Update SJC gold price

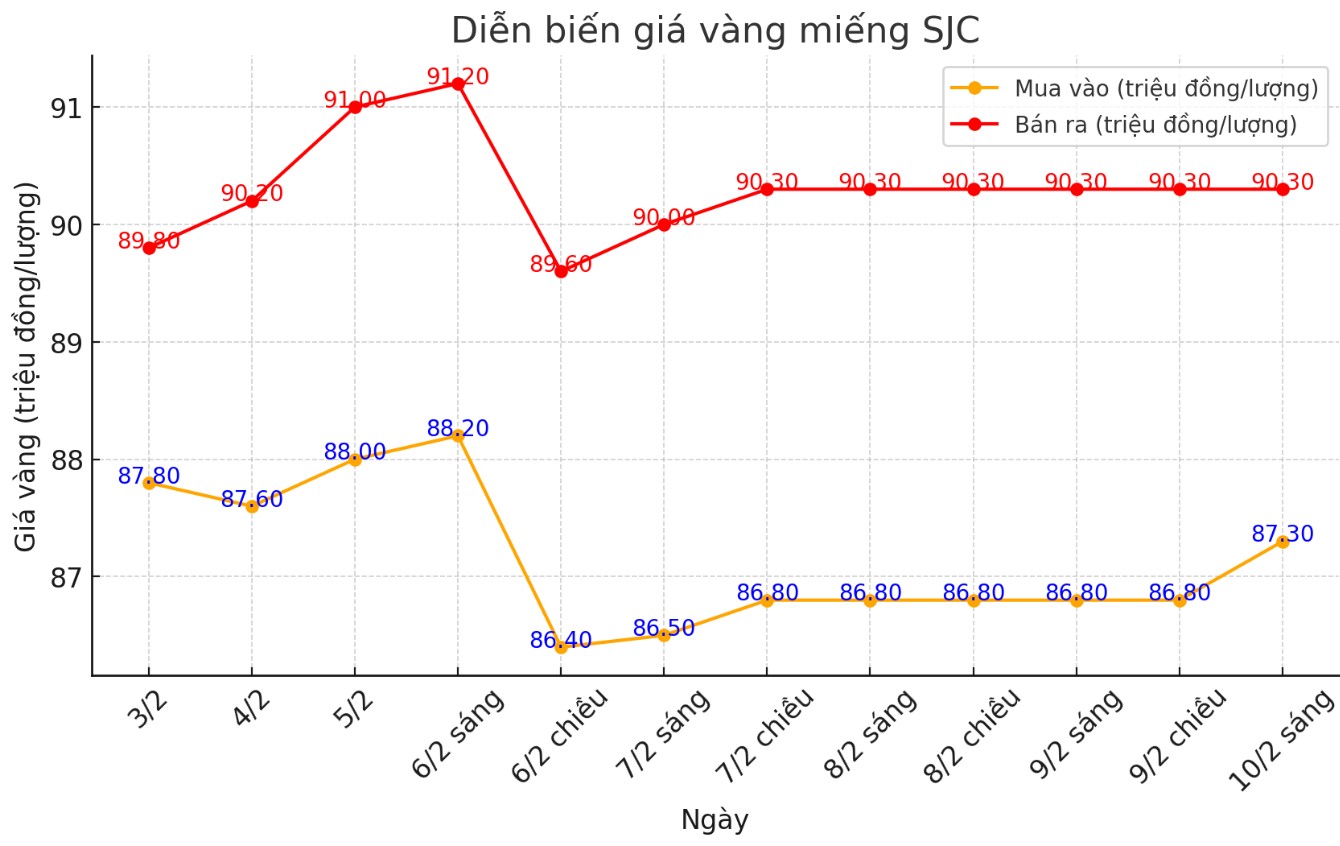

As of 9:00 am, SJC gold price was listed by Saigon SJC VBD Company at the threshold of 87.3-90.3 million VND/tael (buying - selling); Increase 500,000 VND/tael to buy and keep the selling direction.

SJC gold price difference at Saigon SJC VBD Company increased to 3 million VND/tael.

Meanwhile, SJC gold price is listed by DOJI Group at the threshold of VND 86.8-90.3 million/tael (purchased - sold); 87.3-90.3 million dong/tael (bought - sold); Increase 500,000 VND/tael to buy and keep the selling direction.

SJC gold price difference at Doji Group is at 3 million VND/tael.

Gold price round 9999

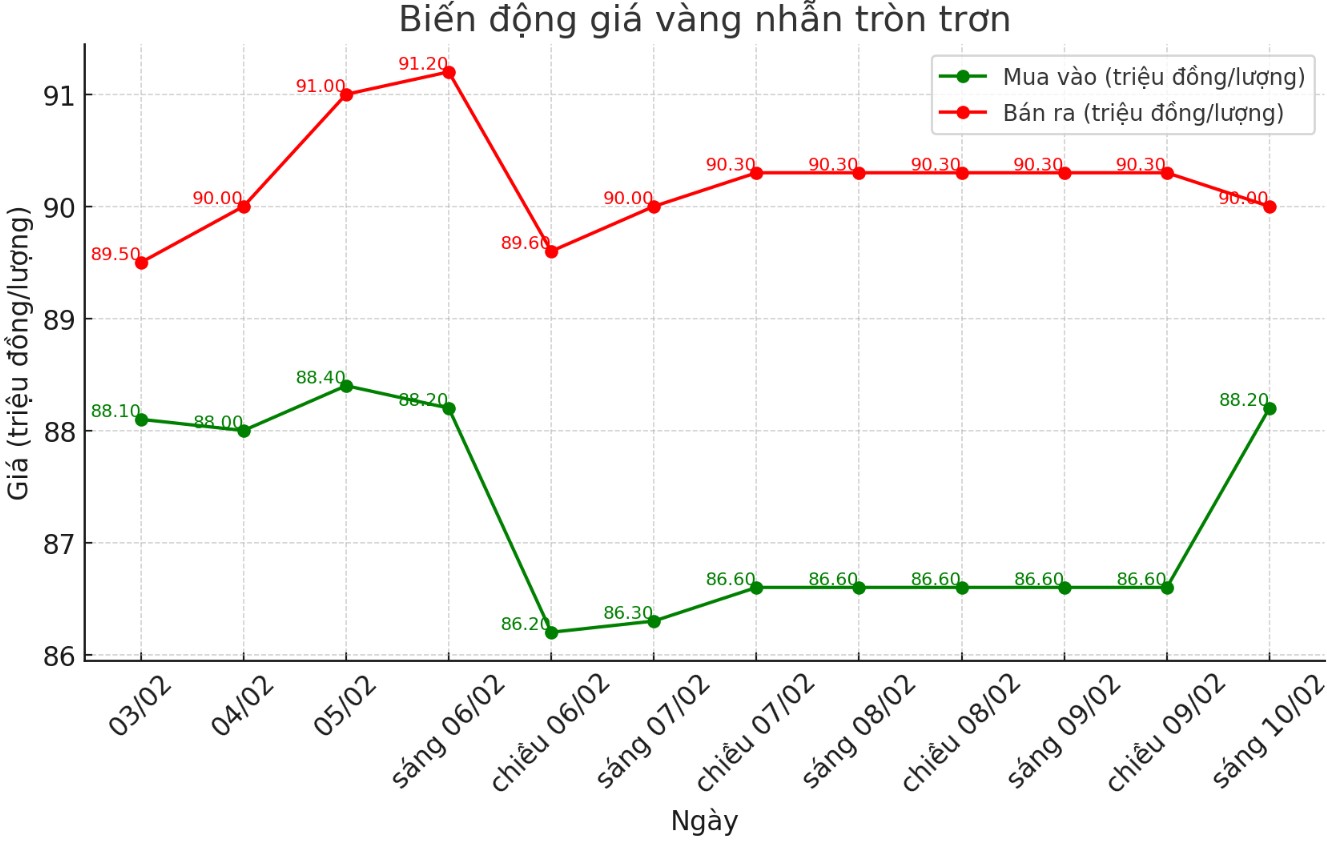

As of 9:00 am today, the price of gold ring 9999 prosperity at Doji listed at the threshold of 88.2-90 million dong/tael (purchased - sold); increased by 1.6 million VND/tael to buy and decreased by 300,000 VND/tael to sell compared to early morning.

Buying difference - selling down to the threshold of 1.8 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 88.2-90.45 million dong/tael (buying - selling), up 1.4 million dong/tael to buy and up 200,000 dong/tael to sell Compared to the early morning.

The difference in buying - selling decreases to the threshold of 2.25 million VND/tael.

World gold price

As of 8:50 am, the world gold price listed on Kitco is at the threshold of 2,868.5 USD/ounce, up 7.3 USD/ounce compared to the beginning of the previous session.

Gold price forecast

The world gold price increased despite the strongest dollar. Recognized at 8:50 am on 10.2, the US Dollar Index measured the fluctuations of green silver coins with 6 key currencies at the threshold of 108,250 points (up 0.3%).

Gold price continues to be supported when central banks started in 2025 by increasing reserves, maintaining the trend of strong gold buying as the end of 2024.

Krishan Gopaul - Senior EMEA area analyst at the World Gold Council (WGC), updated the amount of gold that central banks bought last month.

Gopaul said China continued to increase 5 tons of gold reserves in January 2005.

Analysts are paying special attention to China. This is the third consecutive month of the People's Bank of China increasing the amount of gold reserves, after a period of suspension lasting six months, ending the gold purchase last 18 months earlier.

"Buying in the last month, bringing China's total gold reserve to 2,285 tons," Gopaul said.

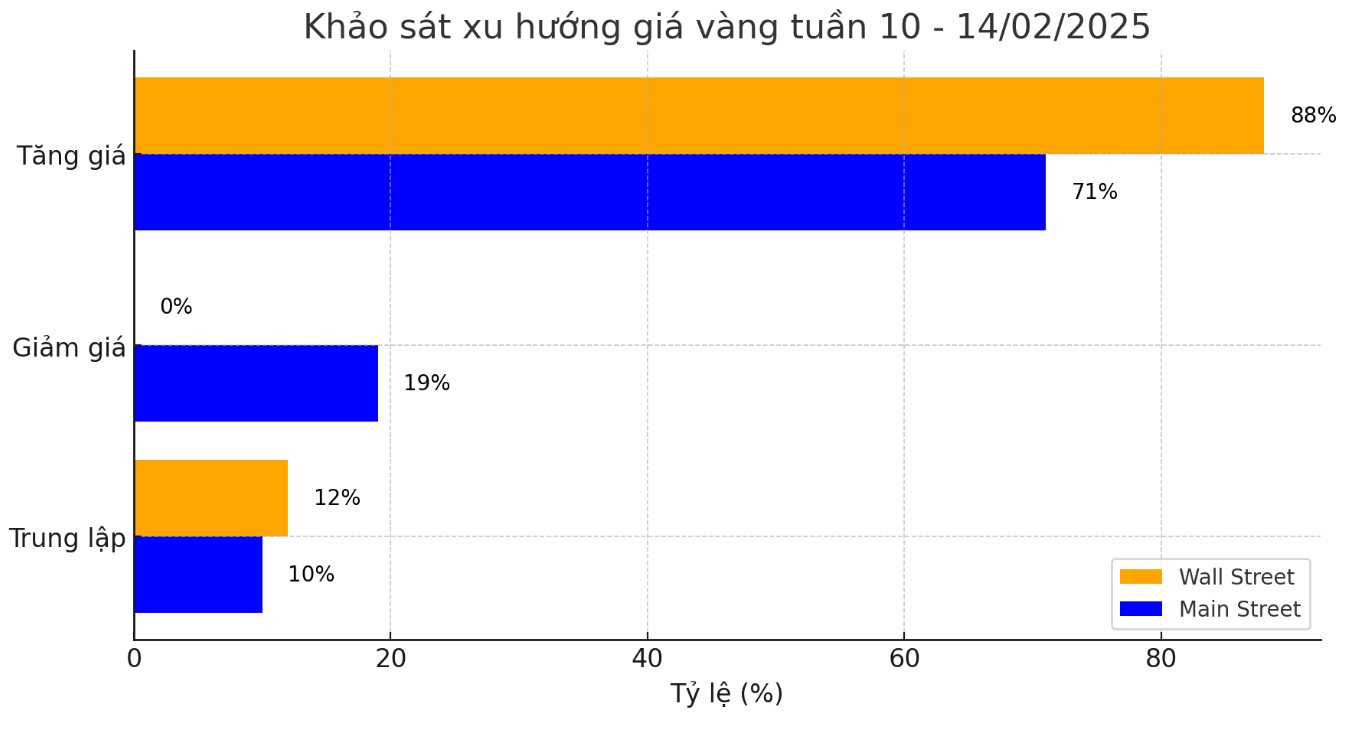

The latest survey of Kitco News shows that experts in the industry are unprecedented optimistic about gold prices this week.

Adrian Day - Adrian Day Asset Management said that gold price would increase this week: "The motivation of gold remains, the factors that promote price in the past year remain intact. The pause and accumulation, but may not be now. "

Sharing the same view, Rich Checkan - President and COO of Asset Strategies International said: "The fluctuations and instability of the first weeks under the new government in the US are making investors find gold as a hiding channel. Safe. This trend will continue. "

John Weyer - Director of the Protection Division in Walsh Trading, looked at the strong fluctuations of gold on Friday morning, and assessed the overall increase trend in the context of increasing geopolitical instability.

"With tariff discussions and inflation, gold is still a safe shelter," Weyer said. Weyer also mentioned recent inflation reports and the possibility of the US Federal Reserve (Fed) may decide to raise interest rates.

After the calm and stable press conference of the President of the Federal Reserve (Fed) Jerome Powell after the FOMC meeting last week, the market may witness more exciting debates this week when Mr. Powell heard before the Senate Bank Committee on Tuesday and the House Financial Services Committee on Wednesday.

Golden traders will also closely monitor the US January Consumer Price Report (CPI) in the fourth announced on Wednesday, the production price index (PPI) and the weekly unemployment allowance in the secondary Five, as well as reporting in January retail sales on Friday.

See more news related to gold price here ...