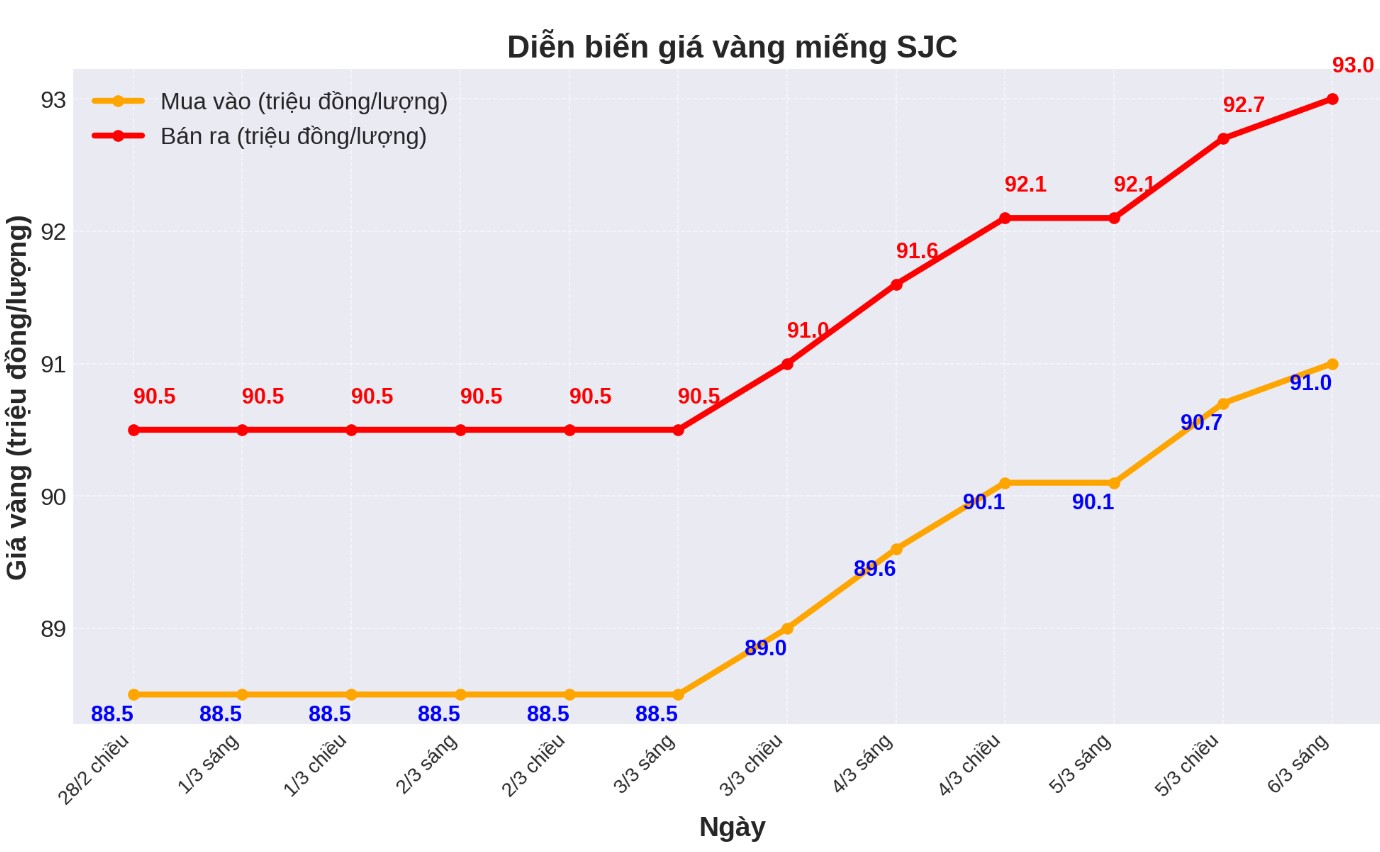

Updated SJC gold price

As of 9:50 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND91-93 million/tael (buy in - sell out), an increase of VND300,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 91-93 million VND/tael (buy - sell), an increase of 300,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at DOJI is at 2 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 90.9-92.7 million VND/tael (buy in - sell out); both buying and selling prices remained unchanged.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 1.8 million VND/tael.

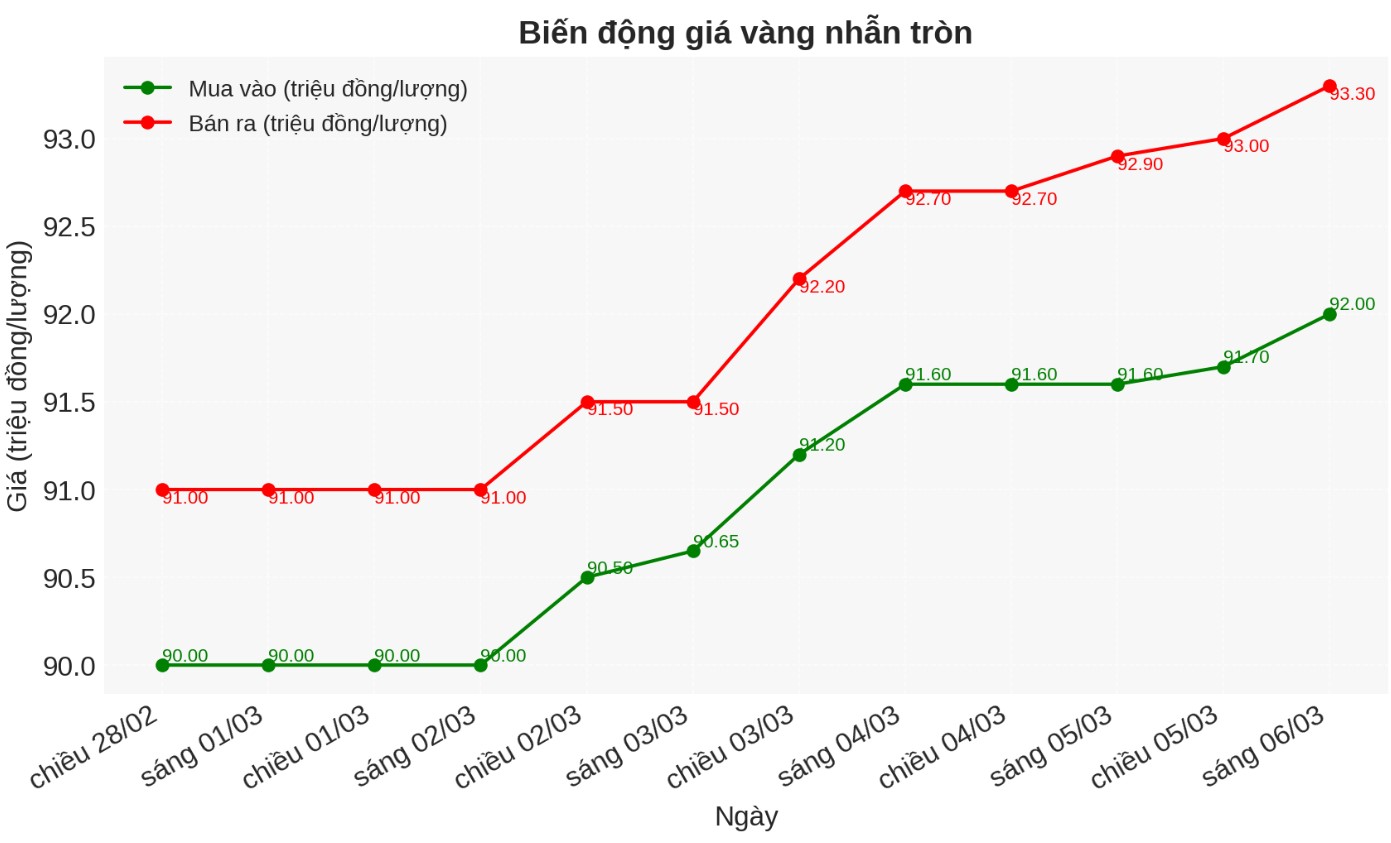

9999 round gold ring price

As of 9:50 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND92-93.3 million/tael (buy - sell); an increase of VND400,000/tael for both buying and selling compared to early this morning.

The difference between buying and selling is at 1.3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 92-93.2 million VND/tael (buy - sell), an increase of 100,000 VND/tael for both buying and selling compared to early this morning.

The difference between buying and selling is at 1.2 million VND/tael.

World gold price

As of 9:50 a.m., the world gold price listed on Kitco was at 2,923.3 USD/ounce, up 16.4 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices recovered in the context of the USD decreasing. Recorded at 9:50 a.m. on March 6, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 104.210 points (down 0.05%).

According to Kitco - Gold prices last night had a time to skyrocket above 2,922 USD/ounce after the US ISM Services PMI index increased.

The latest data from the Institute for Supply Management (ISM) said that the US service sector continued to expand last month, while price pressure increased sharply.

The ISM said Wednesday morning that the purchasing managers' index (PMI) for the service sector rose to 53.5 in February, up from 52.8 in January. This figure is better than economists predict, who predict PMI will reach 53.

February is the third consecutive month that all four components of the service PMI - business operations, new orders, jobs and delivery from suppliers are all in the growth zone. This is the first time this has happened since May 2022.

The slow growth rate of the business performance index has been compensated by the improvement of the remaining three indexes - Steve Miller, Chairman of the Business and Service survey Committee of ISM said.

An index above 50 shows economic growth, below 50 shows decline. The further the distance is from the 50 mark, the faster the rate of increase or decrease.

Gold prices soared to a session high of $2,922.67 an ounce shortly after the data was released at 10:00 (EDT).

Gold is expected by many organizations to soon reach $3,000/ounce if geopolitical tensions escalate or the Fed signals a rate cut.

Gold prices are currently affected by many factors such as inflation data (especially personal spending index - PCE), USD fluctuations and gold demand from central banks. The market is waiting for more leads from the US economic report to shape a clearer trend.

China's lawmakers have just started their annual parliamentary session and kicked it off by reaffirming their 5% economic growth target for 2025. China is considered a "shark" that buys a lot of gold in the international market.

Gold has also often benefited from trade tensions between the US and China. According to the Wall Street Journal, the Trump administration is stepping up trade measures, while Beijing has said it will respond to the end.

In another development, Reuters reported that Polyus (PLZL.MM) has achieved record profits in 2024 despite Western sanctions. The main reason is the sharp increase in gold prices.

Gold prices have risen more than 11% this year, after rising 27% last year - the best increase in more than a decade.

See more news related to gold prices HERE...