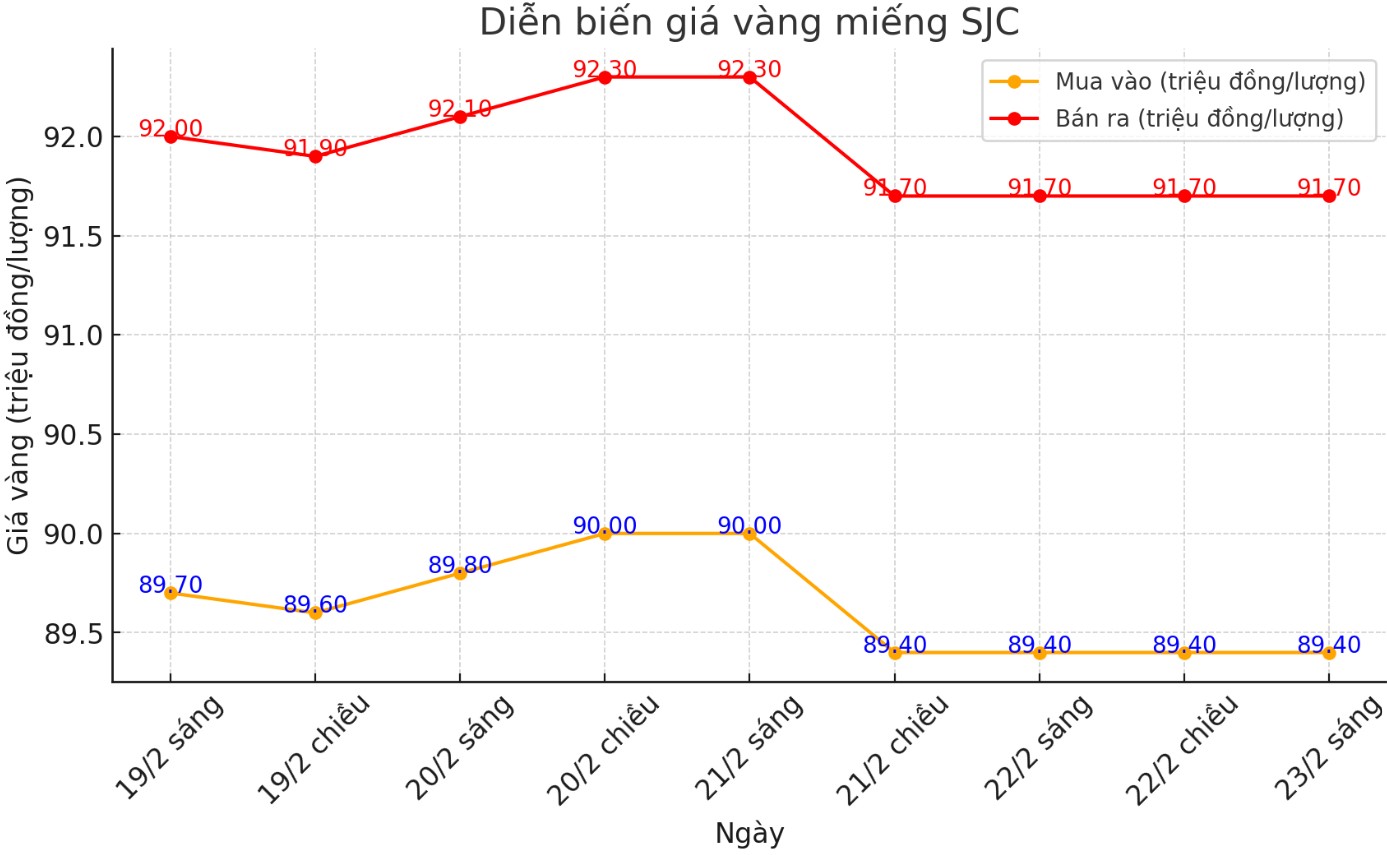

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at 88.5-90.5 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (February 23, 2025), the price of SJC gold bars at DOJI decreased by VND900,000/tael for buying and VND1.2 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 88.5-90.5 million VND/tael (buy in - sell out).

Compared to the closing price of last week's trading session (February 23, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC decreased by VND900,000/tael for buying and VND1.2 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of February 23 and selling it in today's session (March 2), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both lose 3.2 million VND/tael.

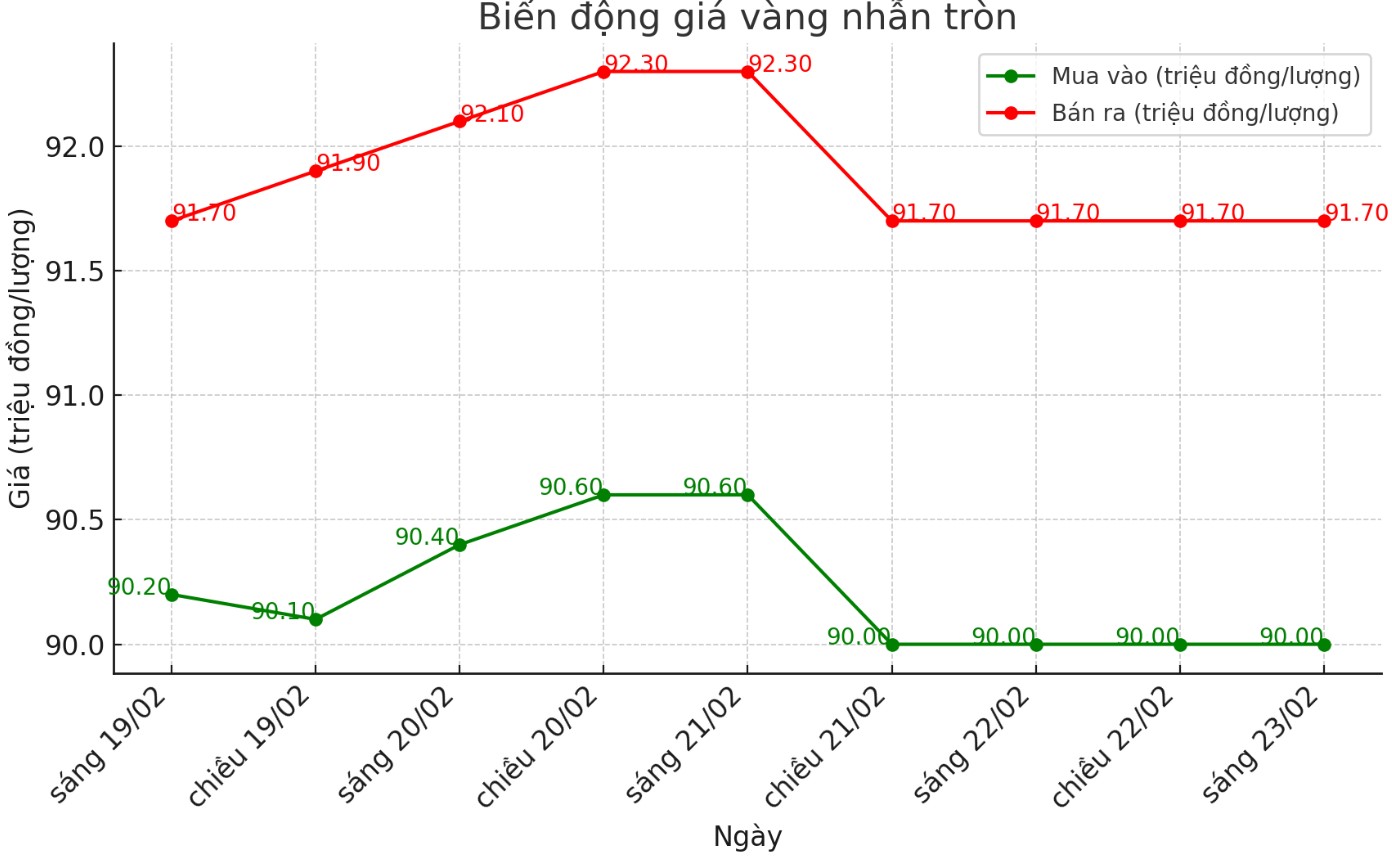

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 90-91 million VND/tael (buy - sell); kept the same for buying and decreased by 700,000 VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.1-91.3 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 500,000 VND/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.2 million VND/tael.

If buying gold rings in the session of February 23 and selling in today's session (February 23), buyers at DOJI and Bao Tin Minh Chau both suffered a loss of 1.7 million VND/tael.

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 2,858.1 USD/ounce, down 78.1 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices were under pressure at the end of the week as the USD index increased. Recorded at 6:00 a.m. on March 2, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.560 points (up 0.35%).

After many weeks of optimistic forecasts, experts have made negative comments about the short-term outlook for gold prices.

The weekly survey by Kitco News shows that out of 14 experts surveyed, only 3 people (21%) predict gold prices will increase next week, while 9 people (64%) predict prices will decrease. The remaining two experts (14%) see gold moving sideways.

In the private investor group (Main Street), out of 138 online polls, 62 people (45%) predicted gold prices to increase, 38 people (28%) predicted prices to decrease. The remaining 38 (28%) believe that gold will continue to move sideways in the coming time.

Adrian Day - Chairman of Adrian Day Asset Management - said that gold prices may continue to adjust down due to profit-taking activities, but this decrease is not a concern. "Gold has gained 12% this year but has only fallen less than 4% since the peak. This is just a temporary correction," he said.

Marc Chandler - CEO of Bannockburn Global Forex - agreed with the above view when he said that gold prices may continue to decline in the short term. "Gold set a record on February 24 at $2,956 an ounce but was later sold off. Gold is showing signs of trading as a risky asset rather than a safe-haven asset," Chandler analyzed.

According to this expert, the next support level for gold could be at 2,814 USD/ounce, if it breaks this level, the price could fall to 2,770 USD/ounce.

Meanwhile, Darin Newsom - senior analyst at Barchart.com - said that technically, gold could form a reversal pattern on the weekly chart. "Even the biggest markets need time to adjust and perhaps it will be gold next week," he said.

Daniel Pavilonis - senior commodity broker at RJO Futures - commented that the recent decline in gold prices is related to the "risk-off" mentality in the financial market. "Stock and gold markets are both falling, while US bond yields are also cooling. This shows that cash flow is shifting away from risky assets," he explained.

Pavilonis said that the important support level for gold is currently at 2,600 USD/ounce, corresponding to the 200-day moving average. "If the S&P 500 falls below 5,700 points, gold could adjust to the $2,600/ounce zone before finding a balance," he warned.

According to Adam Button - Head of Foreign Exchange Strategy at Forexlive.com, gold prices may continue to decrease as cash flow in China is shifting from gold to stocks in the context of the economy having prospects for recovery.

See more news related to gold prices HERE...