Update SJC gold price

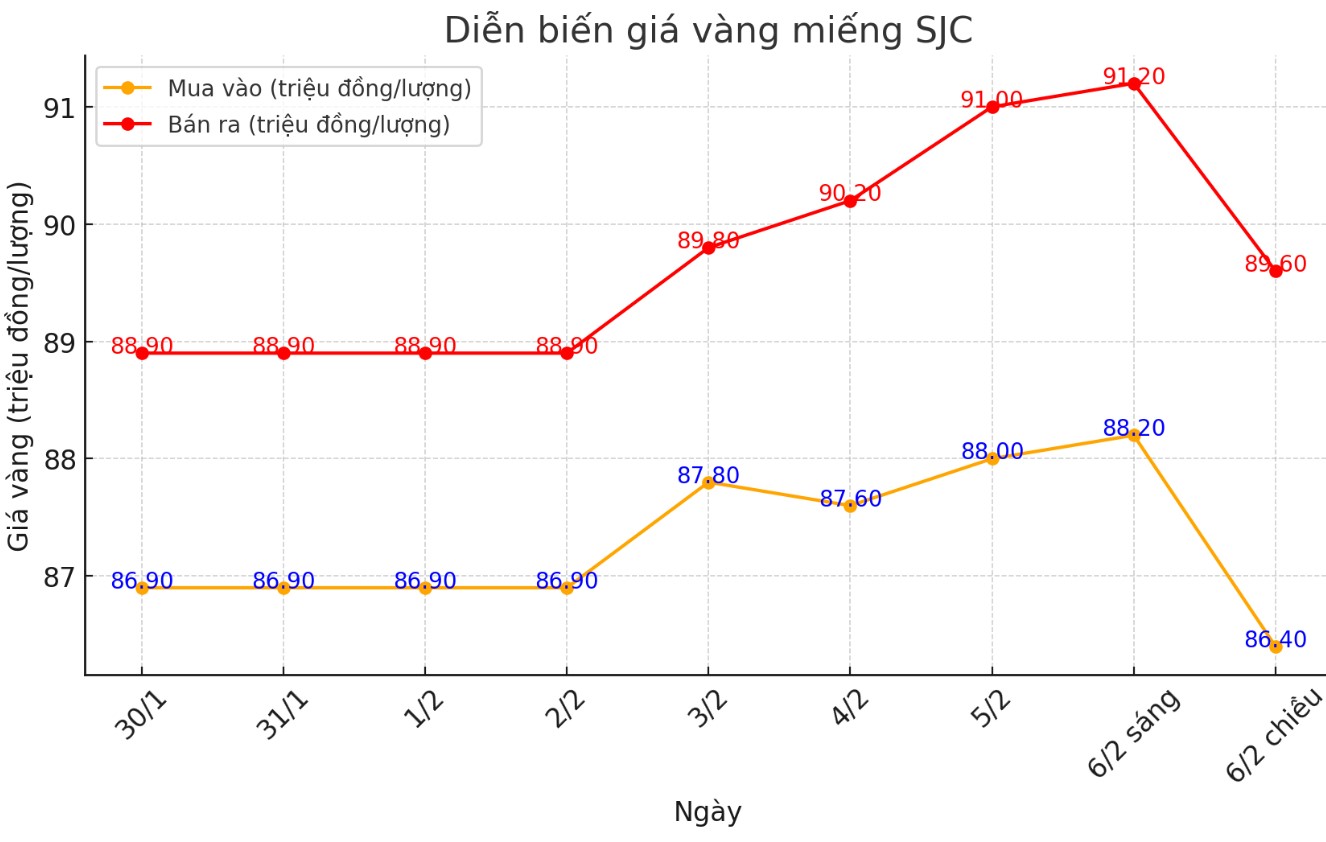

As of 8:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.4-89.6 million/tael (buy - sell); down VND1.6 million/tael for buy and down VND1.4 million/tael for sell compared to the close of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3.2 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 86.4-89.6 million VND/tael (buy - sell); down 1.6 million VND/tael for buying and down 1.4 million VND/tael for selling compared to the close of the previous trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.2 million VND/tael.

Price of round gold ring 9999

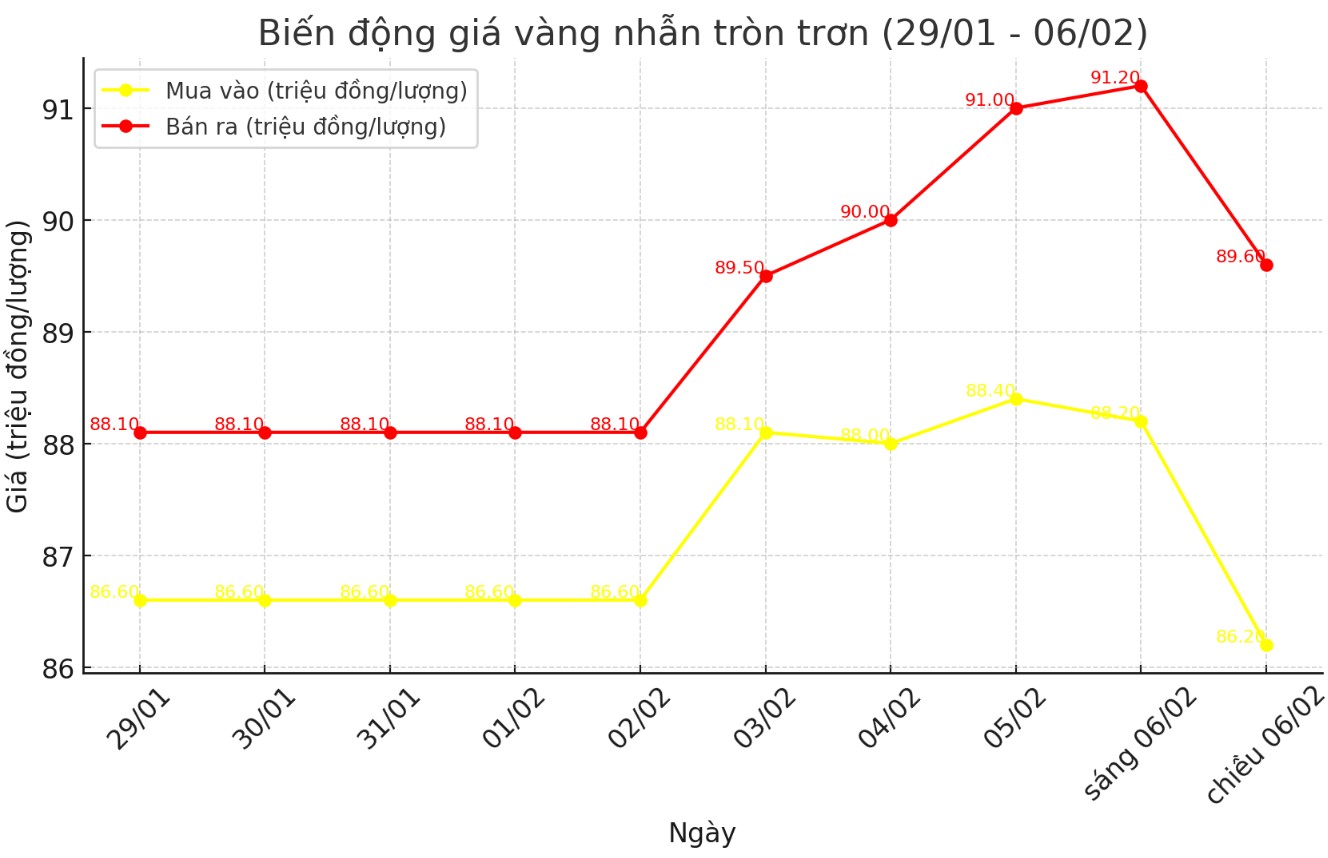

As of 6:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.2-89.6 million VND/tael (buy - sell); down 2 million VND/tael for buying and down 1.4 million VND/tael for selling compared to the closing price of yesterday's trading session.

The difference between buying and selling price of 9999 Hung Thinh Vuong round gold ring at DOJI is 3.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 86.4-89.55 million VND/tael (buy - sell), down 1.8 million VND/tael for buying and down 1.4 million VND/tael for selling compared to the closing price of yesterday's trading session. The difference between buying and selling is at 3.15 million VND/tael.

World gold price

As of 8:15 p.m., the world gold price listed on Kitco was at 2,861.8 USD/ounce, down 5 USD/ounce compared to the same time in the previous session.

Gold Price Forecast

World gold prices cooled down amid the rising USD index. Recorded at 20:15 on February 6, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107,910 points (up 0.44%).

Rising inflation fears are pushing gold prices higher, according to Kitco. Rising U.S. Treasury yields and the threat of a trade war are combining to create a stagflationary environment, prompting investors to seek out gold as a safe haven, Kelvin Wong, senior market analyst at OANDA, said in a note published Wednesday morning.

“The US dollar index has been moving sideways for the past three weeks since hitting a 52-week high of 110.18 on January 13, which has been positive for gold. Gold broke a two-month sideways trend on January 21 and surged 4.4% to hit an intraday record high of $2,865 at press time,” Wong wrote.

The World Gold Council has just released the 2024 Gold Demand Trends Report. In Vietnam, gold consumption demand in 2024 will total 55.3 tons, down slightly from 2023 (55.5 tons). Demand for gold bars, ingots and coins will reach 42.1 tons, up 4% year-on-year, the highest level since 2016. Meanwhile, demand for gold jewelry will decrease by 13% year-on-year in 2023, reaching 13.2 tons.

Although slightly down from 2023, Vietnam still has the highest gold consumption in Southeast Asia. Thailand ranks second with 48.8 tons of gold, Indonesia consumes 47.3 tons. Singapore consumes only 13.3 tons of gold.

Meanwhile, Vietnam’s gold bars and coins bucked the regional trend in Q4/2024 with a year-on-year decline. Limited supply has led consumers to shift away from gold bars, instead opting for gold rings. Although classified as jewelry, these plain rings are often viewed as a form of stored assets.

Important economic data this week

Thursday: Bank of England monetary policy decision, US weekly jobless claims.

Friday: US nonfarm payrolls report, University of Michigan preliminary index of consumer sentiment.

See more news related to gold prices HERE...