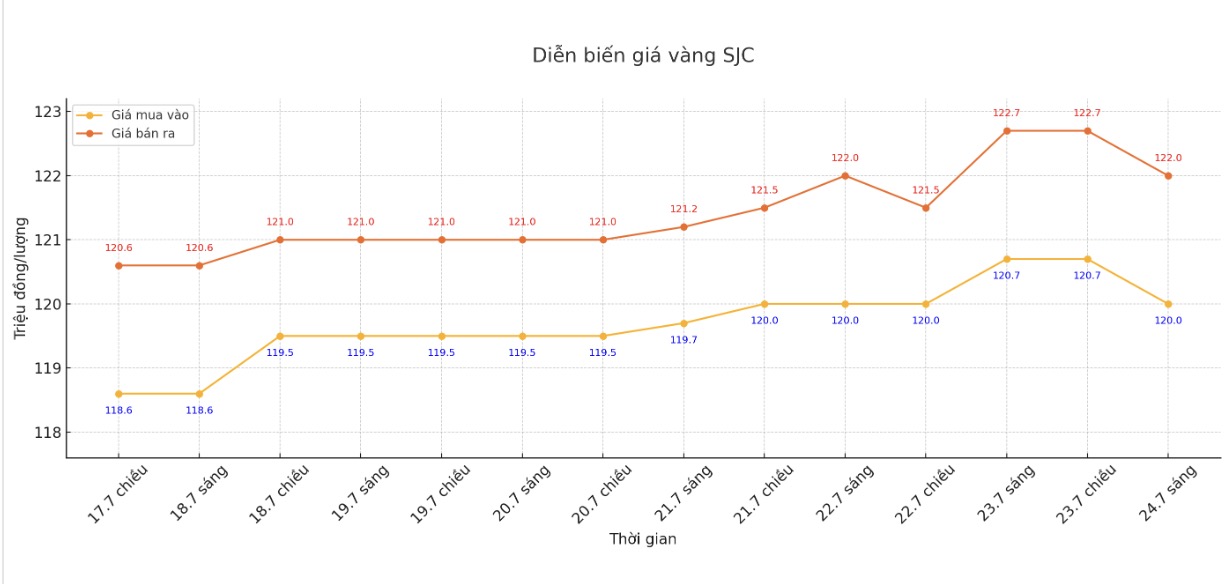

Updated SJC gold price

As of 9:35 a.m., DOJI Group listed the price of SJC gold bars at VND 120-122 million/tael (buy - sell), down VND 700,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120-122 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.5-122 million/tael (buy in - sell out), down VND 700,000/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

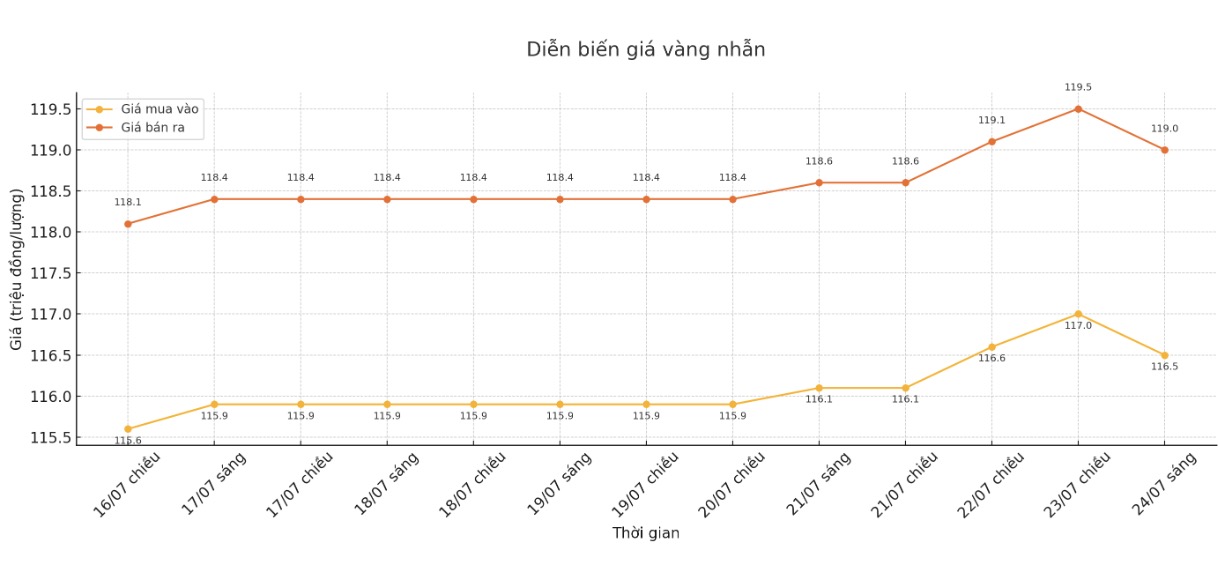

9999 round gold ring price

As of 9:30 a.m., DOJI Group listed the price of gold rings at 116.5-119 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.7-119 7.5 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.7-118.7 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

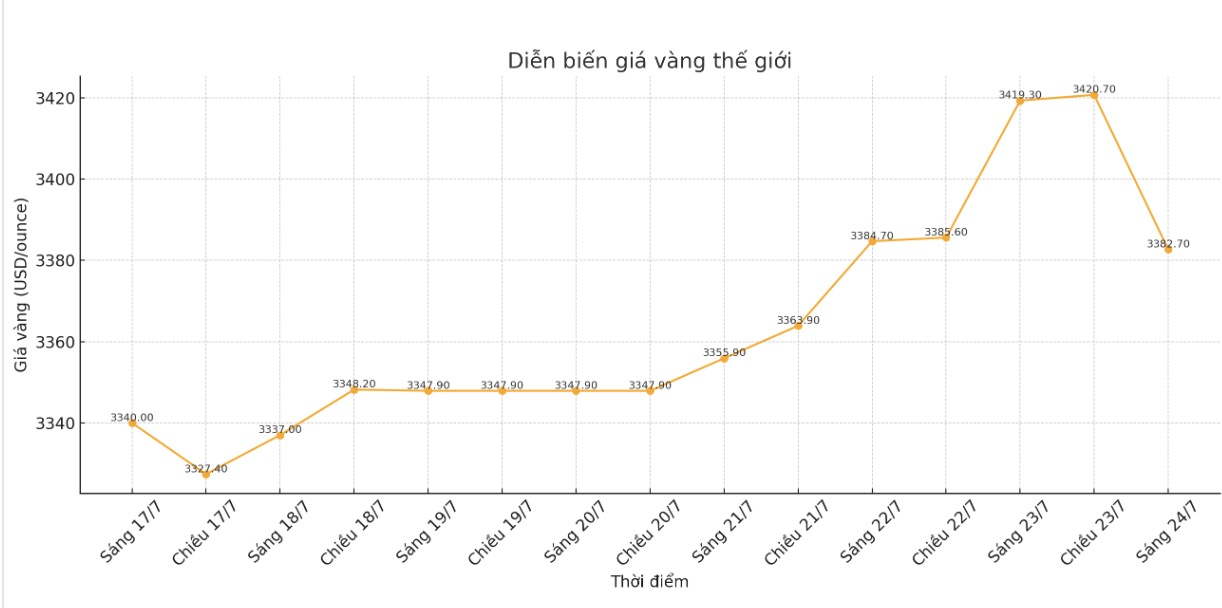

World gold price

At 9:50 a.m., the world gold price was listed around 3,382.7 USD/ounce, down 36.6 USD/ounce.

Gold price forecast

World gold prices are under profit-taking pressure from short-term traders. Improved risk-off sentiment in the market is a negative factor for safe-haven assets.

Risk appetite became stronger in midweek after the US and Japan announced late Tuesday that the two countries had reached a trade deal. Accordingly, the US will impose a 15% tax on imports from Japan, including cars, while Japan will set up a fund worth 550 billion USD to invest in the US. US President Donald Trump called it the largest trade deal ever.

According to Tim Waterer - Head of Market Analysis at CM Trade Financial Services Company, if more trade deals are signed before August 1, this could continue to boost demand for risky assets and reduce demand for gold. However, if the USD continues to be pressured, gold returning to the $3,500/ounce mark is still a feasible prospect in the short term.

Meanwhile, Mr. Naeem Aslam - Investment Director at Zaye Capital Markets maintained a positive view on gold as the instability at the US Federal Reserve (FED) continued to resonate with the increasingly complex geopolitical situation in financial markets. Accordingly, if political tensions escalate and the Fed is under more pressure from the White House, there will be stronger fluctuations in the market.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...