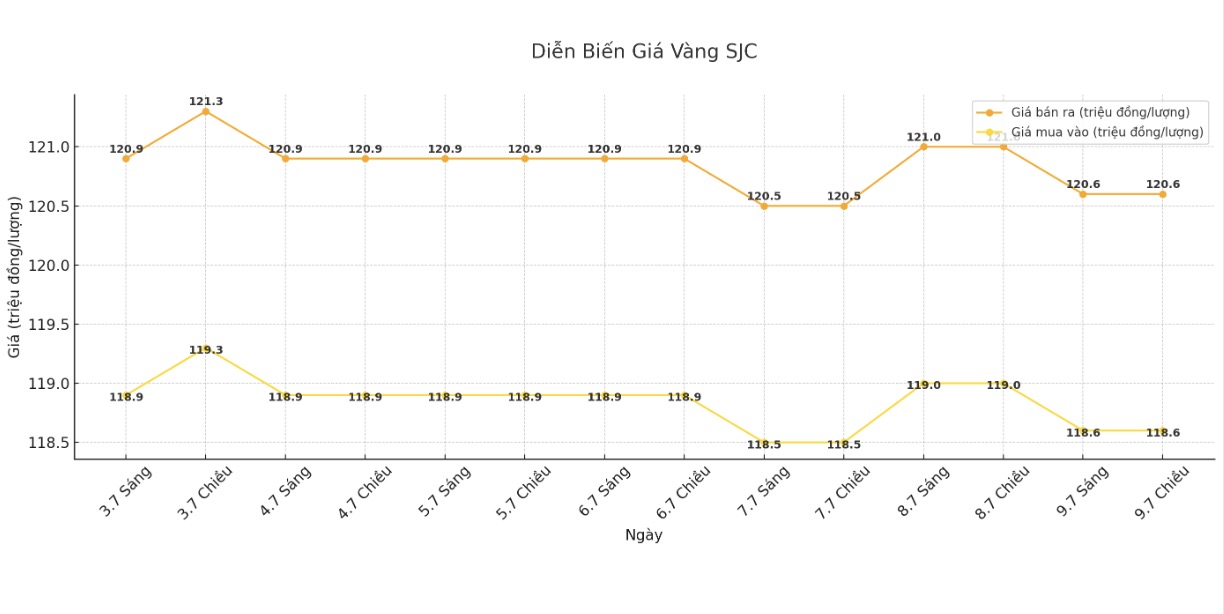

SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 118.6-120.6 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 118.6-120.6 million VND/tael (buy - sell); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117.9-120.6 million VND/tael (buy in - sell out); down 400,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

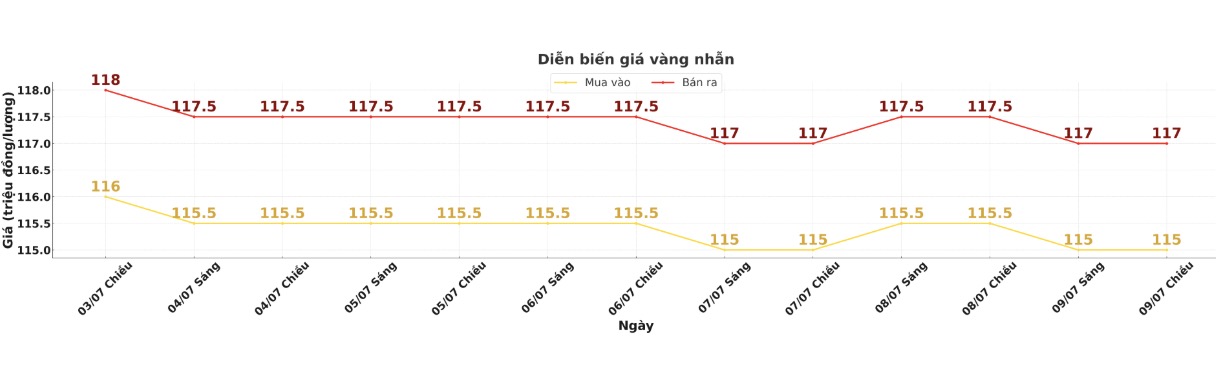

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 115-117 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

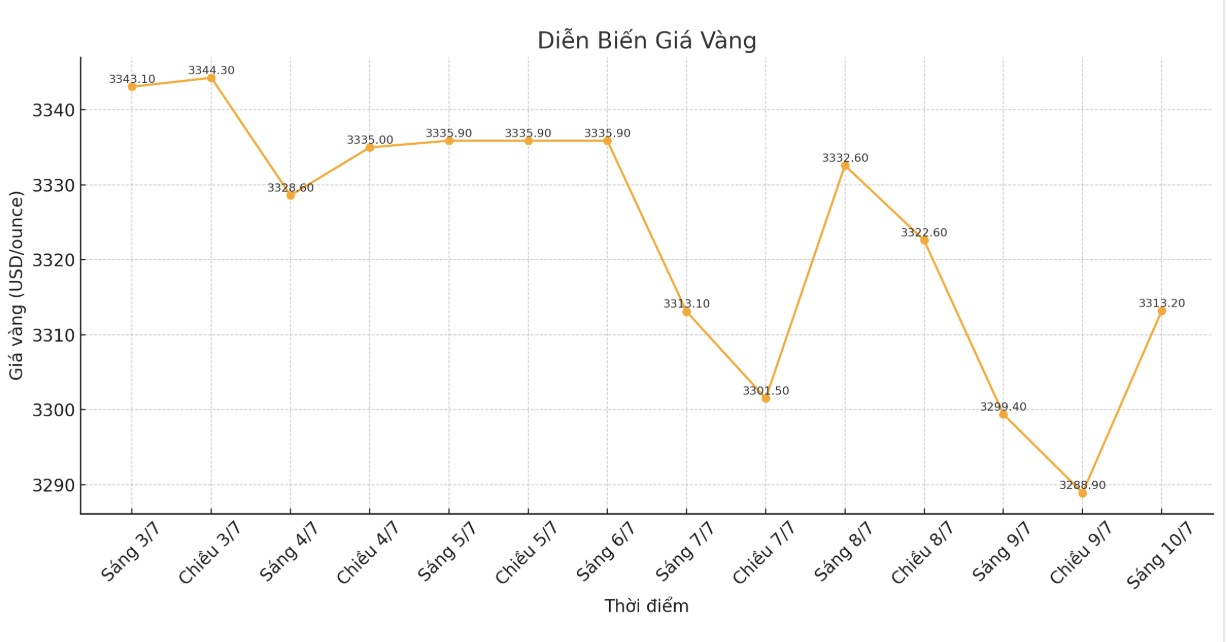

World gold price

Recorded at 0:15 on July 10, spot gold was listed at 3,313.2 USD/ounce, up 17.3 USD/ounce.

Gold price forecast

World gold prices continue to dance when affected by mixed factors. The risk-off sentiment is less severe in the context of the current quiet summer trading situation, which is at a disadvantage for safe-haven metals. bulls in gold and silver are in need of a fresh boost to trigger a rally.

August gold futures still have a short-term technical advantage. The next upside target for buyers is to close above the strong resistance level at 3,400 USD/ounce. Meanwhile, the target for the sellers is to pull the price below the solid technical support level at 3,200 USD/ounce.

The first resistance level peaked overnight at $3,316.5 an ounce, followed by a weekly peak at $3,355.6 an ounce. First support was at the bottom of the night at $3,290.20/ounce, followed by $3,275/ounce.

Currently, investors are waiting for US weekly jobless claims data to assess the health of the labor market and thereby predict upcoming monetary policy. If data shows a weakening in the job market, expectations of the US Federal Reserve (FED) cutting interest rates will increase, thereby supporting gold prices to recover. Conversely, if the labor market remains strong, the pressure to maintain high interest rates will pull gold prices down.

This information is being considered a key factor guiding investors' psychology in the short term. Gold prices may fluctuate strongly immediately after the data is released, especially in the context of the market lacking clear momentum from other macro factors.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...