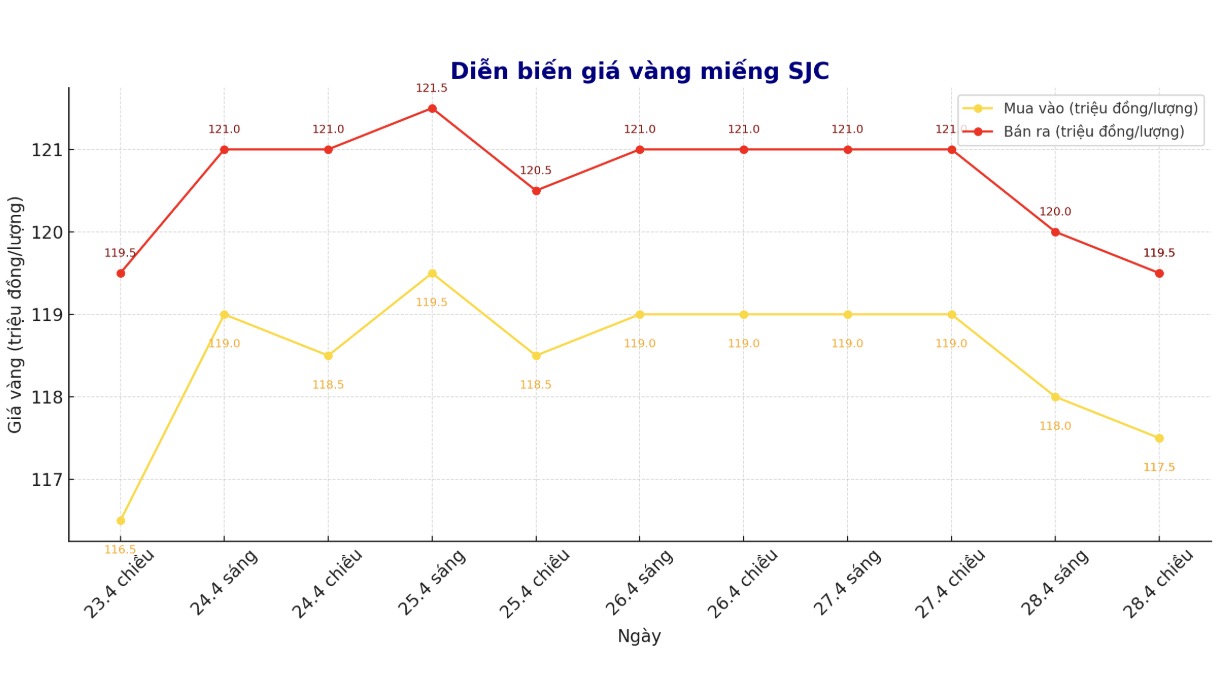

Updated SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.5-111.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.5-111.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-111.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 117-11.5 million VND/tael (buy - sell), down 1.5 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

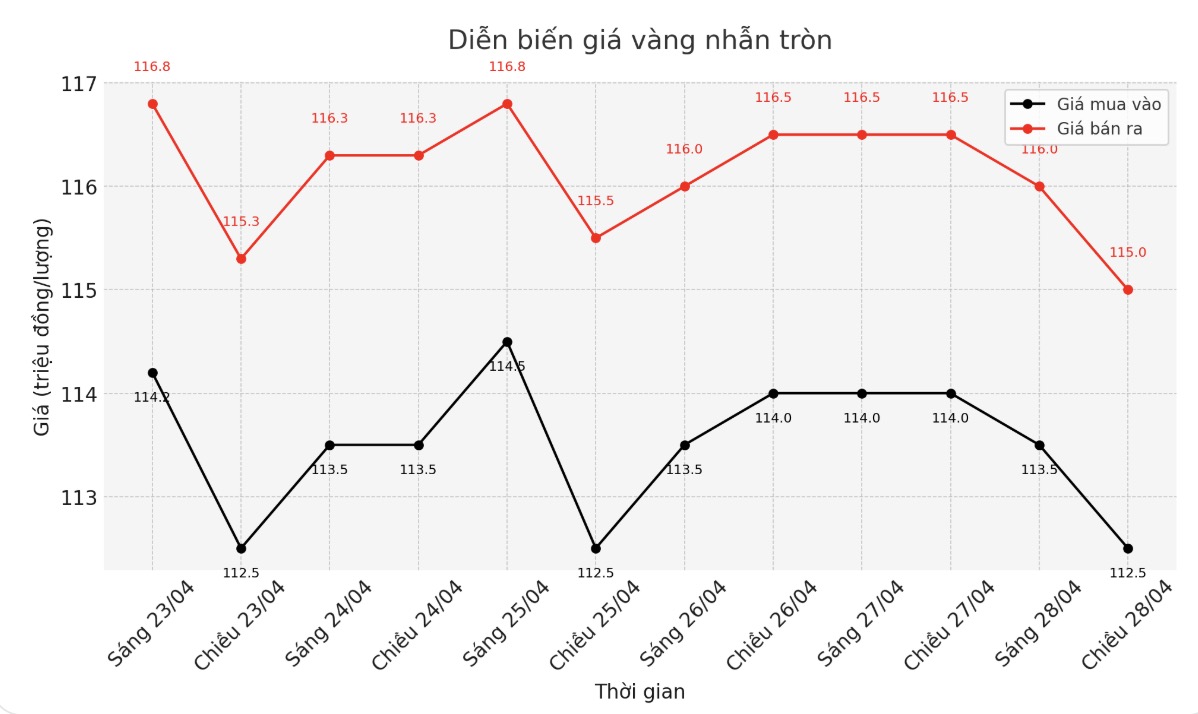

9999 round gold ring price

As of 5:00 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-115 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.5 million VND/tael (buy - sell), down 1.3 million VND/tael for buying and down 1.5 million VND/tael for selling. The difference between buying and selling is 2.8 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy - sell), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

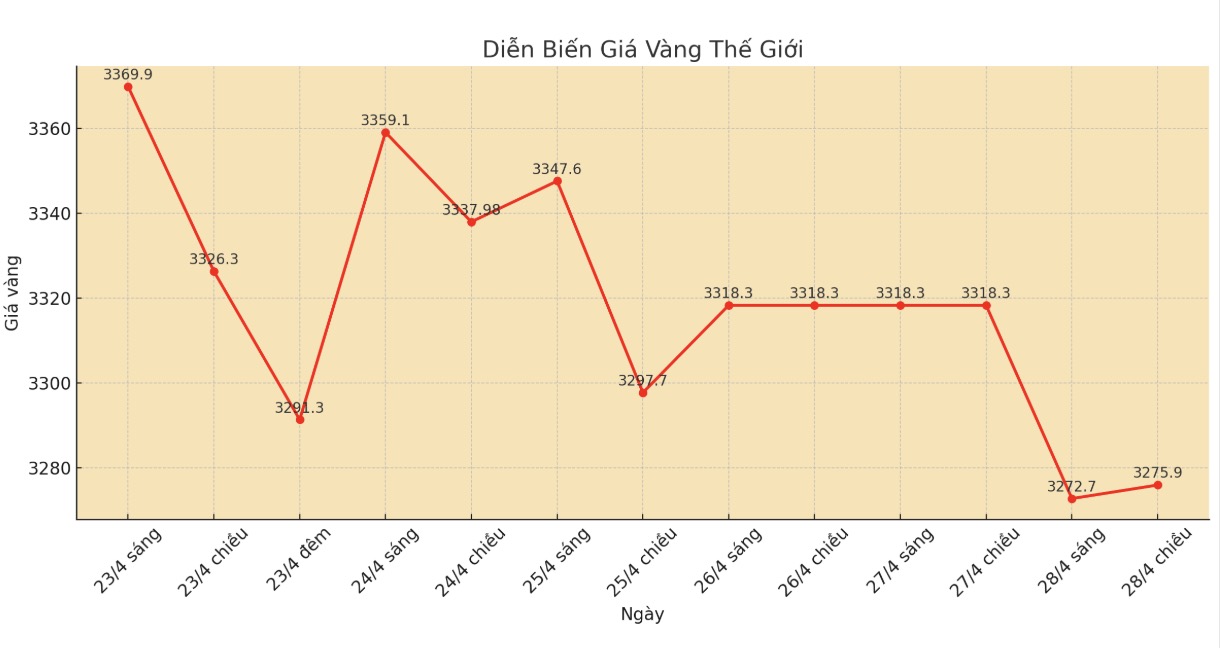

World gold price

At 5:10 p.m., the world gold price listed on Kitco was around 3,275.9 USD/ounce, down sharply by 42.4 USD.

Gold price forecast

Gold prices fell on Monday as trade tensions between the US and China eased, causing investors to turn to more risky assets, reducing the attractiveness of gold. The stronger US dollar also puts more pressure on the precious metal price.

The pressure to decrease gold prices at the beginning of the week continued from last weekend, when gold was sold strongly after US President Donald Trump revealed that Chinese President Xi Jinping had called to discuss tariffs. Mr. Trump is optimistic that the two sides are getting closer to a "both sides are happy" deal.

However, the Chinese side denied and affirmed that there were no consultations. This development caused gold prices to narrow down, holding above $3,300/ounce by the end of the week, but it continued to sell off and lost this mark at the beginning of this week.

"The financial market and risk assets are currently feeling more relieved about the tariff issue compared to the stressful first week of April" - Tim Waterer, chief market analyst at KCM Trade commented.

"Last week's statements from the White House have fueled hopes for a potential US-China trade deal, reducing safe-haven demand for gold," the expert said.

Kitco expert Jim Wyckoff also predicted that gold prices will continue to fall due to worsening technical charts and increased risk-off investment sentiment.

Bob Haberkorn - senior broker at RJO Futures - commented that gold prices may fall to $2,500/ounce but still maintain an upward trend in the long term. He said that gold prices are currently under pressure from optimism about the possibility of reaching a trade deal. Gold could fall below $3,200 an ounce, or even $3,180 an ounce, before bottom-fishing buying power appears.

See more news related to gold prices HERE...