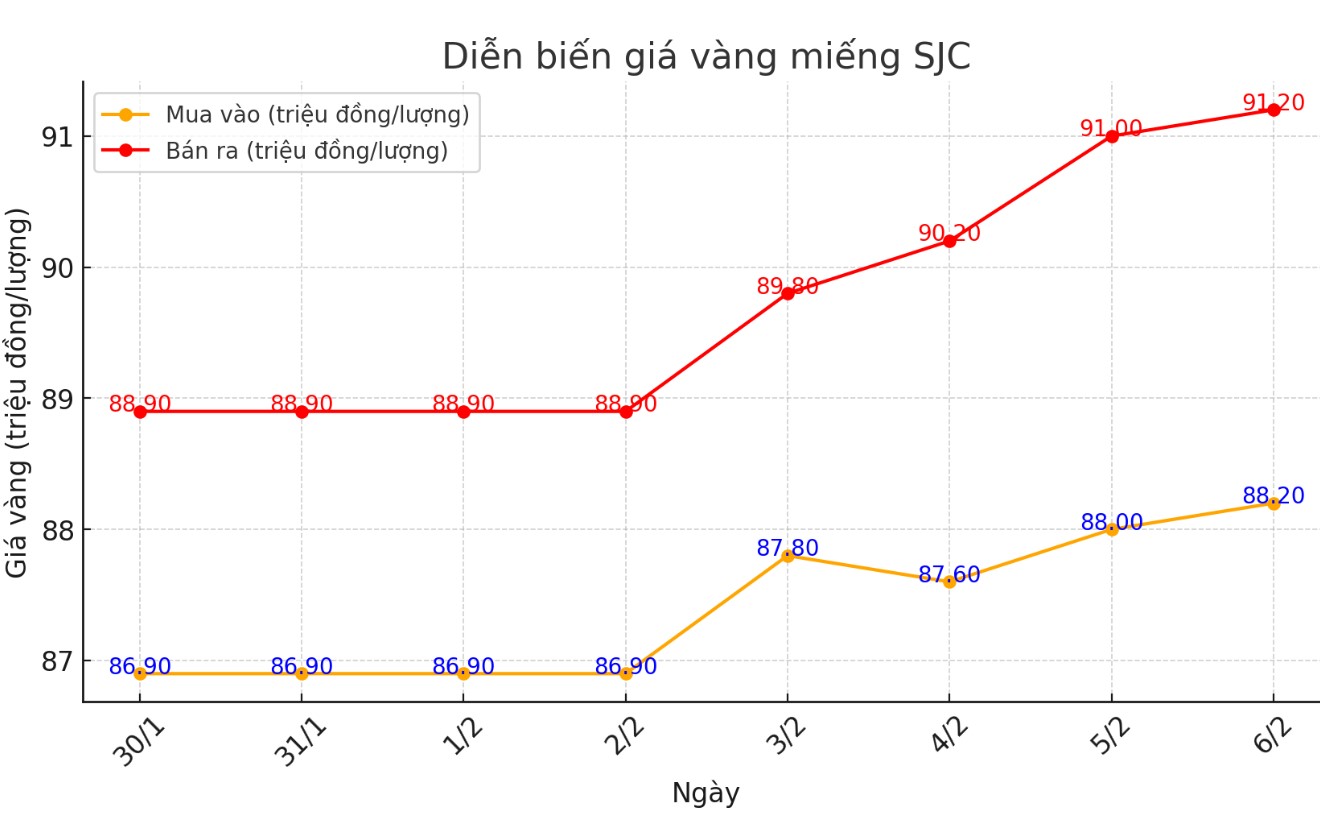

Update SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND88.2-91.2 million/tael (buy - sell); an increase of VND200,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 88.2-91.2 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 3 million VND/tael.

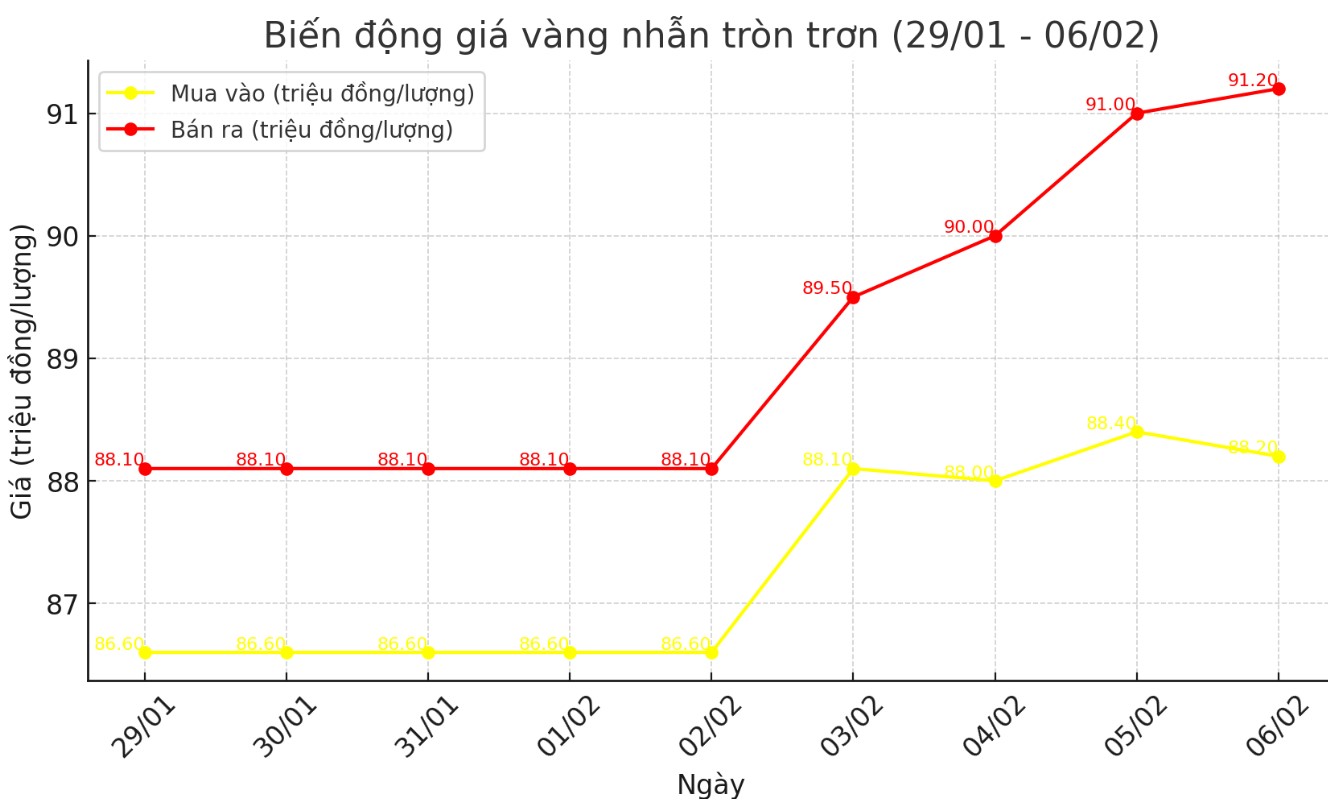

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.2-91.2 million VND/tael (buy - sell); down 200,000 VND/tael for buying and up 200,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 88.1-91.15 million VND/tael (buy - sell), down 300,000 VND/tael for buying and up 200,000 VND/tael for selling compared to early this morning.

World gold price

As of 9:15 a.m., the world gold price listed on Kitco was at 2,868.6 USD/ounce, up 14.9 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased sharply in the context of a weaker USD. Recorded at 9:25 a.m. on February 6, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 107,520 points.

Gold's sharp rise comes amid growing concerns about international trade relations after US President Donald Trump announced new tariffs.

The recent market volatility stems from President Donald Trump’s February 1 announcement of significant tariffs on key trading partners. The initial plan included a 25% tariff on all non-energy imports from Mexico and Canada (with a 10% tariff on energy resources), along with a general 10% tariff on imports from China.

While tariffs on goods from Mexico and Canada have been temporarily suspended for 30 days to allow for further negotiations, the US administration has maintained its tough stance on imports from China and implemented the announced tariffs.

Beijing was quick to respond. On February 6, Chinese finance officials announced retaliatory tariffs, including a 15% levy on coal and liquefied natural gas imported from the United States, effective February 10.

China also increased tariffs by 10% on US crude oil, some auto products and agricultural equipment, and imposed new export controls on key minerals.

Rising tensions between the world’s two largest economies have investors seeking safe havens, especially gold. The US dollar index, which measures the greenback’s strength against a basket of six major currencies (of which the euro has a 57.6% weighting), continued to fall as investors adjusted their portfolios to cope with escalating trade risks.

The simultaneous implementation of retaliatory tariffs by both the United States and China marks a significant escalation in trade tensions, raising concerns about the potential impact on global economic stability.

While world gold prices received many supportive factors, recently released US economic data continued to support the precious metal's price increase.

The U.S. services sector weakened last month while price pressures eased, according to the latest data from the Institute for Supply Management (ISM). The ISM announced Wednesday morning that its services purchasing managers index (PMI) fell to 52.8 in January, down from a revised 54 in December. The data was weaker than expected, with economists expecting a reading of 54.2.

If the index is above 50, the economy is growing; if it is below 50, the economy is shrinking. The further the index is from 50, the faster the growth or contraction.

The services PMI is a key indicator of the health of the service sector, which accounts for a large portion of the US economy. When the index declines more than expected, it reflects a slowdown in economic activity, which can raise concerns about a broader US economic slowdown. In such a context, investors tend to seek gold as a safe-haven asset, pushing up its price.

See more news related to gold prices HERE...