell); an increase of 1.75 million VND/tael for both buying and 1.2 million VND/tael for selling compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 85.5-87.45 million VND/tael (buy - sell), an increase of 1.1 million VND/tael for buying and 600,000 VND/tael for selling compared to early this morning.

World gold price

As of 11:30 p.m. on January 21, the world gold price listed on Kitco was at 2,741.1 USD/ounce, an increase of 36.1 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices are receiving support amid a sharp decline in the USD index. Recorded at 11:30 p.m. on January 21, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.870 points (down 1.22%).

Markets are focused on the policies of US President Donald Trump, who took office on Monday. Bloomberg reported: “Trump’s policies have caused volatility in markets, traders are heeding warnings about currencies...

As the market assesses Mr Trump's plans, JP Morgan has set up a "strategy room" to analyze their impact.

Mr. Trump announced plans to impose tariffs of up to 25% on products imported into the United States from Mexico and Canada by February 1. He also promised to accelerate US energy development and remove restrictions on oil drilling in most of the US coast.

Asian and European stock markets traded mixed overnight. US stock indexes are expected to open higher and hit two-week highs when trading in New York begins.

In key overseas markets, Nymex crude oil futures fell sharply, trading around $76.00 a barrel. The yield on the 10-year US Treasury note is currently at 4.582%. There are no major US economic data releases on Tuesday.

Technically, the February gold futures are tilted to the upside, giving the short-term bulls an advantage. The buyers’ objective is to push the price above the key resistance at the December high of $2,761.30. Conversely, the sellers want to push the price below the strong support at $2,650.00.

Gold is currently trading between key support and resistance levels. The nearest resistance level is $2,750/ounce, followed by last week's high of $2,759.2/ounce. The nearest support level is $2,715.6/ounce, the overnight low, and further below that is $2,700/ounce.

See more news related to gold prices HERE...