Although China has slowed down its buying pace this year, it still plays a key role in the global gold market.

Citing data from the People's Bank of China, Mr. Krishan Gopaul - senior analyst for the EMEA region at the World Gold Council said that the People's Bank of China increased 2 tons of gold in June.

"This is the 8th consecutive month that China has added gold. However, this speed has slowed down compared to 10.3 tons in December 2024 and 5 tons in January 2025. Thus, the total amount of gold net purchased since the beginning of the year is 19 tons, bringing the total gold reserve to 2,299 tons" - Mr. Gopaul shared.

Although China's demand for gold has decreased slightly recently, experts believe that the buying trend will not stop. They emphasized that geopolitical instability continues to strengthen the role of gold as a neutral currency asset.

Ms. Eugenia Mykuliak - founder and CEO of B2PRIME Group commented: "Central banks are not buying gold to prepare for an upcoming crisis; they are diversifying in the current context. And the current reality is policy uncertainty, lack of global coordination and prolonged inflation. Gold is regaining its role as a form of silent protection.

In a recent interview, Joy Yang, director of index product management at MarketVector indexes, said that US President Donald Trump's trade war is making many countries want to reduce their dependence on the US dollar.

No currency can replace the US dollar, but that does not mean that countries will not reduce their exposure to it. The only remaining option is gold, she said.

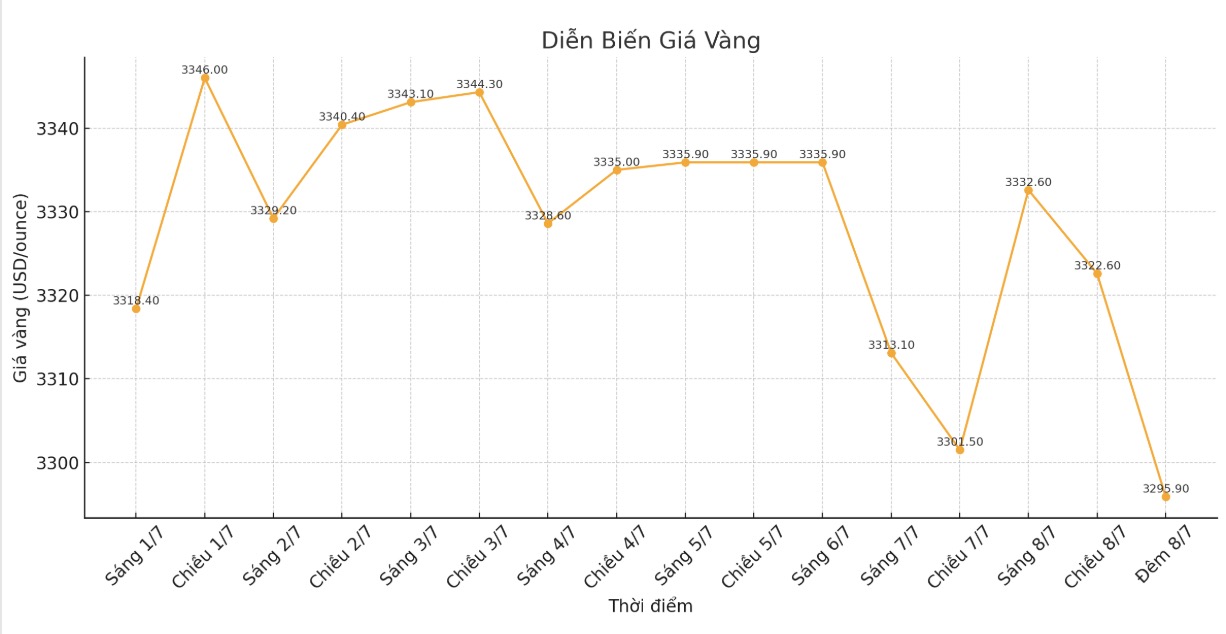

Yang said stable demand from central banks will help keep gold prices above $3,000/ounce.

In the annual report Gold Focus released last month, analysts at Metals Focus predict central banks will buy about 1,000 tons of gold this year. If true, this will be the fourth consecutive year that official gold purchases have exceeded the 1,000-ton threshold, accounting for about 21% of global gold demand. 15 years ago, this rate was only about 10%.

Although China has attracted much attention, the People's Bank of China is not the only organization to increase gold reserves.

The Central Bank of Uzbekistan increased its gold reserves by 9 tonnes last month - the country's first increase of the year, Gopaul said. However, as a gold producer, Uzbekistan's gold trading activities are often very fluctuating.

Uzbekistan has been a net seller since the beginning of the year (18 tons). The total gold reserves are currently 365 tons, he added.