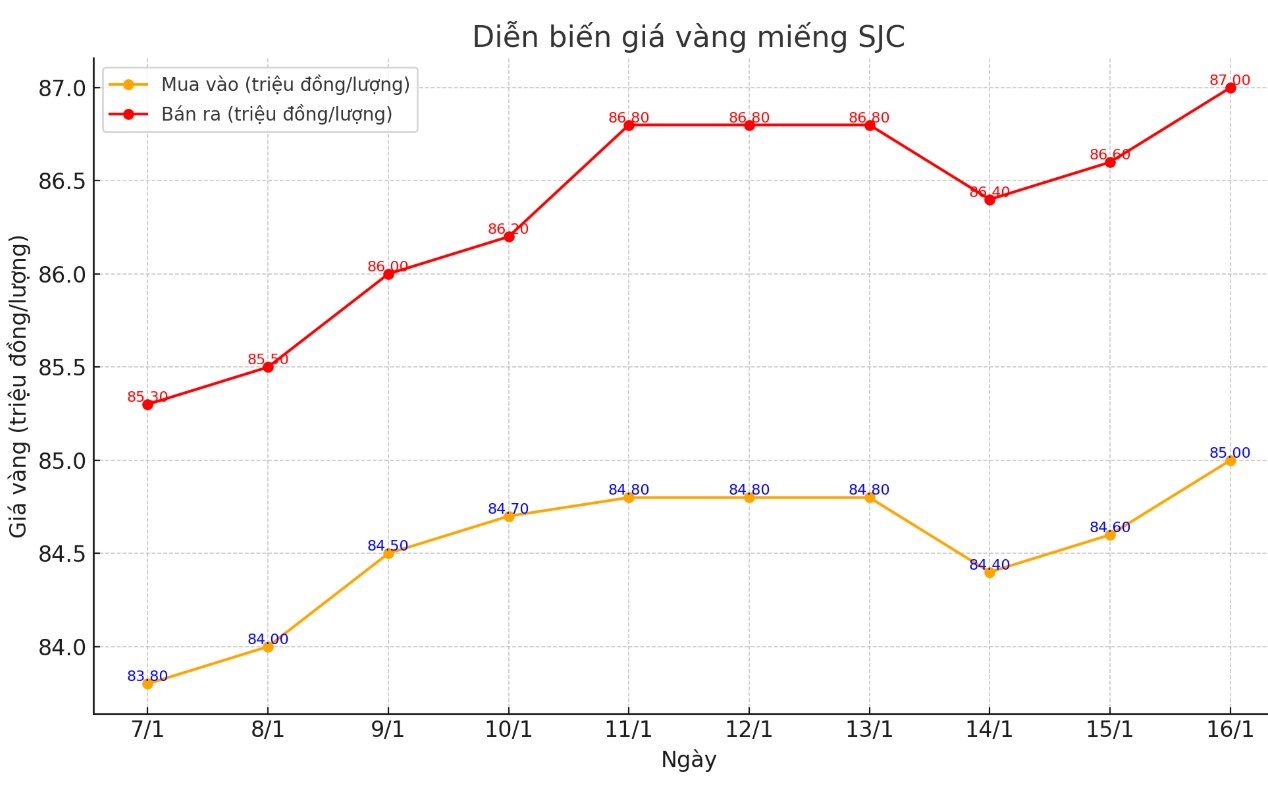

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND85-87 million/tael (buy - sell); an increase of VND400,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 85-87 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 85-87 million VND/tael (buy - sell); increased 400,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

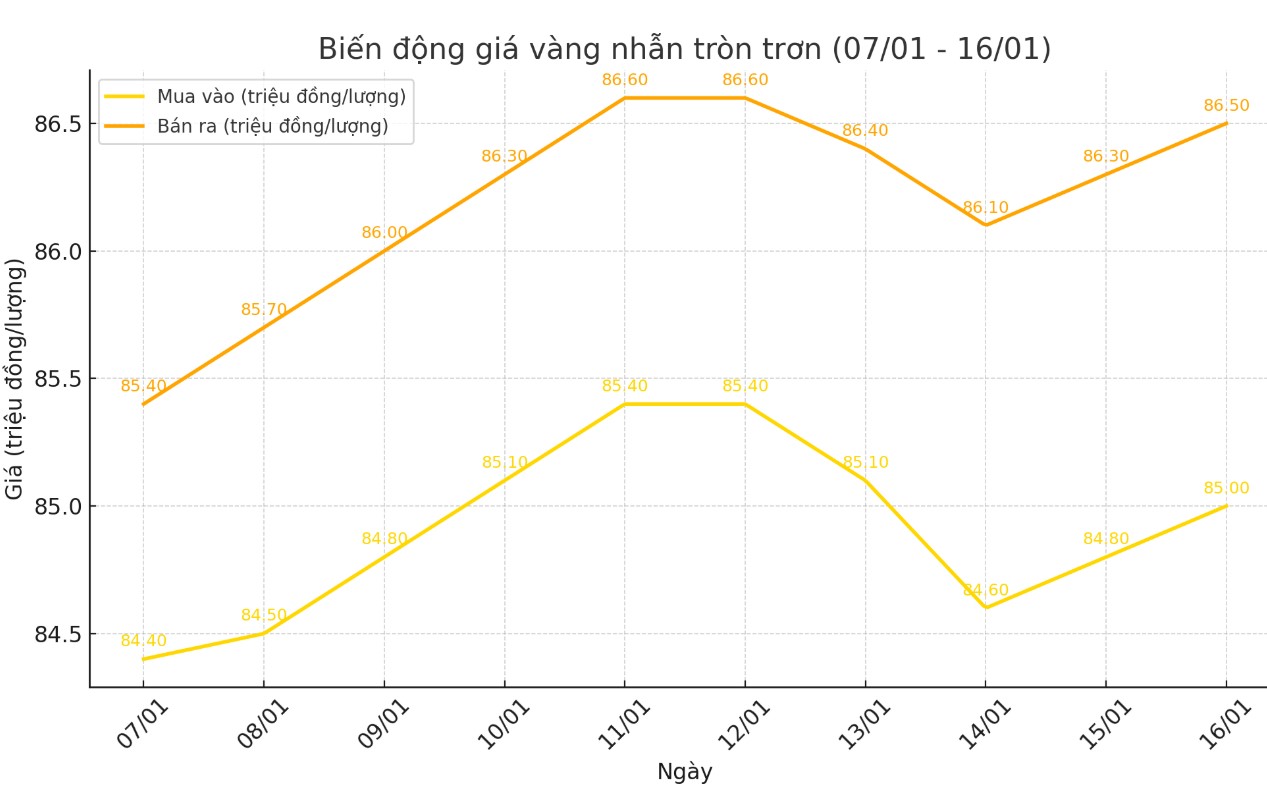

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85-86.5 million VND/tael (buy - sell); an increase of 400,000 VND/tael for both selling prices compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 85.45-86.95 million VND/tael (buy - sell), an increase of 950,000 VND/tael for buying and 600,000 VND/tael for selling compared to early this morning.

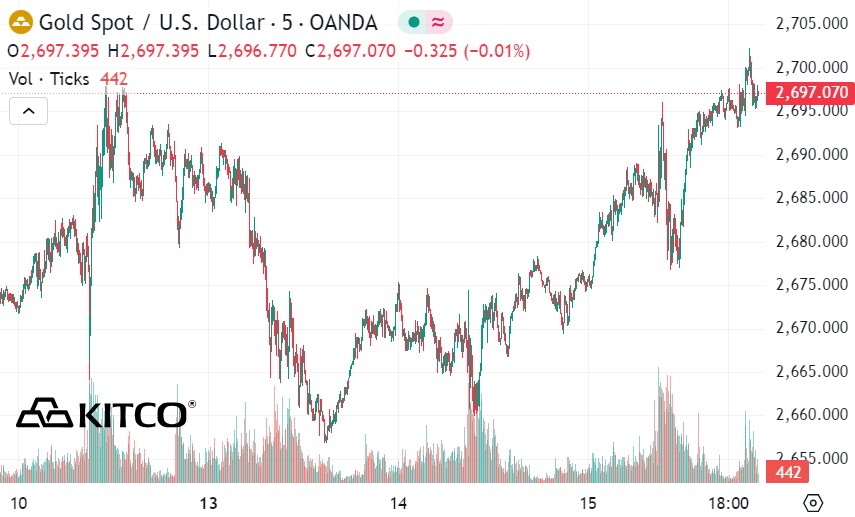

World gold price

As of 9:40 a.m., the world gold price listed on Kitco was at 2,697 USD/ounce, up 26.3 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased as the USD tended to decrease. Recorded at 9:40 a.m. on January 16, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.915 points (down 0.03).

After several sessions of decline, last night the gold price recorded an impressive increase, approaching the threshold of 2,700 USD/ounce. The gold price increased sharply due to receiving momentum after the new US inflation report showed that the increase was not too hot.

Key US economic data released today showed that the consumer price index (CPI) in December rose 2.9% year-on-year, in line with market expectations, compared to a 2.7% increase in the November report. The core CPI (excluding food and energy prices) rose slightly more than expected, only 0.2% compared to the forecast of 0.3% month-on-month.

US stock indexes are set to open sharply higher in New York trading, supported by softer US inflation data. In overnight news, the Japanese yen rose sharply on renewed speculation that the Bank of Japan will raise interest rates at its monetary policy meeting later next week.

Gary Wagner, a commodities broker and market analyst, told Kitco that the gold market will see "one last pullback before continuing its strong rally towards a new record high in 2025."

Gold prices have seen significant rallies in recent years, rising by around $500 an ounce on two separate occasions. Wagner said that if gold prices fall to $2,600 and then rise another $400, as they have in previous cycles, gold could hit $3,000 by the end of this year or early next year.

“I predict gold prices will not only surpass $2,800 an ounce, but also reach around $2,900 an ounce, with a high of $3,000 an ounce. This is based on different bull cycles.

In October 2023, gold was below $2,000 an ounce, then rose to $2,535 an ounce, an increase of about $500 an ounce. Then, gold corrected lower. From $2,380 an ounce, it rose to $2,800 an ounce. We saw a $500 rally, followed by a $400 rally," Wagner told Kitco News.

See more news related to gold prices HERE...