Updated SJC gold price

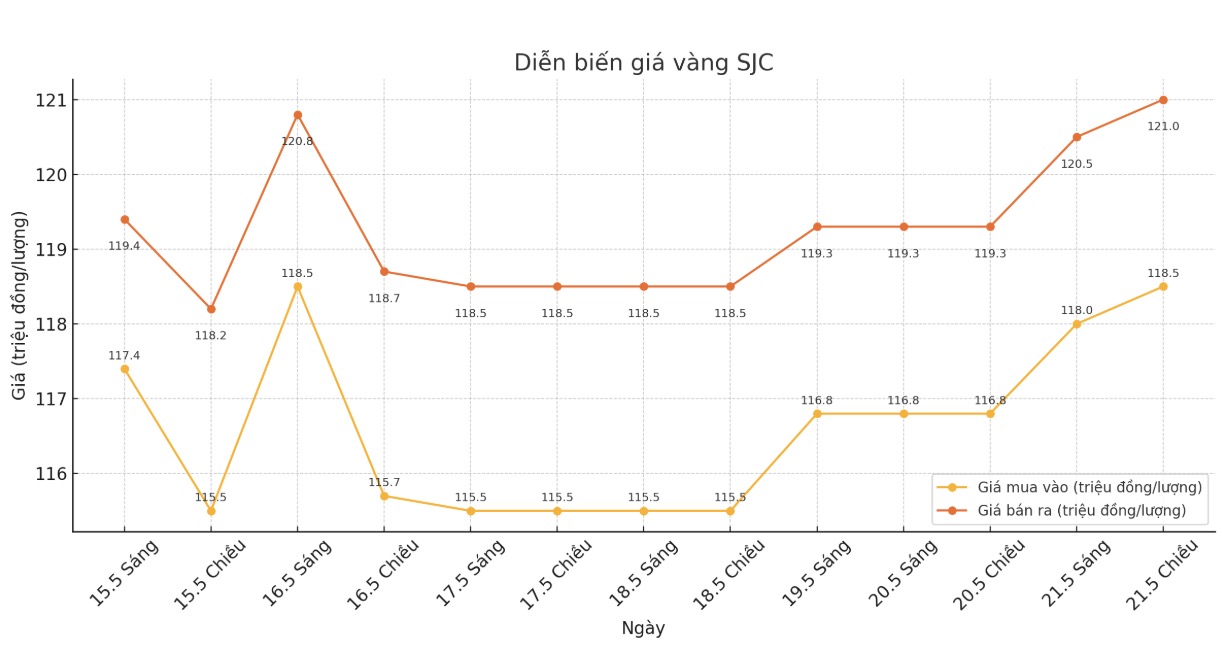

As of 6:00 a.m. on May 22, the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-121 million/tael (buy in - sell out), an increase of VND 1.7 million/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-121 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-121 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 118-121 million VND/tael (buy - sell), an increase of 1.7 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

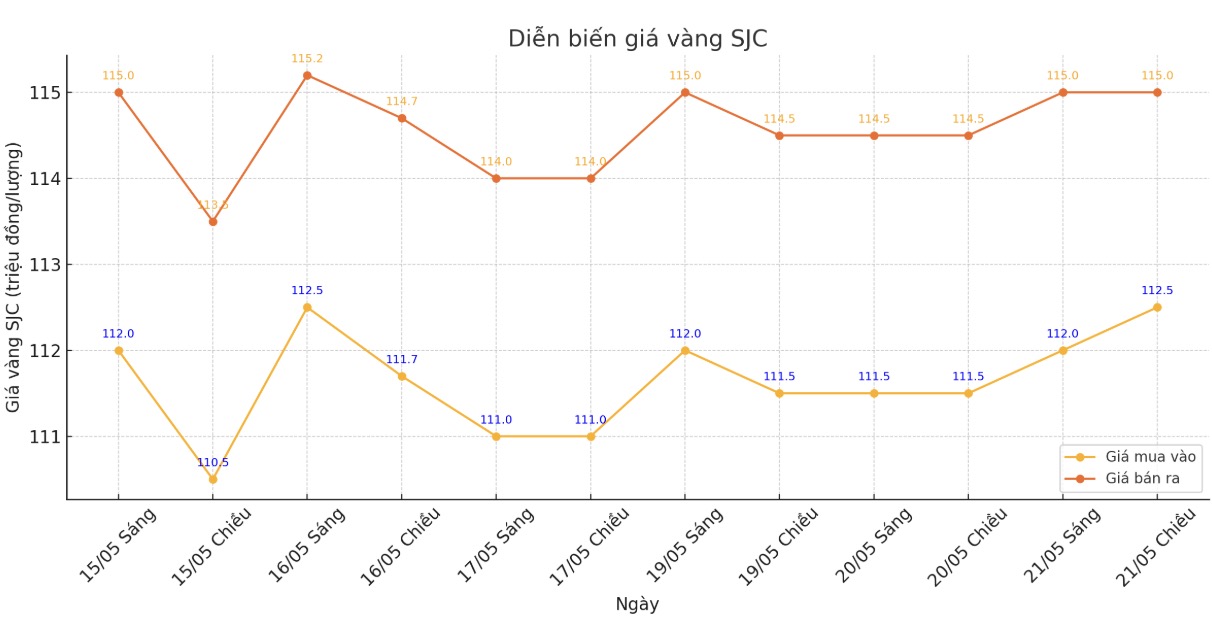

As of 6:00 a.m. on May 22, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND112.5-115 million/tael (buy - sell), an increase of VND1 million/tael for buying and VND500,000/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 114.5-117.5 million VND/tael (buy - sell), an increase of 700,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 112.5-125.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

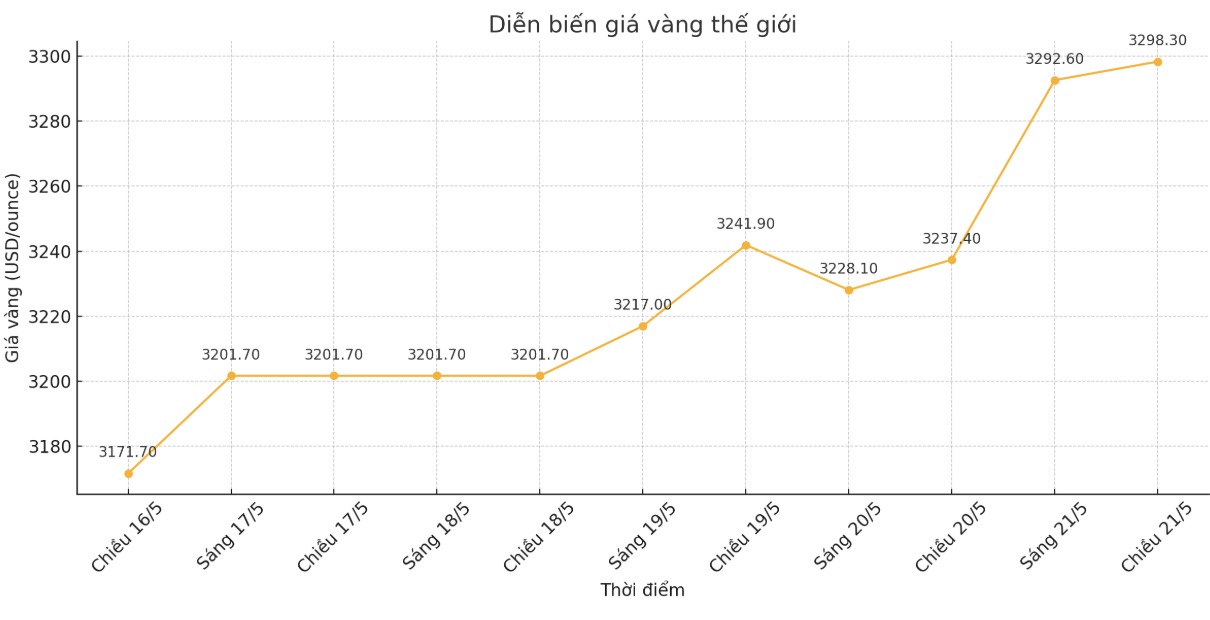

At 9:11 p.m. on May 21, the world gold price listed on Kitco was around 3,298.3 USD/ounce, up 14.7 USD.

Gold price forecast

According to Kitco, the wave of buying to find a safe haven has continuously pushed up the price of precious metals this week. June gold contract increased by 26.3 USD, to 3,310.9 USD/ounce. July silver prices also rose $0.126, reaching $23.30 an ounce.

According to CNN, US intelligence said Israel was preparing to attack Iranian nuclear facilities. However, the market is not too concerned about this information because Israel may have had a backup plan for the above scenario for many years.

Gold prices recovered in midweek thanks to increased safe-haven demand, in which China played an important role. brokerage SP Angel said in today's email:

We continue to see that demand for gold from China is the main driver behind gold prices. The market can rest assured as data shows that China's gold imports in April increased by 73% compared to the previous month, reaching 127.5 tons, the highest level in 11 months.

The Chinese Central Bank has recently granted additional rates to commercial banks, boosting demand for gold.

In addition, Chinese insurance companies are also encouraged to increase their gold holdings, in the context of China diversifying foreign exchange reserves and asset portfolios. Chinese people are buying a lot of gold amid concerns about the domestic real estate market and the yuan depreciation.

Bloomberg reported last night that Chinese gold traders and investors imported the most platinum in the past year, as the stability of this precious metal increased its appeal compared to the more volatile gold market.

The Asian and European stock markets fluctuated in opposite directions but mainly towards the up in the last session. The US stock index is expected to open down today in New York.

Technically, the June gold contract is under the control of the bulls with a strong current increase. The next target for buyers is to close above the important resistance level of 3,400 USD/ounce.

Meanwhile, the bearings are trying to push prices below the support level of $3,123.30/ounce. The most recent resistance levels are $3,322.50 an ounce and $3,350 an ounce, respectively. The most recent support levels are $3,287/ounce and $3,250/ounce.

The foreign exchange and commodity markets recorded a sharp decrease in the USD index. Nymex crude oil futures rose slightly, trading around $62.5 a barrel. The yield on the 10-year US Treasury note is currently at 4.567%.

See more news related to gold prices HERE...