Update SJC gold price

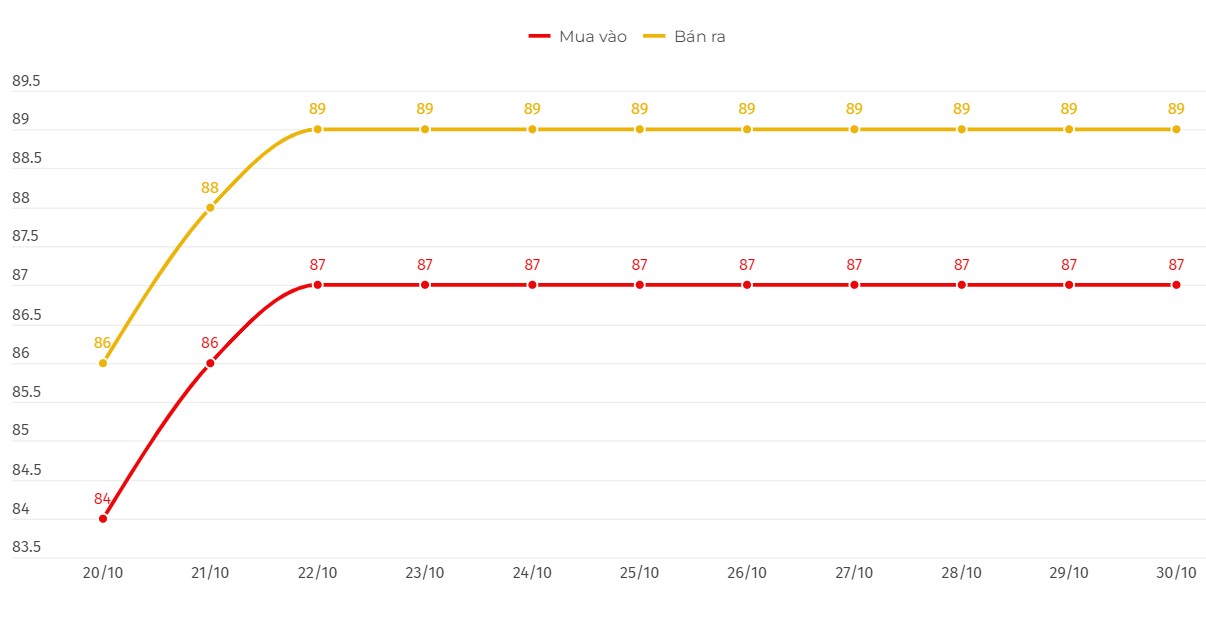

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 87-89 million VND/tael (buy - sell).

Compared to the close of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 87-89 million VND/tael (buy - sell).

Compared to the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

9999 round gold ring price

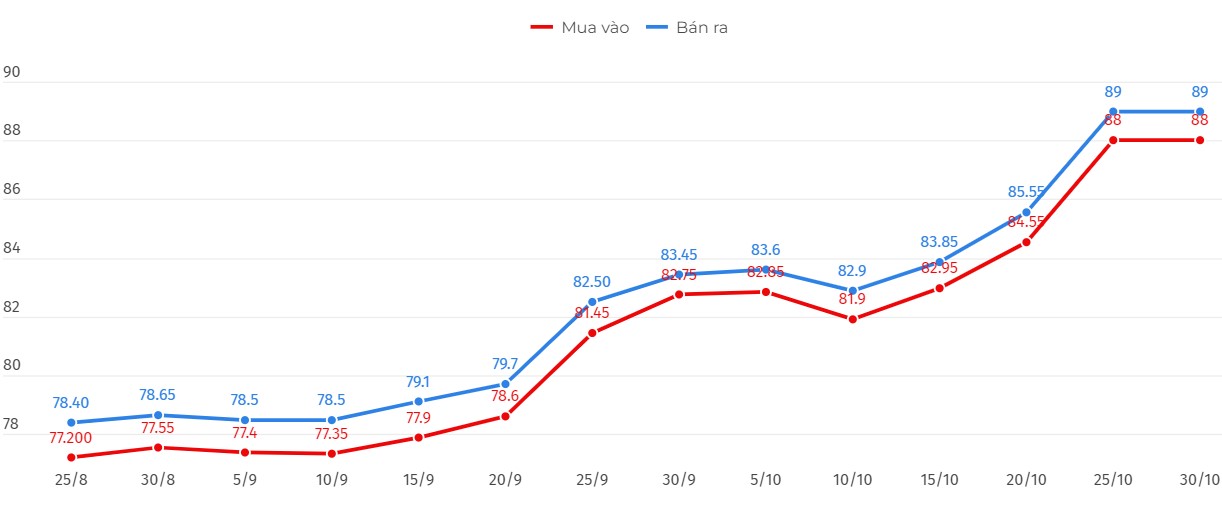

As of 9am today, the price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 88-89 million VND/tael (buy - sell); increased by 100,000 VND/tael in both directions.

Bao Tin Minh Chau listed the price of gold rings at 87.98-88.98 million VND/tael (buy - sell); increased by 100,000 VND/tael in both directions.

World gold price

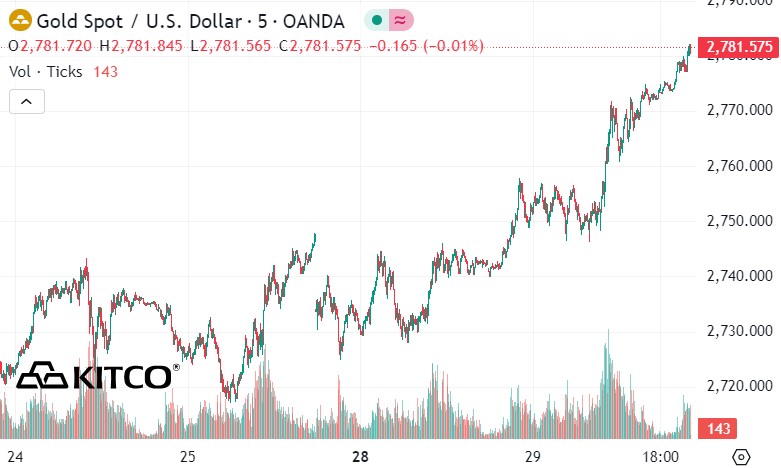

As of 9:00 a.m., the world gold price listed on Kitco was at 2,781.5 USD/ounce, up 27.5 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased as the USD index decreased. Recorded at 9:00 a.m. on October 30, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 104.114 points (down 0.02%).

According to Kitco, the world gold price increased sharply, breaking the threshold of 2,780 USD/ounce when receiving many supporting factors. In a week, Americans will officially go to the polls to elect a new Congress and president. Information surrounding the election has fueled instability in the financial market, causing investors to turn to gold as a safe haven asset.

Increased safe-haven demand for gold has helped push prices to all-time highs.

Krishan Gopaul, senior market analyst at the World Gold Council, noted that the ETF market (exchange-traded funds backed by gold) saw inflows of about 15 tonnes, worth $1.4 billion, last week.

Meanwhile, ETF demand has turned positive this year, rising by about eight tonnes. “Asia led the inflows into gold, driven largely by Chinese funds, followed by North America,” he said.

Ole Hansen, head of commodity strategy at Saxo Bank, said the news about US politics was a driver of renewed safe-haven demand across commodity markets.

However, given the shocking rise in gold prices, Hansen said the precious metal is facing increasing downside risks. "Next week, gold prices could see a rapid correction of $100 to $150 an ounce."

Today, some economic data that could affect gold prices include ADP employment data, third quarter GDP and pending home sales in the US. Bank of Japan monetary policy decision.

Economic data to watch this week include core PCE, personal income and spending and weekly US jobless claims on Thursday and US nonfarm payrolls and manufacturing PMI on Friday.

See more news related to gold prices HERE...