Domestic gold prices increase simultaneously

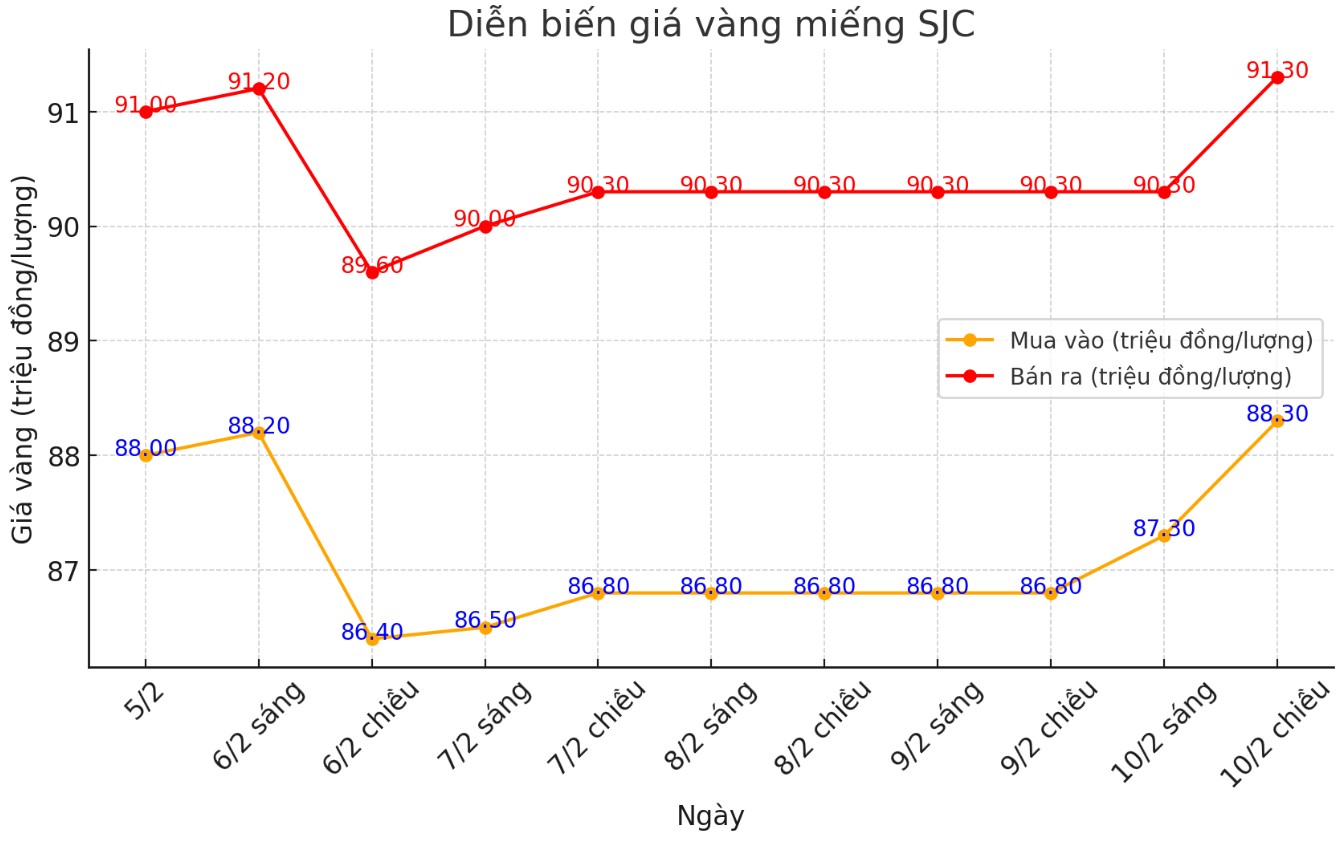

Closing the session yesterday (9.2), Doji Group and Saigon SJC VBQ Company listed the price of SJC gold at the threshold of 86.8-90.3 million dong/tael (purchased in - sold). SJC gold price difference in two units is at 3.5 million VND/tael.

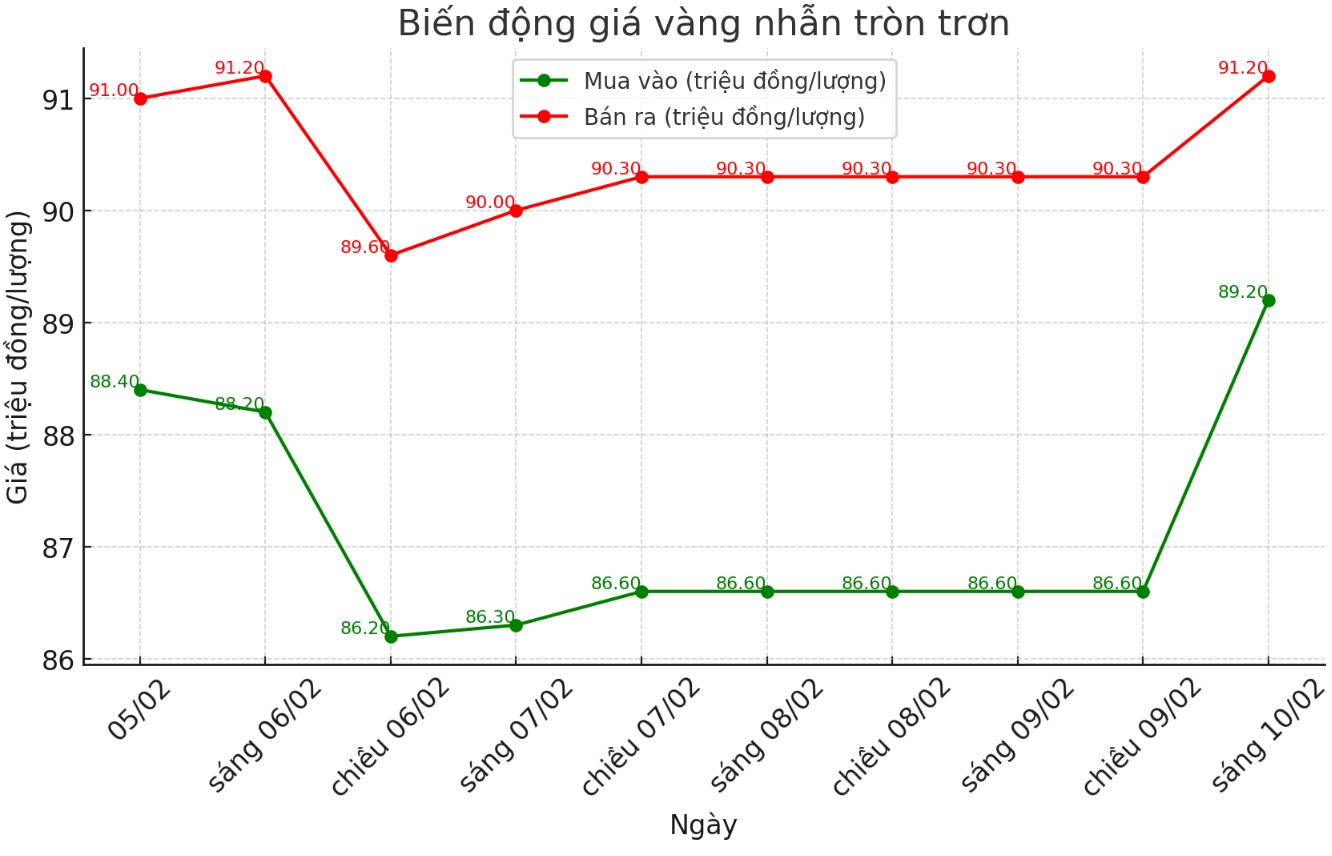

Meanwhile, the price of 9999 prosperous gold rings at Doji listed at the threshold of 86.6-90.3 million VND/tael (purchased - sold); Buying difference - sold at the threshold of 3.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 86.8-90.25 million dong/tael (bought - sold); Buying difference - sold at the threshold of 3.45 million VND/tael.

Closing the session this afternoon (10.2), Doji Group and Saigon SJC VBD company adjusted the price of SJC gold to the threshold of 88.3-91.3 million VND/tael (buying - selling), increasing 1.5 Million dong/tael buy and increase 1 million dong/tael to sell. SJC gold price difference in two units adjusted to a threshold of VND 3 million/tael.

Meanwhile, the price of gold ring 9999 prosperity at Doji listed at the threshold of 89.2-91.2 million VND/tael (purchased - sold); Increasing VND 2.6 million/tael to buy and an increase of VND 900,000/tael. The difference in buying - selling reduced to the threshold of 2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 88.85-91.25 million dong/tael (purchased - sold); Increasing VND 2.05 million/tael to buy and an increase of VND 1 million/tael. The difference in buying - selling decreases from 3.45 million VND/tael to 2.4 million dong/tael.

What is the difference between buying and selling gold?

When the difference between buying and selling prices decreases, that shows that market liquidity improves. That means buyers and sellers of gold are more likely to achieve more reasonable prices, making transactions more vibrant. As the price gap narrows, investors are more likely to make quick profits, increasing liquidity for the gold market.

An important indicator of the difference in buying and selling gold is the price volatility. When the gold market tends to fluctuate strongly, gold businesses will increase the difference to offset risks. On the contrary, when gold prices tend to be more stable, the difference decreases, it means that the market is calm and investors assess lower risks.

As the demand for transactions increases, gold trading enterprises tend to narrow the price difference to attract customers. The reduction of price difference can help increase the volume of transactions, help businesses maintain revenue even when the profit margin of each transaction is narrowed.

Recent trading sessions difference - selling gold in the country have been pushed to a very high threshold. The adjustment of business units reduces the difference in buying and selling gold helps investors reduce the risk of losses when buying.

Although the difference in buying and selling gold has decreased, but still high. This means that gold prices must increase sharply for buyers to be profitable. In the context of a large difference, the risk of gold investing is also higher, so investors need to consider carefully before deciding on the transaction.

World gold price is also an important factor for reference, because domestic gold price tends to fluctuate in the same international market.

See more news related to gold prices HERE...