Updated SJC gold price

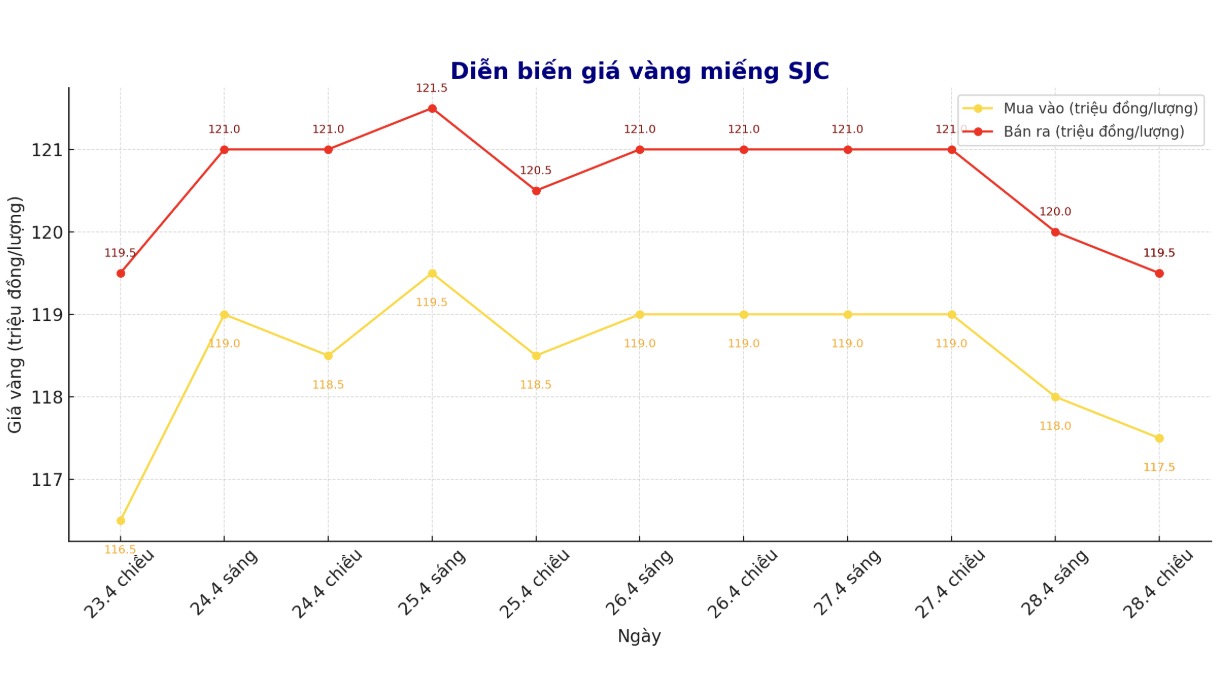

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.5-111.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.5-111.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-111.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-11.5 million VND/tael (buy - sell), down 1.5 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

9999 round gold ring price

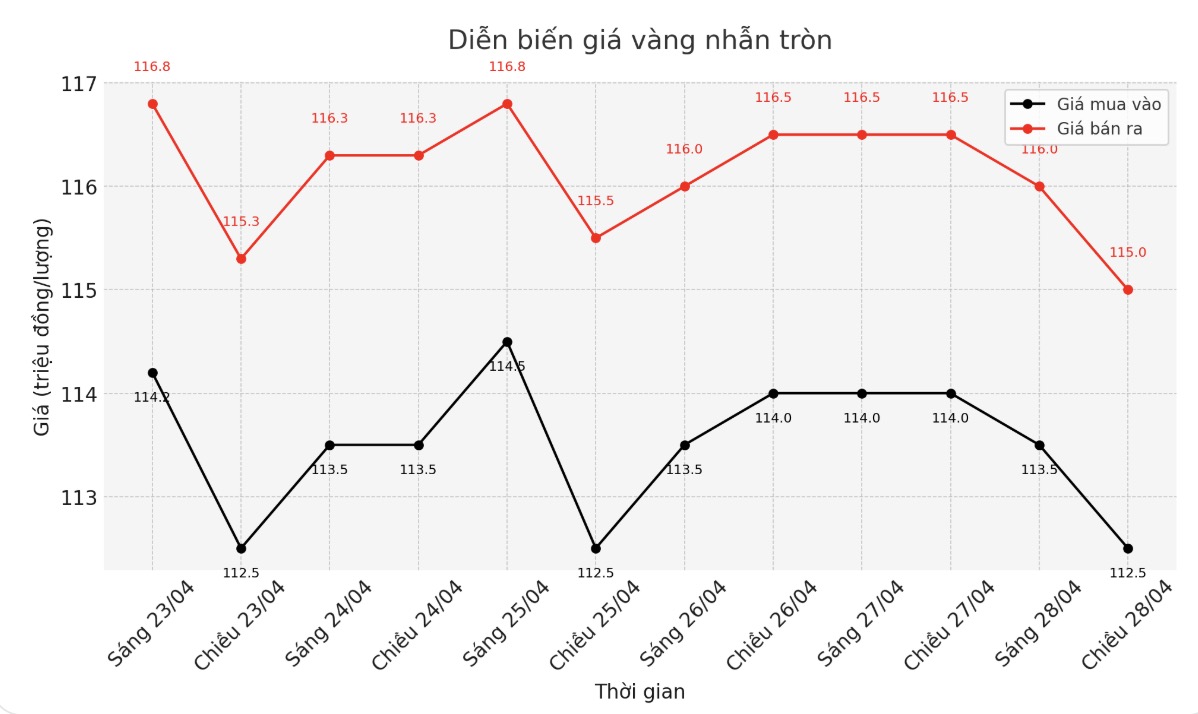

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-115 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.5 million VND/tael (buy - sell), down 1.3 million VND/tael for buying and down 1.5 million VND/tael for selling. The difference between buying and selling is 2.8 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy - sell), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 1:00 a.m., the world gold price listed on Kitco was around 3,334.4 USD/ounce, up 16.1 USD.

Gold price forecast

Gold prices increased sharply in the trading session on Monday after US stocks and the USD index both decreased. Gold prices for June delivery are currently up 46.84 USD, to 3,345.4 USD/ounce. The price of silver delivered in May increased slightly by 0.01 USD, to 33.02 USD/ounce.

US stocks fell in the morning session due to a poor production outlook report in Texas, showing that global tariffs and trade tensions are starting to affect businesses.

A Chinese official said over the weekend that the US should lift unilateral tariffs if it is to resolve a trade dispute with China.

The Chinese Ministry of Commerce spokesperson also said that China and the US are not currently holding any negotiations, and the US needs to show goodwill if it wants to negotiate.

The amount of Chinese goods exported to the US has decreased by up to 60% since the US raised the tariffs to 145% in April - according to brokerage SP Angel. Meanwhile, President Donald Trump said he could impose new tariffs on China in the next 2-3 weeks.

Technically, bulls are dominating in the short term. The next target is to close above the resistance level of $3,509.9/ounce. On the contrary, the sellers want to push the price below 3,200 USD/ounce.

The immediate resistance was Friday's high of $3,384.10 an ounce, followed by $3,400 an ounce. The near support level was $3,300/ounce, followed by last week's low of $3,270.8/ounce and $3,250/ounce.

Overseas markets saw the USD index fall. Nymex crude oil prices also fell, standing around $61.75/barrel. The yield on the 10-year US Treasury note is currently at 4.227%.

See more news related to gold prices HERE...