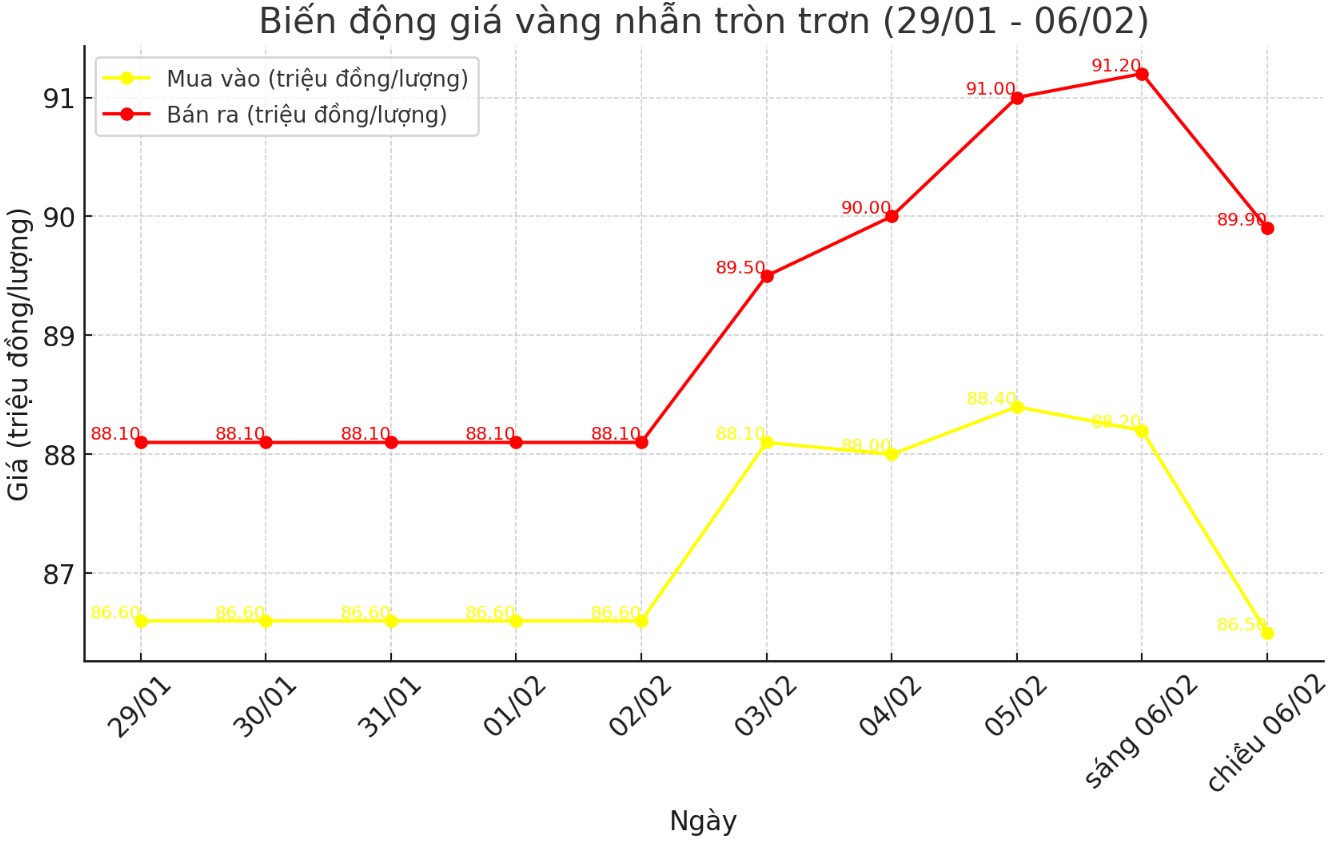

Early this morning, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 88.2-91.2 million VND/tael (buy - sell). The difference between buying and selling is at 3 million VND/tael.

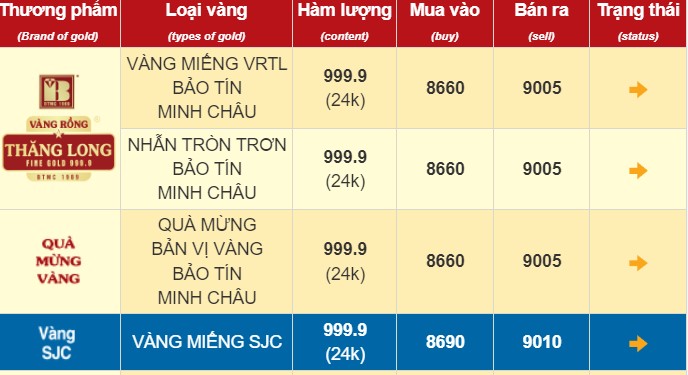

Bao Tin Minh Chau listed the price of gold rings at 88.1-91.15 million VND/tael (buy - sell). The difference between buying and selling is 3.05 million VND/tael.

At 4:00 p.m. the same day, the price of Hung Thinh Vuong 9999 round gold rings was adjusted by DOJI to 86.5-89.9 million VND/tael (buy - sell), down 1.7 million VND/tael for buying and down 1.3 million VND/tael for selling. The difference between buying and selling increased to 3.4 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of gold rings at 86.6-90.05 million VND/tael (buy - sell), down 1.5 million VND/tael for buying and down 1.1 million VND/tael for selling. The difference between buying and selling continued to increase, up to 3.45 million VND/tael.

When the difference between buying and selling prices widens, investors will have to suffer losses as soon as they buy gold. With the current difference of 3.4 - 3.45 million VND/tael, if they buy gold and sell it immediately, investors will lose about 3.4 - 3.45 million VND/tael, making it difficult to surf.

In the afternoon session, the price of gold rings at DOJI and Bao Tin Minh Chau decreased from 1.1 to 1.7 million VND/tael. If investors buy at a high price in the morning and sell in the afternoon, they may suffer heavy losses due to both the loss of gold value and the large price difference.

For example, if a customer buys gold at DOJI this morning for VND91.2 million/tael and sells it this afternoon for VND86.5 million/tael, they will lose up to VND4.7 million/tael. Similarly, the loss when buying gold rings at Bao Tin Minh Chau will be VND4.55 million/tael.

Experts say that when the difference between buying and selling prices is high, it could be a sign that gold traders are worried about the risk of price fluctuations. They widen the price range to hedge against risks, while also creating a buffer to minimize the impact if the gold price drops sharply. This makes it difficult for investors to buy and sell in the short term without suffering losses.

For those who buy gold for speculative investment purposes, the large buying and selling margin forces them to wait for the gold price to increase further to make a profit, prolonging the holding period and increasing the risk if the price does not move as expected.

See more news related to gold prices HERE...