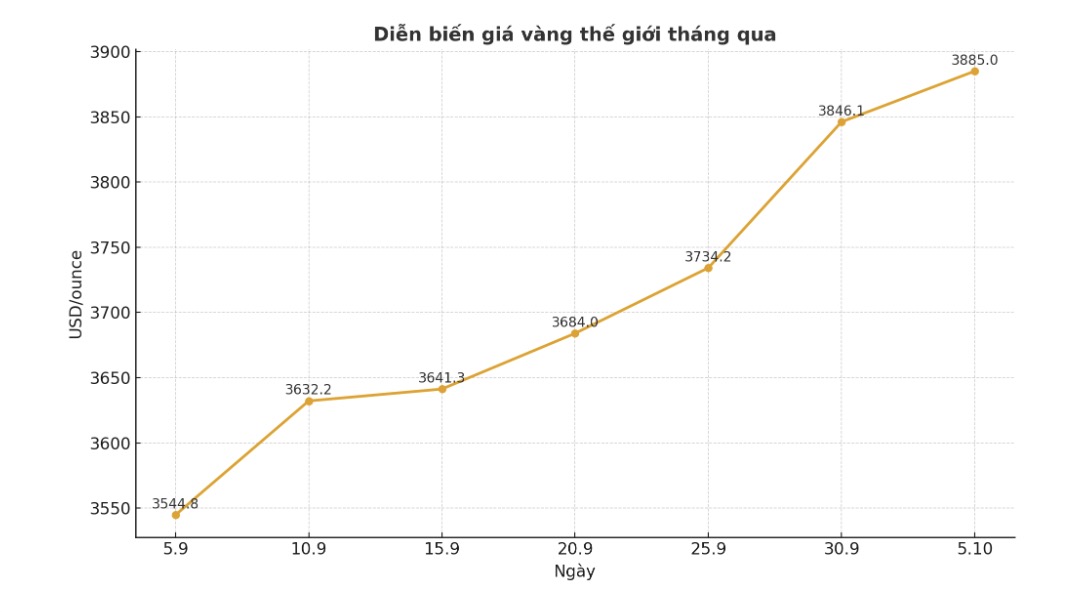

On September 5, world gold prices hovered around $3,641.30/ounce. As of today (October 5), the precious metal has risen to $243.7, to $3,885/ounce.

Thus, after only one month, world gold has increased by nearly 6.7%. Despite profit-taking pressure in early October, gold prices remained firmly at a high level, without recording any significant corrections.

Overall, spot gold has risen more than 48% to $2,625 an ounce since the start of the year, marking its strongest annual increase since 1979.

The explosive increase of the world market has also caused domestic gold prices to increase.

The persistent increase in gold prices in recent times reflects investors' growing confidence that the precious metal is entering a new growth cycle, driven by many simultaneous factors.

One of the key drivers is the weakening of the US dollar. In the context of the US budget deficit continuing to widen and fiscal risks increasing, the greenback is gradually losing its appeal.

Along with that, expectations that the US Federal Reserve (FED) will cut interest rates twice more in the remainder of the year will reduce the cost of holding gold, boosting cash flow into precious metals.

Along with monetary factors, political and geopolitical instability continue to push gold higher. Tensions in Ukraine, the Middle East and Europe have not shown any signs of cooling down, while the US has fallen into a deadlock as the US Congress cannot pass the budget, causing the federal government to shut down in early October.

According to experts, each week of closures could cost the US economy between $7 billion and $15 billion, while increasing concerns and demand for "safe havens" such as gold.

Notably, JPMorgan described the shift from the US dollar to gold in September as a trade that weakened the greenback's position, showing a widespread loss of confidence from organizations to retail investors. Many people are concerned about prolonged inflation and the continued printing of deficit finance by governments will reduce the real value of legal currency.

The demand for gold does not only come from individual investors. According to the World Gold Council (WGC), global central banks net bought an additional 15 tonnes of gold in August, with Kazakhstan, Turkey, Bulgaria, Uzbekistan, Ghana and El Salvador participating.

The People's Bank of China also continues to add 2 tons of gold to its reserves, bringing its total holdings to more than 2,300 tons, equivalent to 7% of total national foreign exchange reserves.

In the financial market, the increase in gold ETFs also shows a clear shift in capital flow. SPDR Gold Shares (GLD) - the world's largest gold ETF - increased its gold holdings to 35.2 tons in September, with a record of 18.9 tons in just one day on September 19, the highest ever.

JPMorgan said that this is a sign that the gold rally has entered a new phase as retail investors join in.

Analysts from Deutsche Bank and Goldman Sachs predict that if the FED does indeed cut interest rates in the coming months, gold prices could surpass the threshold of 4,000 USD/ounce in the first quarter of 2026. However, risks remain if the Fed delays interest rate cuts or the US economy continues to show strength, weakening demand for holding non-yielding assets such as gold.

See more news related to gold prices HERE...