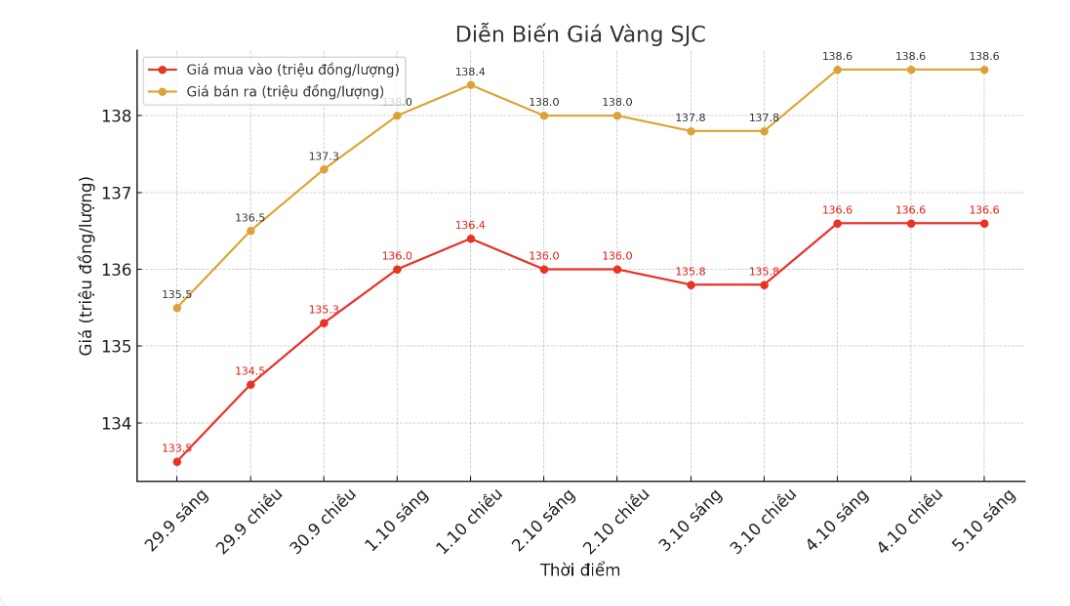

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 136.6-138.6 million VND/tael (buy in - sell out).

Compared to the closing price of the previous trading session (September 28, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by 3.6 million VND/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 136.6-138.6 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was increased by 3.6 million VND/tael by Bao Tin Minh Chau in both directions. The difference between the buying and selling prices of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

If buying SJC gold at Saigon Jewelry Company SJC and Bao Tin Minh Chau in the session of September 28 and selling it in today's session (October 5), buyers will make a profit of 1.6 million VND/tael.

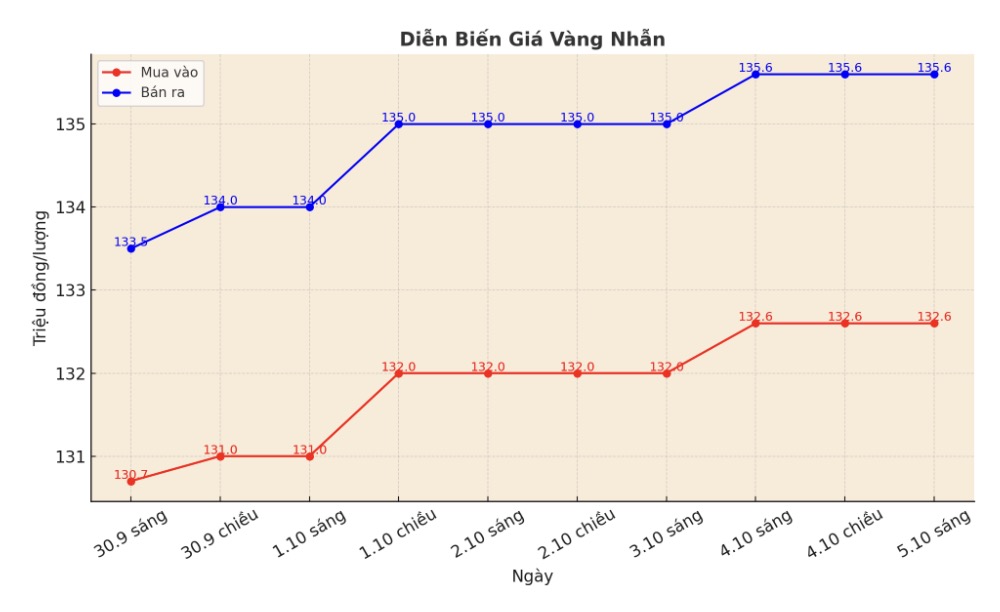

9999 gold ring price

Bao Tin Minh Chau listed the price of gold rings at 133.6-136.6 million VND/tael (buy - sell); increased by 4.5 million VND/tael in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 132.7-135.7 million VND/tael (buy - sell), an increase of 3.9 million VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of September 28 and selling in today's session (October 5), buyers at Bao Tin Minh Chau will make a profit of 1.5 million VND/tael. Meanwhile, the profit when buying in Phu Quy is 900,000 VND/tael.

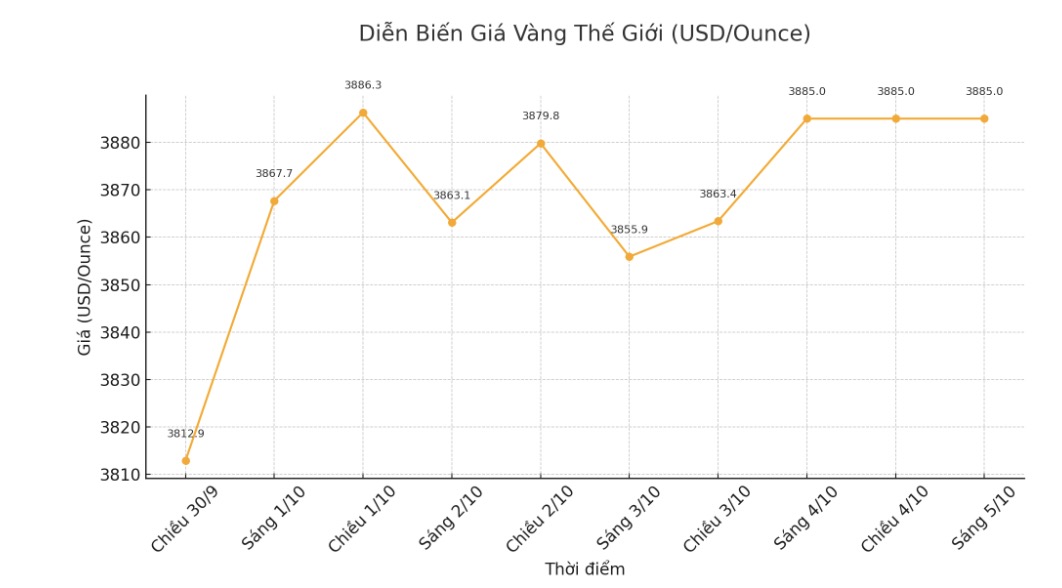

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,885 USD/ounce, up 126.3 USD compared to a week ago.

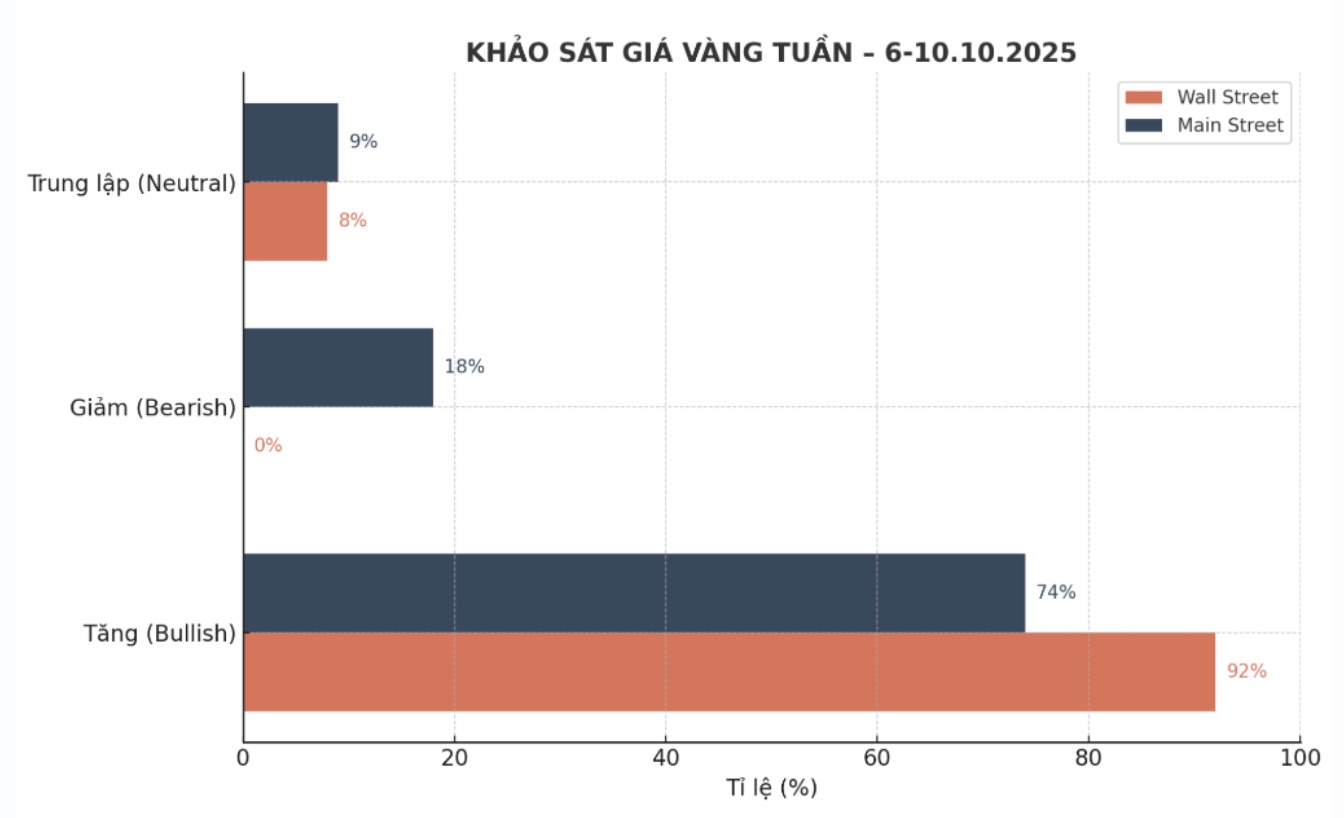

Gold price forecast

A survey of gold with Wall Street experts shows that optimism is still majority after a week of strong gold trading.

Of the 12 analysts participating in the survey, 11 people (equivalent to 92%) predict gold prices will increase next week. No expert predicts a price drop. The remaining 1 person (8%) believes that gold prices will move sideways.

Mr. Darin Newsom - senior market analyst at Barchart.com, said that gold prices will increase next week: "I cannot say that the economic situation in the US will remain stable, because there have been many more unfavorable factors. Central banks and investors around the world see this, so they should continue the gold buying trend.

Mr. Adrian Day - Chairman of Adrian Day Asset Management predicted that gold prices will increase next week: "There are a number of factors that could cause gold prices to temporarily suspend strong increases: The US government ends the closure, and reaches a peace deal in Gaza, in the context of demand from gold buyers in China temporarily slowing down.

However, the first two factors are not the reason for gold's price increase, so logically, if they are reversed, they will not have much impact. Meanwhile, the Chinese's temporary suspension of gold purchases, as reflected in the large discount in Shanghai - has been going on for a while. So, we see gold continuing to overcome these potential negative factors.

According to Krishan Gopaul - Senior EMEA Analyst at the World Gold Council (WGC), the National Bank of Kazakhstan leads the gold buy list. In addition, Bulgaria and El Salvador are also on the list of countries buying gold in 2025.

Central banks net bought a total of 15 tonnes of gold in August, based on data released by the IMF and central banks, Gopaul wrote in the latest WGC update report.

This purchase level is equivalent to the average monthly level in the period from March to June, and shows the return of the buying trend after global reserves remained unchanged in July (we have adjusted the initial estimate down from +10 tons to 0 after the Bank of Indonesia reported 11 tons of sales) - he said.

This expert emphasized that the delay in July does not mean that central banks have reduced their interest in gold. On the contrary, recent developments show that central banks are still very interested in increasing their holdings of gold.

Economic data to watch next week

Wednesday: Minutes of the US Federal Reserve's September monetary policy meeting.

Friday: University of Michigan Consumer Confidence Index preliminary report.

See more news related to gold prices HERE...