Experts predict positively

Adrian Day - Chairman of Adrian Day Asset Management predicts that gold prices will continue to increase and surpass the $3,000/ounce mark. He said that central banks continue to buy strongly, especially foreign banks, which are not affected by the price of 3,000 USD/ounce.

In addition, North American investors are also returning to the gold market after two years of absence, creating new demand.

Darin Newsom - Senior analyst at Barchart.com commented that both technical and basic analysis are no longer important at this time. He said gold remains a safe haven amid global economic and political fluctuations.

Sharing the same view, Sean Lusk - Co-Director of Trade Risk Prevention at Walsh Trading said that gold prices are being driven by economic and political events. He said central banks continue to increase their gold holdings whenever prices have a correction.

We have seen a strong rally from 2023 to present, thanks to the prolonged uncertainty that has benefited gold over the past three years, Lusk said.

He also noted that the next potential prices could be $3,036/ounce and $3,168/ounce.

Kevin Grady - President of Phoenix Futures and Options believes that the $3,000/ounce mark is an important psychological threshold, but the most important thing is who is buying and who is selling.

He found that central banks such as Poland, Turkey and China have all increased their gold reserves. I think youll see prices around $3,000 an ounce for a while, but the general trend is still up, Grady said.

Experts at CPM Group have recommended buying gold with a target of 3,050 USD/ounce next week. They predict that gold prices may surpass the newly established high because investors do not want to hold a selling position when the political situation is still full of risks.

Alex Kuptsikevich - Senior Analyst at FxPro said that gold prices are being driven by expectations of falling interest rates. He predicted that gold prices could reach $3,190/ounce, or even go further to $3,400/ounce.

The most important thing is the psychology in the global currency market that is boosting gold prices, said Kuptsikevich.

Michael Moor - Founder of Moor Analytics maintains an optimistic view when saying that gold is still in a long-term uptrend since 2015. He sets a price target of around $3,151 - $3,954 an ounce, with the current price only reaching a part of this trend.

Jim Wyckoff - Senior analyst at Kitco commented that gold will continue to conquer new highs next week thanks to safe-haven demand, positive chart trends and expectations of the FED to loosen monetary policy.

Experts predict gold prices will decrease

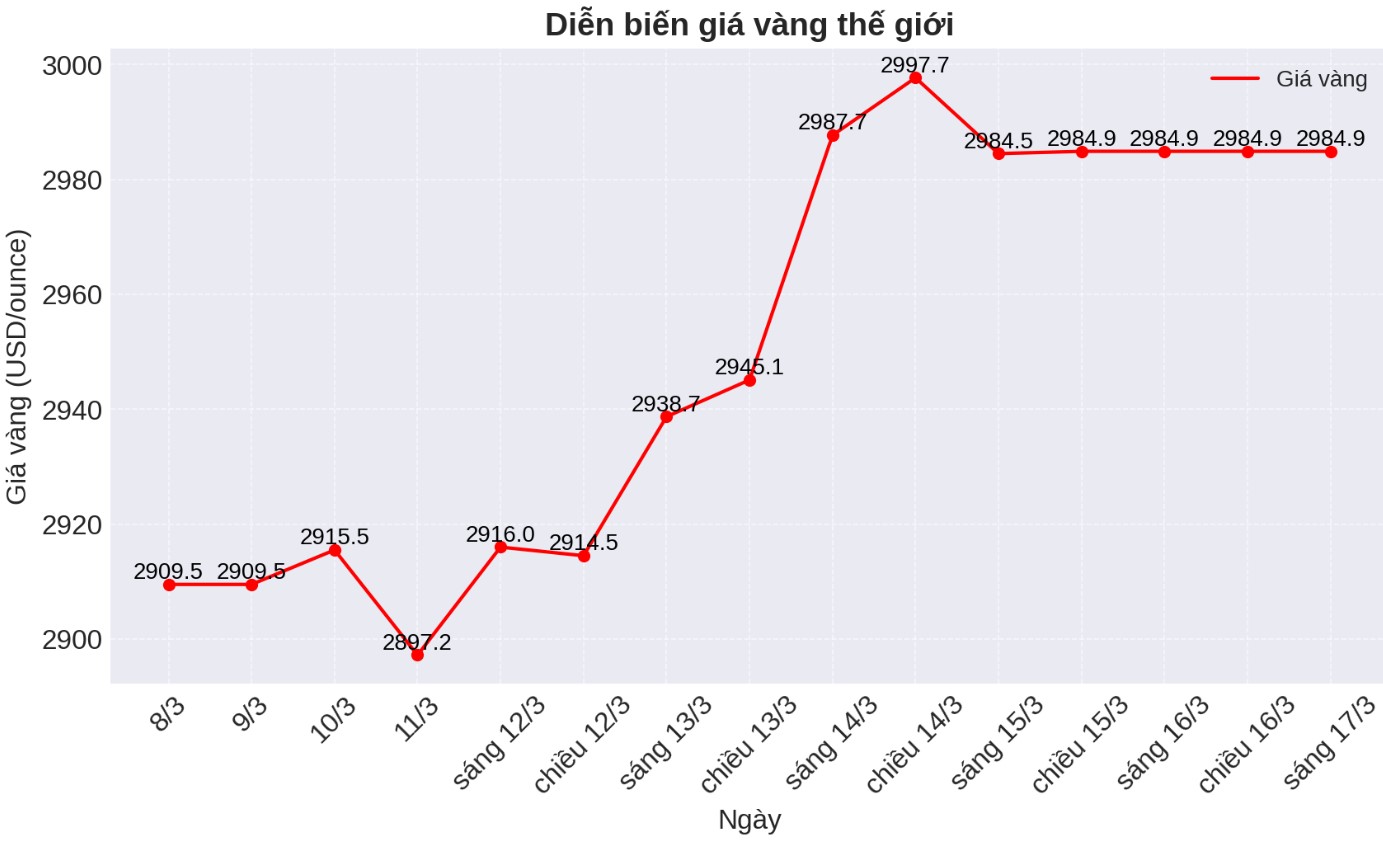

Rich Checkan - President and COO at Asset Strategies International said that after reaching $3,000/ounce, gold may face a profit-taking before continuing to increase again.

James Stanley - Senior strategist at Forex.com believes that the $3,000/ounce mark will create selling pressure, allowing gold prices to adjust slightly instead of completely reversing.

Marc Chandler - CEO at Bannockburn Global Forex predicted that gold prices may decrease slightly after surpassing the $3,000/ounce mark.

He warned of the risks from strong US economic data and the possibility of the US Federal Reserve (FED) taking a more cautious view on interest rates. He predicted that gold could fall to the $2,980/ounce zone before determining the next trend.

Experts predict gold prices to remain stable

Mark Leibovit - VR Metals/Resource Letter Publishing House is neutral on gold next week.

Sean Lusk also noted that the gold market is reacting to new and constantly emerging economic and political information, which could leave prices uncertain in the short term. He said prices could hover around $3,000 an ounce before determining a new trend.

Kevin Grady believes that although prices may adjust, the bottom of gold will continue to rise. He predicted prices would fluctuate around $2,950 - $3,000/ounce before establishing the next trend.

See more news related to gold prices HERE...