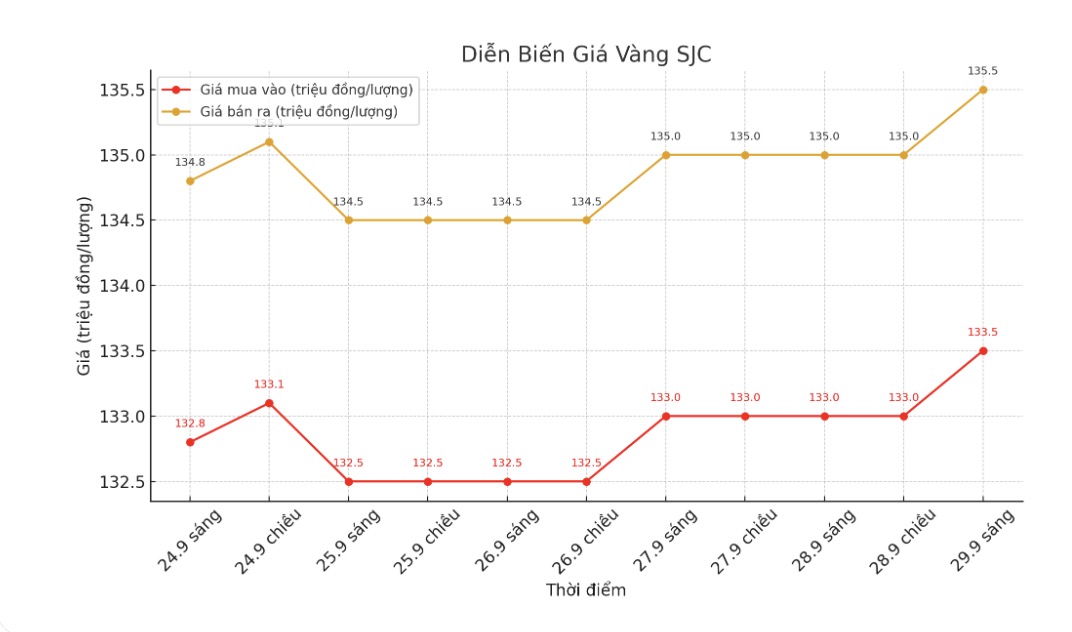

Updated SJC gold price

As of 9:15 a.m., DOJI Group listed the price of SJC gold bars at VND133.5-135.5 million/tael (buy in - sell out), an increase of VND500,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 133.5-135.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 133-135.5 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

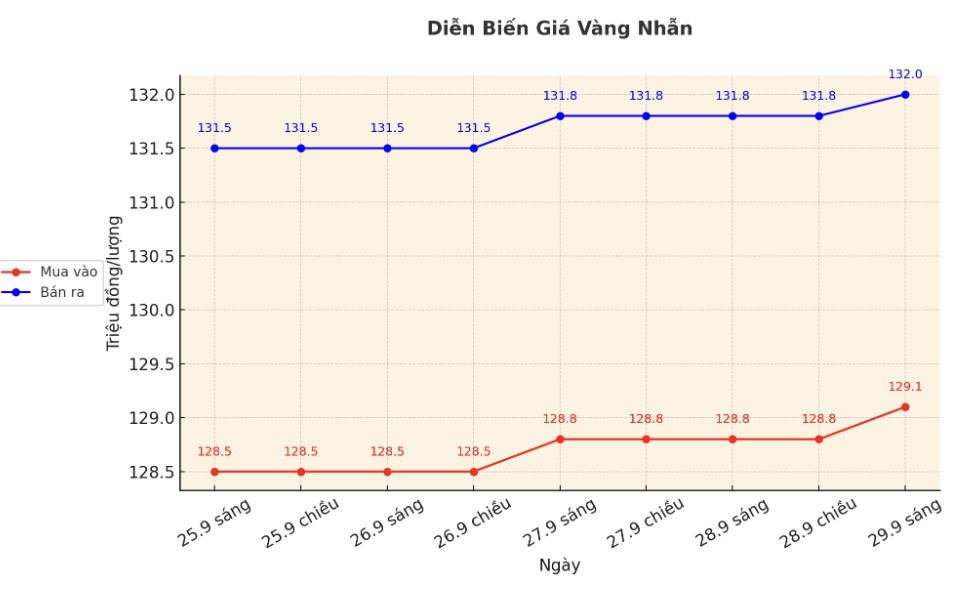

9999 round gold ring price

As of 9:15 a.m., DOJI Group listed the price of gold rings at 129.1-132 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and an increase of 200,000 VND/tael for selling. The difference between buying and selling is 2.9 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 129.6-132.6 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 129-132 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

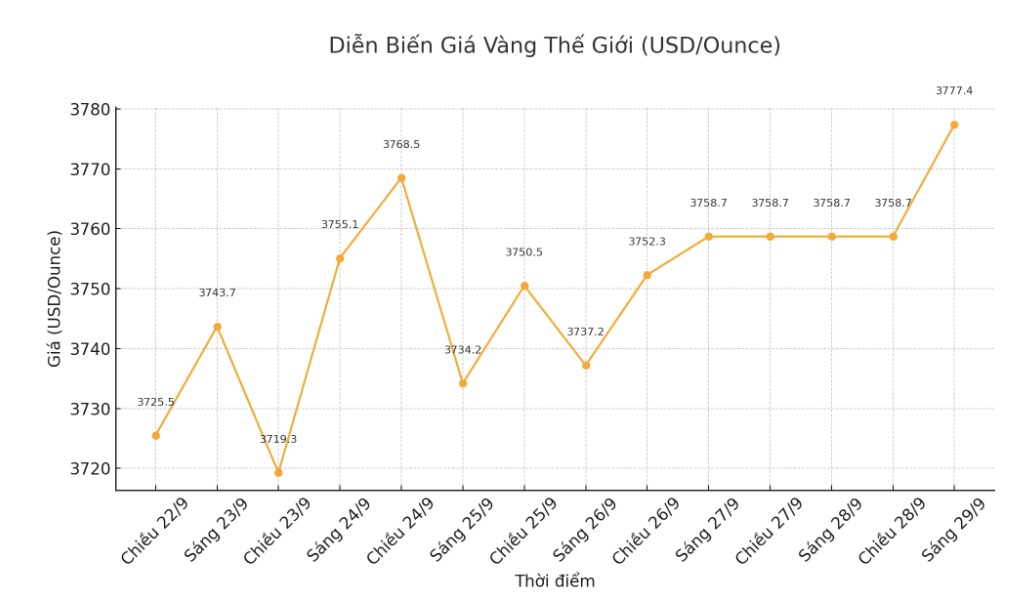

World gold price

At 9:10 a.m., the world gold price was listed around 3,777.4 USD/ounce, up 18.7 USD compared to a day ago.

Gold price forecast

Many Wall Street experts have a very positive view of the gold price outlook this week.

There is no reason to doubt the trend at the moment, said James Stanley, senior market strategist at Forex.com. The $3,800/ounce market for spot delivery may cause prices to stagnate, but since the bottom of last year, prices have increased by about 91%, so I will continue to follow the main trend until there is evidence to the contrary.

Sharing the same view, Adrian Day - Chairman of Adrian Day Asset Management said: Increase. The economic story in the US is gradually changing, although newly released reports on consumer spending and inflation do not support that. In fact, retail sales data adds reason to the US Federal Reserve's (FED) refusal to cut interest rates further in October, and this could disappoint the market - which has priced another cut. However, the trajectory of the US economy and the pace of interest rate cuts are clearly no longer as important to gold as other factors.

Meanwhile, Kevin Grady - Chairman of Phoenix Futures and Options said that market momentum is currently leaning strongly towards an increase.

I think the message remains: its all about interest rates, and there will be many cuts. That is what the market is looking for and also what gold is reacting to. In addition, the weakening USD is also pushing gold up, he said.

Grady said all of these factors are contributing to higher gold prices. The $4,000/ounce mark is right ahead. I don't know who will dare to stop it, because the buyers are still taking orders."

He said geopolitics continue to play a supporting role in the precious metals market. Last year, the largest gold buyer was Poland. Looking at what happened to Russia, the cases of sending drones across the border... I think these things will continue. Many countries have realized that they have to strengthen everything: security, accounting, everything, he said.

Kitco expert Jim Wyckoff believes that the less resistant path for gold prices is still moving sideways with an upward trend. Gold prices are steadily rising in the context of maintaining a strong uptrend in terms of technology, Wyckoff said.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...