Gold prices rose nearly 1% on Wednesday, hitting a more than a weekly high, as the US dollar weakened amid financial uncertainty in the US as the country's parliament debated a major tax bill, increasing demand for safe-haven assets.

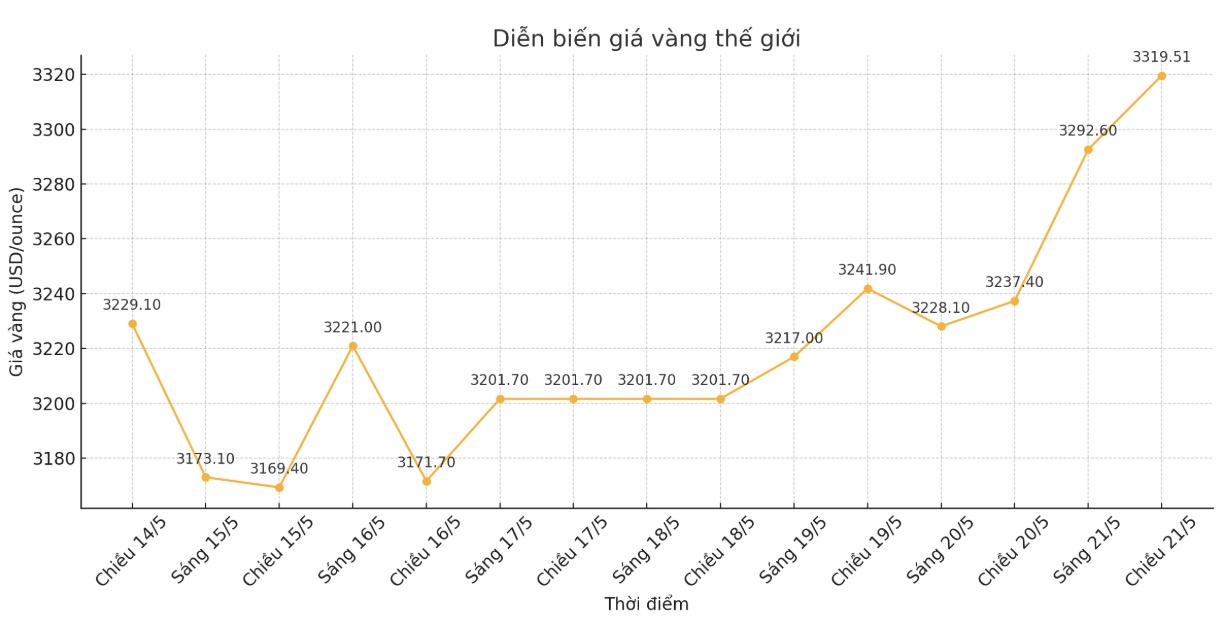

Spot gold prices increased by 0.9%, reaching 3,319,51 USD/ounce at 6:43 GMT (13:43 Vietnam time). Previously, in the session, gold prices had reached their highest level since May 12.

The US dollar index (.DXY) fell to its lowest level since May 7, making USD-denominated gold cheaper for other foreign currency holders.

"The US dollar index has fallen more than one point over the past 24 hours due to Moody's decline in confidence, combined with doubts about Donald Trump's tax bill continuing to weaken the USD, which is a positive signal for gold prices," said senior analyst Edward Meir from Marex.

Donald Trump's tax and spending cuts will face a major test of the day as Republican lawmakers in the US House of Representatives seek to overcome internal divides over cuts to the Medicaid health program and tax incentives in coastal states with high costs.

Gold, which is considered a safe asset in the context of political and economic instability, often tends to increase in price when interest rates are low.

"In the medium and long term, gold prices tend to increase, but if there is positive news about trade deals, this could hinder gold from conquering the $3,500/ounce threshold," said Timerer, senior market analyst at KCM Trade.

The Chairman of the US Federal Reserve (FED) St. Petersburg branch. Louis, Alberto Musalem, told the Minnesota Economic Club that reducing trade tensions will help the labor market maintain strength and keep inflation on track to reach the Fed's 2% target.

Meanwhile, palladium prices fell 0.8% to $1,005.11/ounce, despite previous sessions reaching their highest level since February 4.

Palladium has been lacking positive news recently, said independent metals trader Tai Wong. Hondas shift to mass-producing hybrid vehicles instead of electric vehicles is a reasonable reason.

Palladium and platinum are both used by automakers in catalysts to reduce emissions.

Silver prices increased slightly by 0.2% to 33.14 USD/ounce, while platinum prices decreased by 1% to 1,043.35 USD/ounce.