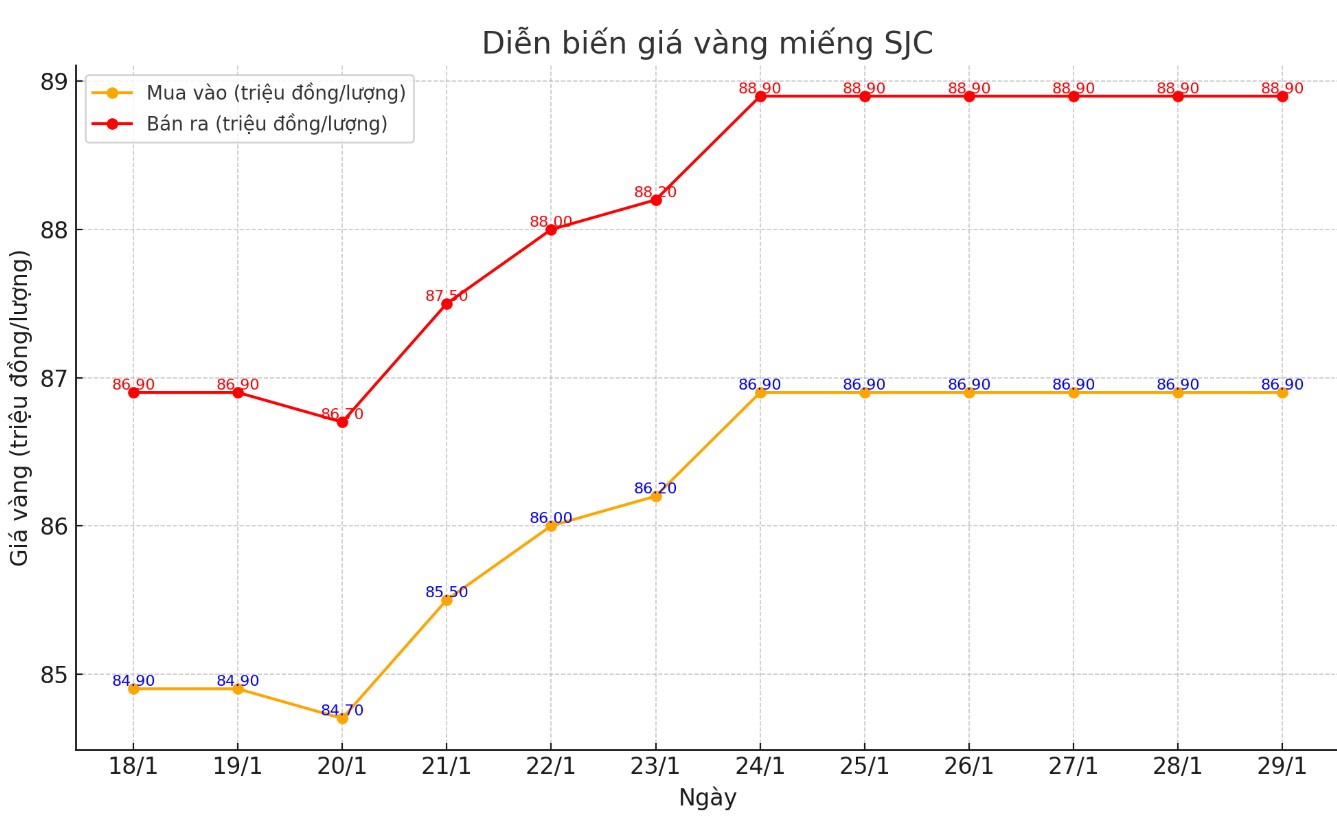

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); increased by 100,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

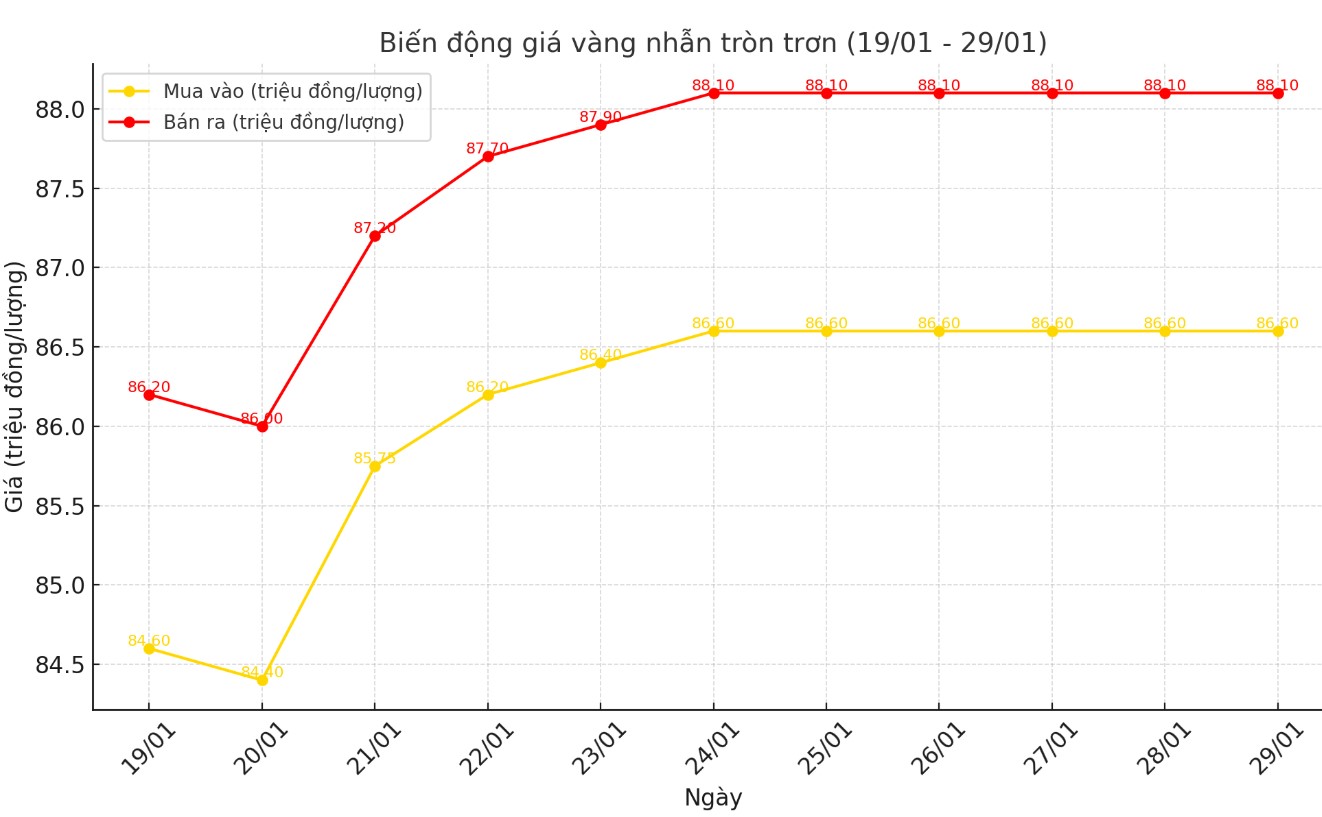

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain the same compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

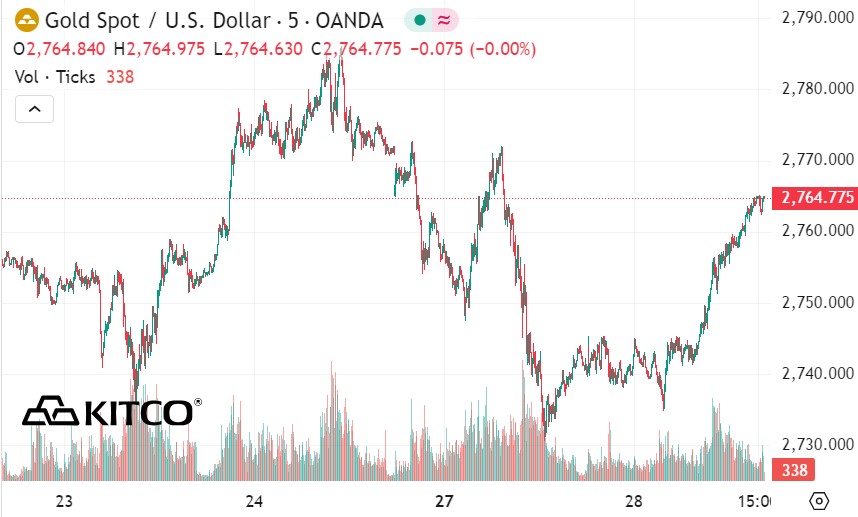

World gold price

As of 3:45 a.m. on January 29, the world gold price listed on Kitco was at 2,764.7 USD/ounce, up 23.4 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices recovered despite the high USD index. Recorded at 3:45 a.m. on January 29, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.720 points (up 0.52%).

Gold prices rose sharply on safe-haven demand amid volatility in US stock markets after a sharp sell-off on Monday.

Uncertainty surrounding upcoming policies in the US has fueled risk-off sentiment in the market, helping precious metals prices rise.

US stocks rose midday on Tuesday, following Monday’s shock plunge in tech stocks. But many traders and investors questioned whether the decline was a one-day event or a sign of a bigger problem. “DeepSeek Disrupts the AI Game,” ran the headline in Barrons today.

“It’s hard to imagine a single stock losing more than half a trillion dollars in market value. But that’s what happened to Nvidia’s market capitalization on Monday, bringing to mind the dot-com crash of 2000-2001, when the Nasdaq Composite Index plunged 72 percent from peak to trough,” Bloomberg reported Tuesday morning.

In another development, President Donald Trump proposed much higher global tariffs than the 2.5% initially proposed by Treasury Secretary Bessent. Trump said the tariffs were aimed at restructuring US supply chains and “protecting our country.” The dollar rose after his latest comments.

The key U.S. economic data this week is the Federal Reserve’s interest rate decision, with rates widely expected to remain unchanged at the FOMC meeting that begins Tuesday morning and ends Wednesday afternoon with a statement and press conference from Fed Chairman Jerome Powell. The market consensus is that no rate change will be in sight, but the language and tone of the FOMC statement and Powell’s press conference will be closely watched.

The major outside markets today saw Nymex crude oil futures trading mostly flat at around $73.25 a barrel. The yield on the 10-year US Treasury note is currently at 4.577%.

Gold February Futures: Currently, the bulls are in control and have a clear near-term advantage, with gold prices on the rise. The next target for the bulls is to push the price above the strong resistance at the recent high of $2,826.30 per ounce. On the other hand, the bears are trying to push the price below the important support at $2,700 per ounce. The nearest resistance levels are $2,778.10 per ounce (weekly high) and $2,800 per ounce.

See more news related to gold prices HERE...