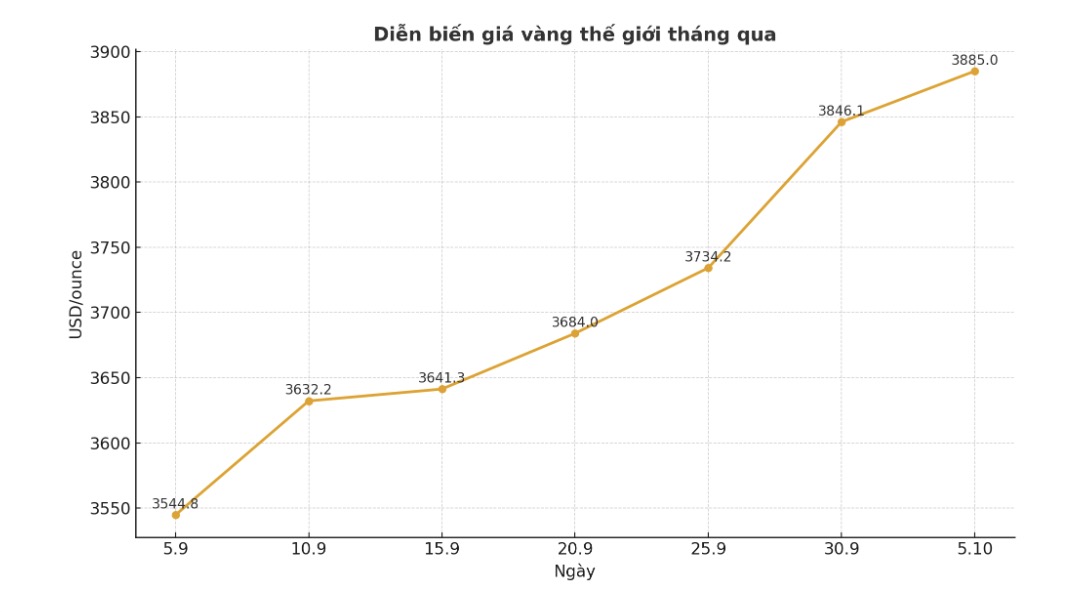

Marc Chandler - CEO of Bannockburn Global Forex - said that gold prices have increased for the 7th consecutive week. "From the end of July until now, there has only been one week of declining gold prices. The US government's closure, discussions in Europe about fiscal policy and geopolitical tensions in the region are reinforcing market cautious sentiment.

The short-term support zone is forming around $3,800/ounce. The $4,000/ounce threshold does not seem to be too far away, Chandler added.

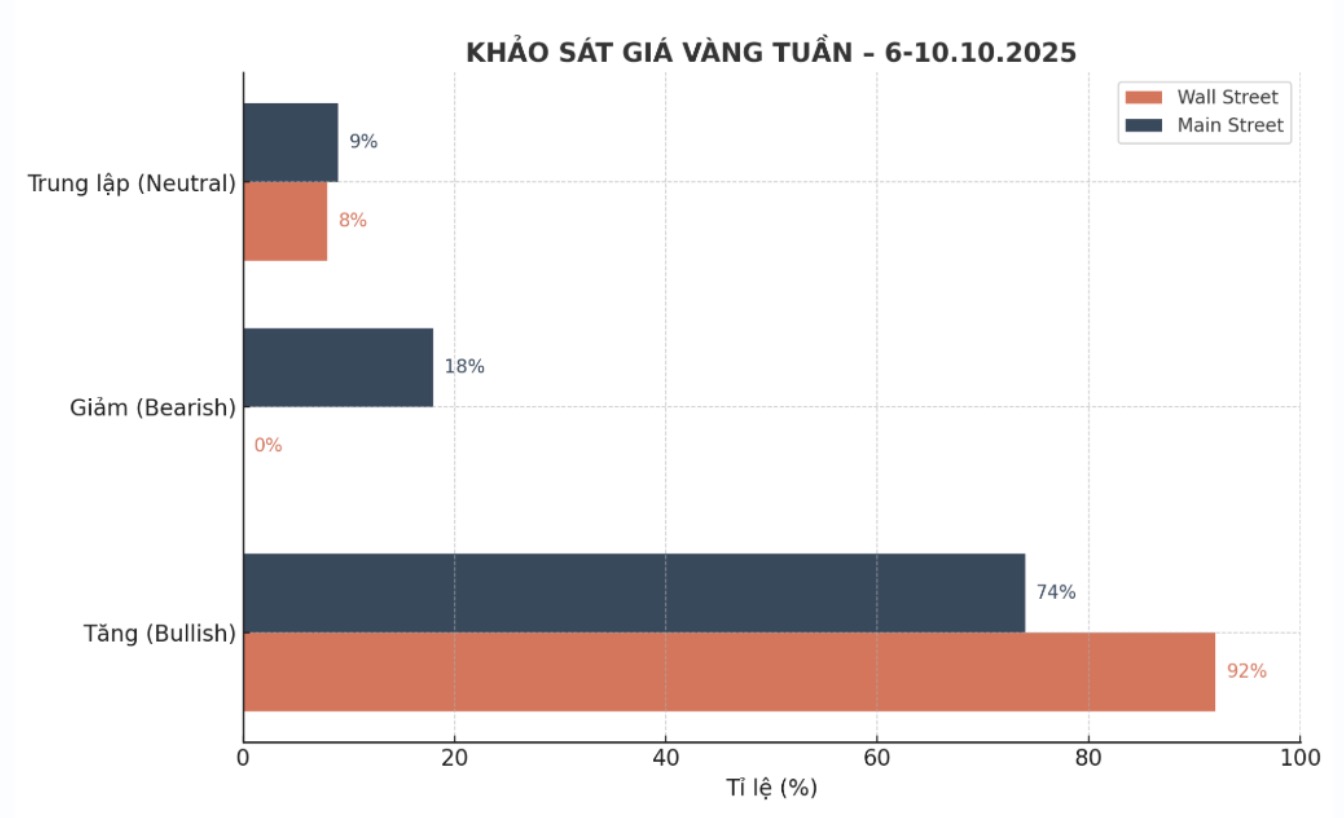

Colin Cieszynski, chief strategist at SIA Wealth Management, is also bullish on gold next week. There is no currently any predictable factor that could disrupt the precious metals uptrend, unless a major surprise comes as a result, he said.

He said the US government's shutdown does not have a direct impact on the metals market. Actually, the problem is that this does not help the USD. It makes the US less attractive to investors. Previously, global capital flows have come to the US as a safe haven, but events like the government's closure have made many investors reconsider the stability of the US market, so part of the capital flow is temporarily shifting to precious metals.

Of course, if the situation is resolved, or peace is achieved somewhere, or there is great positive news, metal prices may slow down a bit. The metal market has been rising steadily for a long time, and at some point it will need a break or correction, but it is unpredictable when, he added.

Cieszynski said that if gold prices surpass the $3,900/ounce mark, the market will quickly move towards the target of $4,000/ounce. 4,000 is a round number, which has great psychological significance. I feel gold is being sucked towards $4,000/ounce, while silver is heading towards $50/ounce, he said.

He said that the entire group of precious metals is clearly strengthening. My feeling is that this increase is spreading, the market is growing, not getting small.

Foreseeing next week, Cieszynski said that even without new US economic data, the FOMC meeting minutes and statements from the US Federal Reserve (FED) will hardly have a big impact. People are more interested in other factors than the Fed, unless someone says something surprising, he said. "Everything is being temporarily put on hold until the government's closure is resolved."

The US ADP jobs report released last Wednesday was bad, and I think the market is relying on that. In the short term, that is enough. In just about a week, the corporate profit announcement season will begin, and attention will gradually shift away from the Fed. Normally, investors are interested in economic data when it affects FED policy or when there is nothing else to say. But in the near future, when profit reports are released, the focus will be on business results - which directly reflects the health of the economy".

Darin Newsom - senior market analyst at Barchart.com - said that the gold price trend next week will still be upward: "I cannot say that the situation in the US will remain the same, because the US economy is facing many challenges. Central banks and international investors have found this and continue to increase gold purchases to hedge against risks.

Sharing the same view, Rich Checkan - Chairman and CEO of Asset Strategies International - said that all signals are currently "blue light" for gold.

While there may be adjustments to make a profit in the future or after the US government reopens, I have not seen any signs of it happening immediately.

Weak management with legal basis is beneficial for gold. Geopolitical crises are beneficial for gold. Social instability is beneficial for gold. Cutting already low interest rates is beneficial for gold. A weakening USD is beneficial for gold. The ratio of gold/ silwer over 80 is beneficial for gold. The Dow/Gold ratio is beneficial for gold. And... although investor sentiment is gradually recovering, it is still weak, continuing to create momentum for gold prices to increase, he said.

See more news related to gold prices HERE...