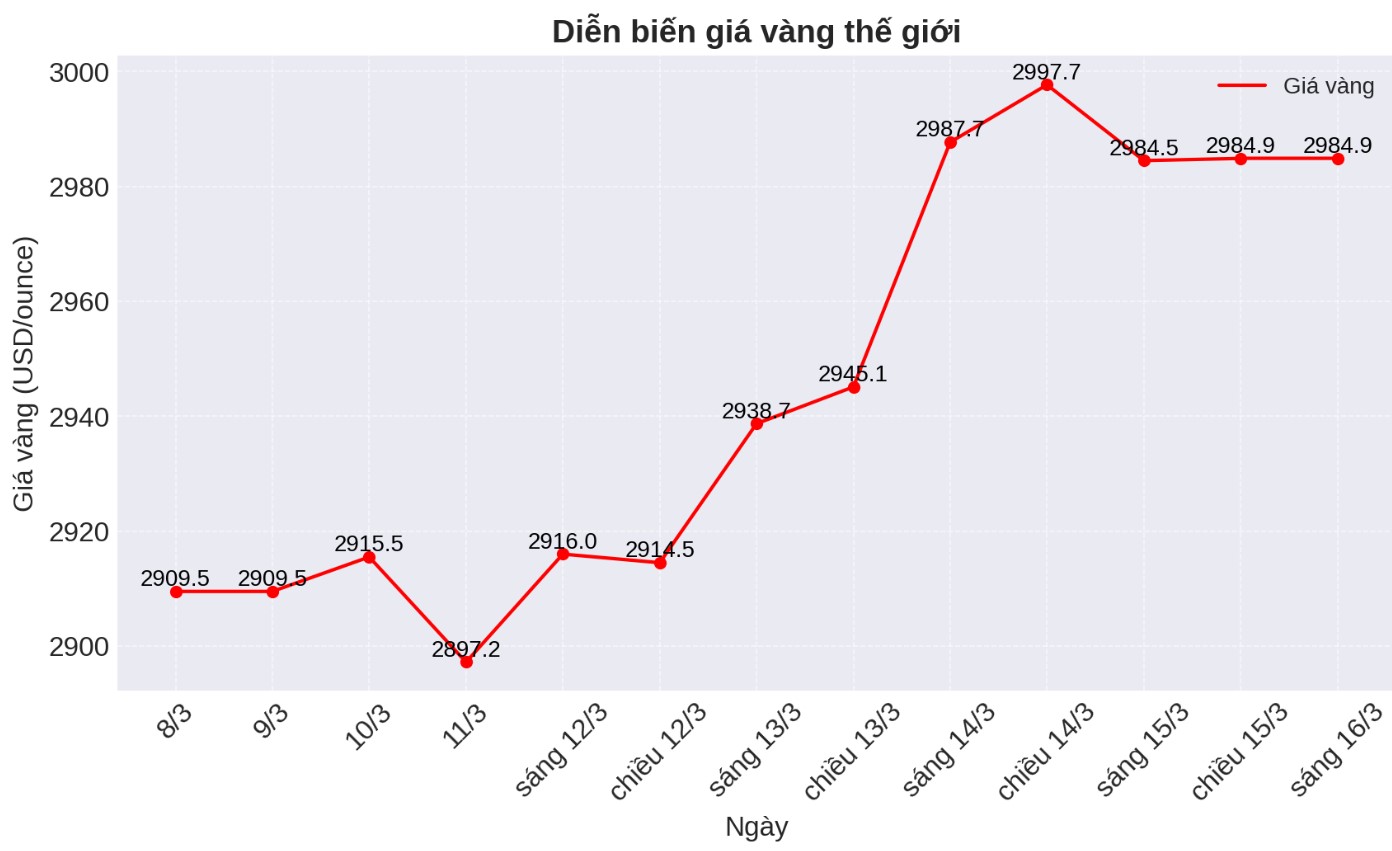

Gold temporarily stopped before the threshold of 3,000 USD but still has a chance to break out

On Kitco, Jesse Colombo - independent precious metals analyst and author of The Bubble Bubble Report on Substack - commented that the decline in gold prices at the end of the week was just a temporary stop at an important resistance level and an important psychological level.

"The trend is still strong and I expect gold prices to continue to try to break the $3,000 threshold, maybe next week."

Meanwhile, commodity analysts at TD Securities note that gold's testing at $3,000/ounce will mark the third largest rally in modern history. They said that although risks are increasing in the market, the increase is not over.

Macro funds are still capable of buying more, but their budgets are not endless. However, larger macro factors are still supporting the increase in the medium term, the analysts said in a note.

With such a strong breakout, it is difficult to predict how far prices will go before profit-taking pressure creates a significant correction, said James Stanley, senior strategist at Forex.com.

However, he noted that even as gold hit $3,000 an ounce, the volume indicators have not yet fallen into the overbought zone as they have seen in previous increases. He stressed that when gold surpassed $2,000/ounce in 2020, the precious metal's Relative Strength Index (RSI) surpassed 80 points. Stanley believes that gold's correction in the last months of 2024 has helped the market not fall into a state of overheating.

I dont know how much more gold could increase, but I believe there is still momentum to continue. I would not rush to bet on gold falling right now because it could continue to rise and remain above $3,000/ounce for some time, he said.

Although gold still has room to increase in price, Stanley believes that an adjustment in the next few weeks will be necessary. He warned that if gold prices continue to climb too quickly, it could trigger a mass exit from the market.

The difference between the current gold price increase and 2011

Some analysts warned that gold's rally to $3,000 an ounce is similar to the record rally of $1,900 an ounce in 2011. Gold prices fell sharply after three consecutive years of rising due to profit-taking pressure.

However, some experts believe that the big difference between now and 2011 is that economic instability is just getting started. At the same time, ongoing geopolitical tensions continue to strengthen gold's position as an important safe-haven asset.

While gold is trading near an all-time high, the US stock market is facing the risk of correction. The S&P 500 ended the week down 2.4% and has fallen more than 5% since the beginning of the year. Meanwhile, gold prices have risen nearly 13%.

Colombo believes that a weakening of the stock market could continue to boost gold's rally.

The capital flow from stocks to gold has begun strongly, and this will provide missionel fuel for the gold bull market for many years to come, he said.

Important economic data next week

Monday: US retail sales, Empire State Production Index

Tuesday: Housing started construction and construction permit in the US, monetary policy decision of the Bank of Japan

Wednesday: Fed monetary policy decision

Thursday: Swiss National Bank and Bank of England monetary policy decision, weekly jobless claims in the US, Philly Fed manufacturing survey, existing home sales in the US.