Update SJC gold price

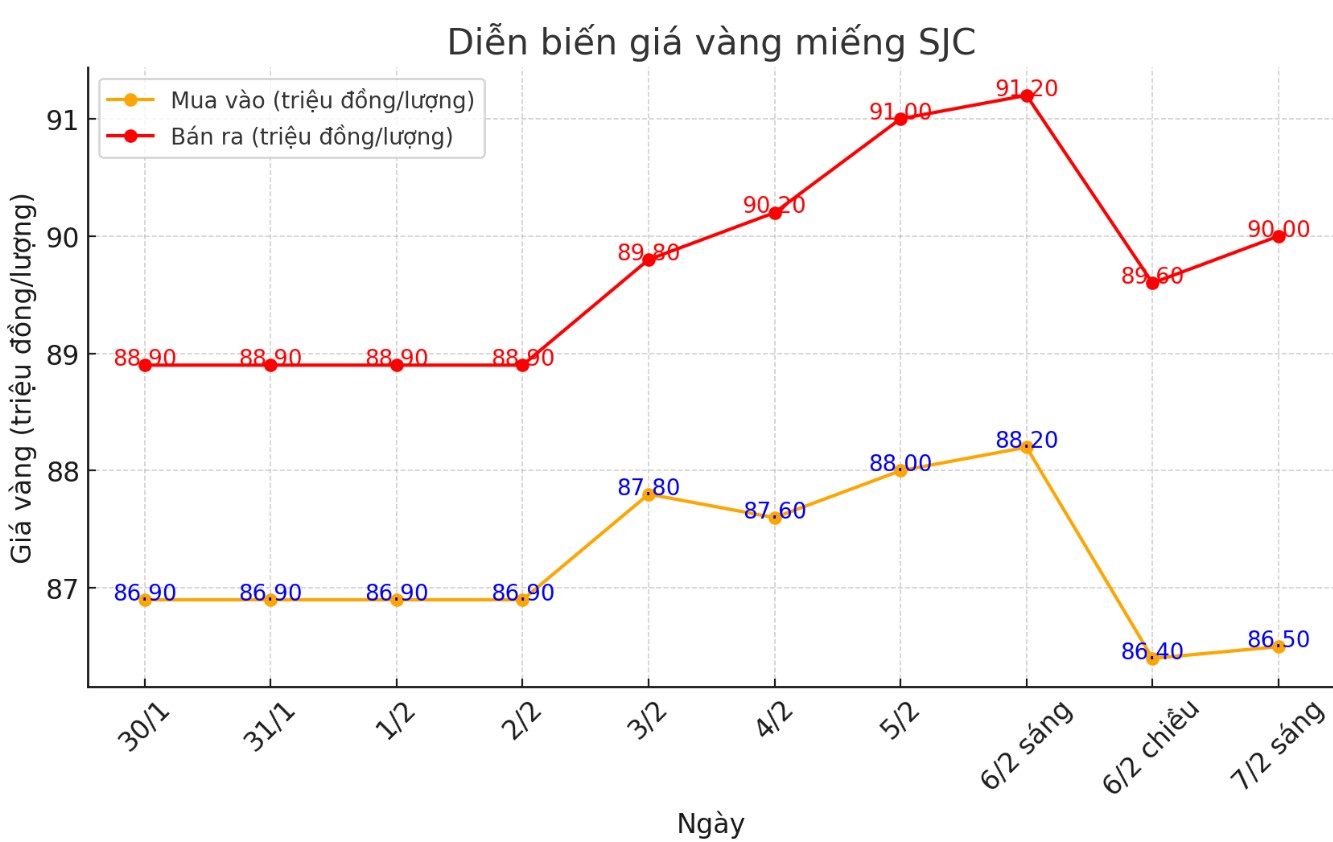

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.5-90 million/tael (buy - sell); down VND1.7 million/tael for buying and down VND1.2 million/tael for selling.

The difference between buying and selling prices of SJC gold at Saigon Jewelry Company increased to 3.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 86.5-90 million VND/tael (buy - sell); down 1.7 million VND/tael for buying and down 1.2 million VND/tael for selling.

The difference between buying and selling prices of SJC gold at DOJI Group also increased to 3.5 million VND/tael.

Price of round gold ring 9999

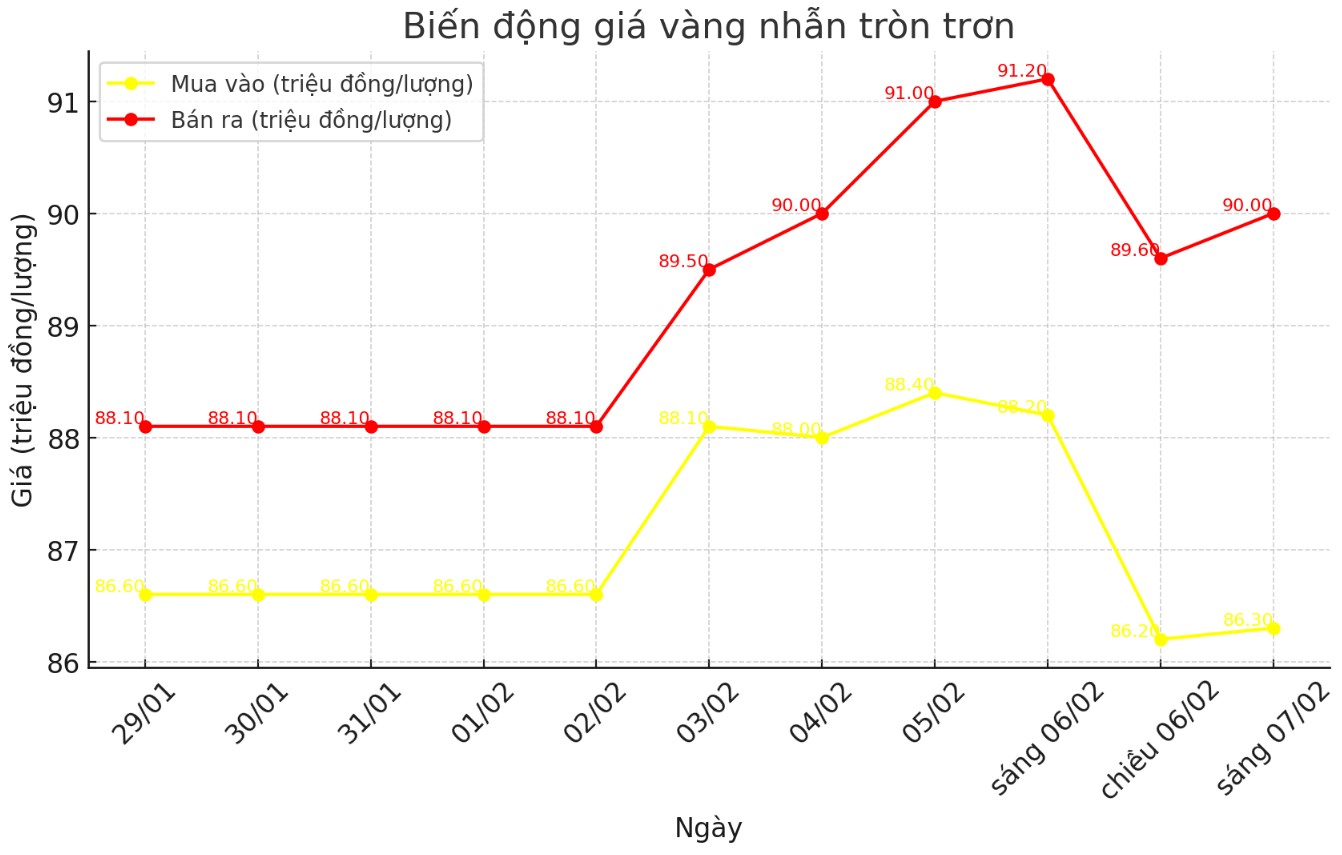

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.3-90 million VND/tael (buy - sell); down 1.9 million VND/tael for buying and down 1.2 million VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 86.5-89.95 million VND/tael (buy - sell), down 1.6 million VND/tael for buying and down 1.2 million VND/tael for selling compared to early this morning.

Combined with the huge difference, the decline in domestic gold prices caused investors to suffer heavy losses after one day of buying. If investors bought round gold rings in the session of February 6, 2025 at DOJI Group and Bao Tin Minh Chau and then sold them in today's session, they would have suffered losses of VND4.9 million and VND4.65 million/tael, respectively.

World gold price

As of 9:30 a.m., the world gold price listed on Kitco was at 2,867.5 USD/ounce, down 1.1 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices have not changed much in the context of the USD being almost motionless. Recorded at 9:35 a.m. on February 7, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 107.580 points (up 0.02%).

According to Kitco, world gold prices temporarily paused before the US announced one of the most important economic data of the month - the January employment report on Friday morning.

Nonfarm payrolls are expected to increase by 169,000, compared with an increase of 256,000 in the December report. Bloomberg said the US January payrolls data will be difficult to analyze due to the impact of wildfires in Los Angeles and cold weather in other parts of the country.

Investors avoiding buying gold because the US Federal Reserve is unclear about cutting interest rates this year are looking in the wrong direction, a market strategist said.

In a recent interview with Kitco News, Kathy Kriskey, commodity strategist at Invesco, said investors should pay attention to a new factor driving gold prices.

Kriskey explained that investors are turning to gold as a hedge against global economic and geopolitical uncertainty. She pointed out that this sentiment is not new, as many older investors have long viewed gold as a hedge against wealth. However, what is surprising is that even younger investors are starting to take an interest in gold as market volatility increases.

“If you are an investor and something scares you, you need to have gold in your portfolio. Gold is a safe, solid hedge,” she said.

In a forecast sent to the London Bullion Market Association (LBMA), Bernard Dahdah - precious metals analyst at Natixis - said that central bank demand and renewed investor interest will continue to push gold prices higher in 2025.

“Central bank demand will remain near 2024 levels, with the de-dollar trend continuing in countries that are not friendly to the West (mainly due to concerns about freezing Russian assets following the conflict in Ukraine). We also see a return of capital from Western investors, helping to keep flows into physical gold ETFs positive,” he said.

Looking further into the supply-demand dynamics of the gold market, Dahdah is quite optimistic about the precious metal, predicting that prices will exceed $3,200/ounce and average around $2,725/ounce this year.

See more news related to gold prices HERE...