Gold prices fell on Tuesday as trade tensions between the US and major partners cooled, reducing the safe-haven appeal of the precious metal. Investors are also waiting for US economic data to assess the policy direction of the US Federal Reserve (FED).

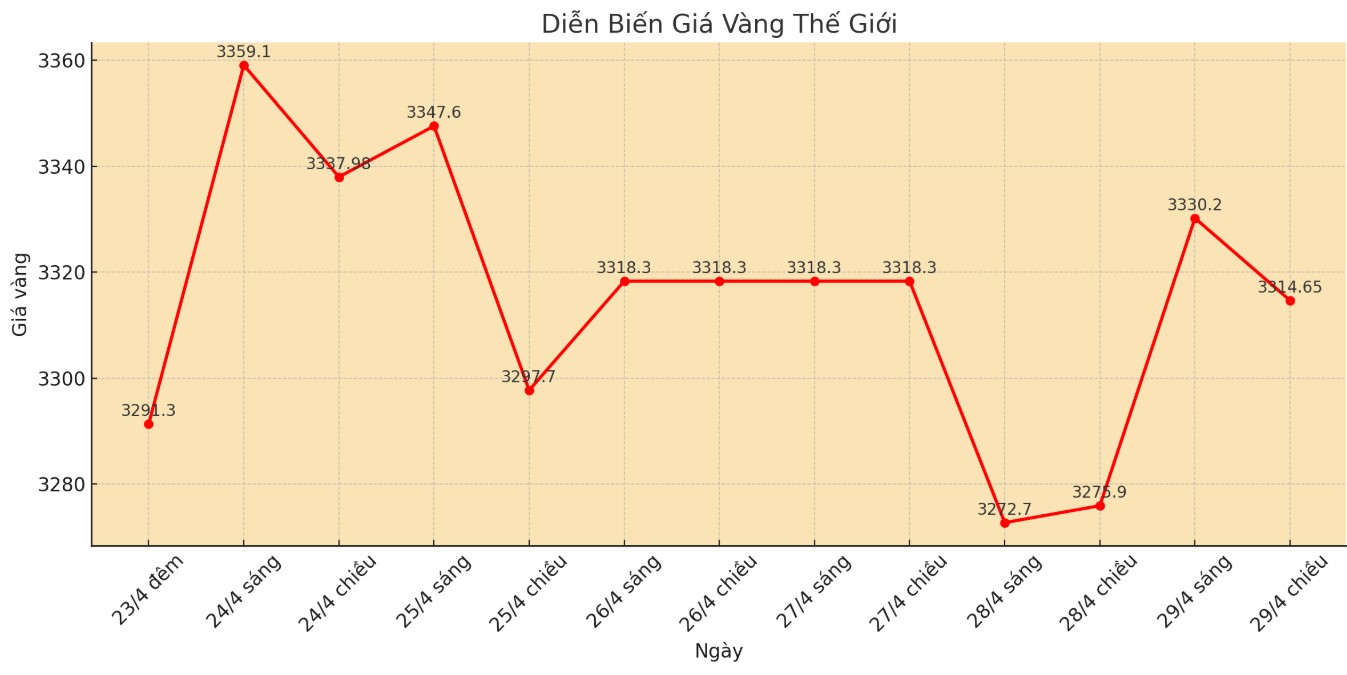

At 6:19 GMT (1319 - Vietnam time), spot gold prices fell 0.8%, down to $3,314.65/ounce. US gold futures also fell 0.7%, to $3,324.2 an ounce.

Its clear that the risk environment has improved recently, as the market is optimistic that the worst possible trade tensions are over, given the positive signals about trade deals, IGs market strategist Yeap Jun Rong said.

US Treasury Secretary Scott Bessent said on Monday that some major trading partners have made very good proposals to avoid US tariffs, with India likely to be the first to complete the deal.

Mr. Bessent also added that China's recent exemption of retaliatory tariffs on some US goods shows goodwill to cool down trade tensions.

The Trump administration also plans to reduce the impact of auto taxes by easing some of the tariffs on domestically assembled imported auto components.

However, according to Reuters' survey results, the majority of economists believe that the risk of a global economic recession this year is very high, with many saying that Mr. Trump's tariff policies have weakened business confidence.

Last week, gold increased to a record high of $3,500.05/ounce due to increased political and financial instability, as gold was considered a safe haven.

This week, investors will pay attention to important economic reports released, including the US Open Employment Service (JOLTS) data later today, the Personal Consumption Expenditures (PCE) index on Wednesday and the non-farm payrolls report on Friday.

In the long term, institutional support factors will continue to maintain the upward trend of gold prices, especially thanks to central banks in emerging markets continuing to diversify foreign exchange reserves, Mr. Rong added.

In addition to gold, spot silver prices fell 0.6% to 32.98 USD/ounce, platinum prices fell 0.2% to 984.65 USD/ounce and palladium prices fell 0.5% to 944.34 USD/ounce.