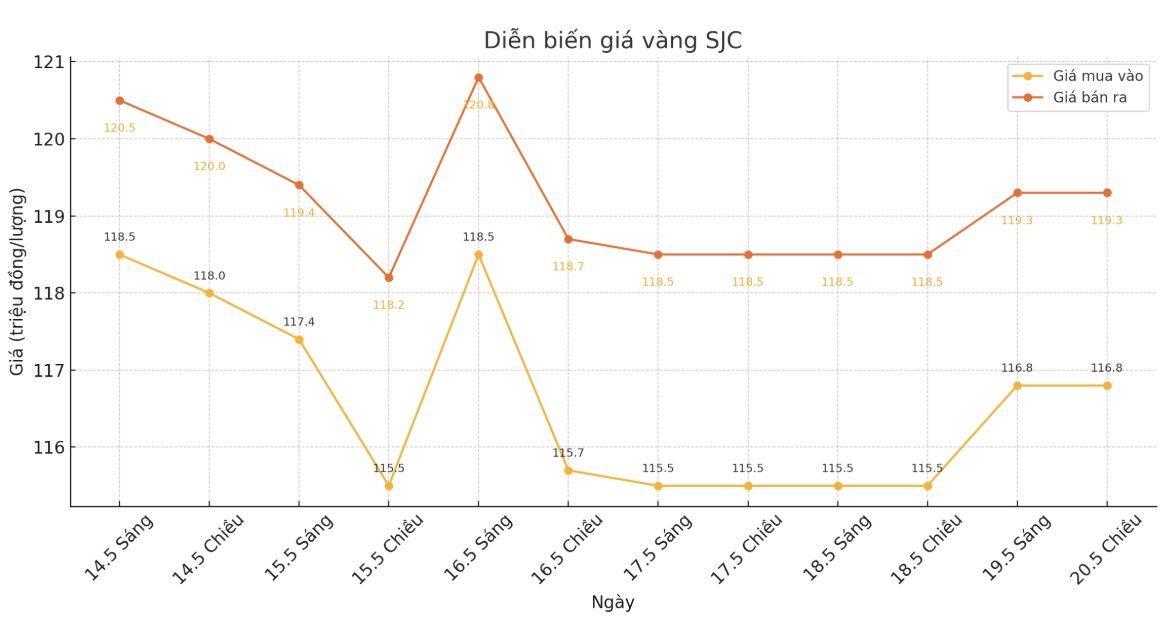

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 116.8-19.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars listed by DOJI Group was at 116.8-119.000 VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.8-119,3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 116.3-119.3 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

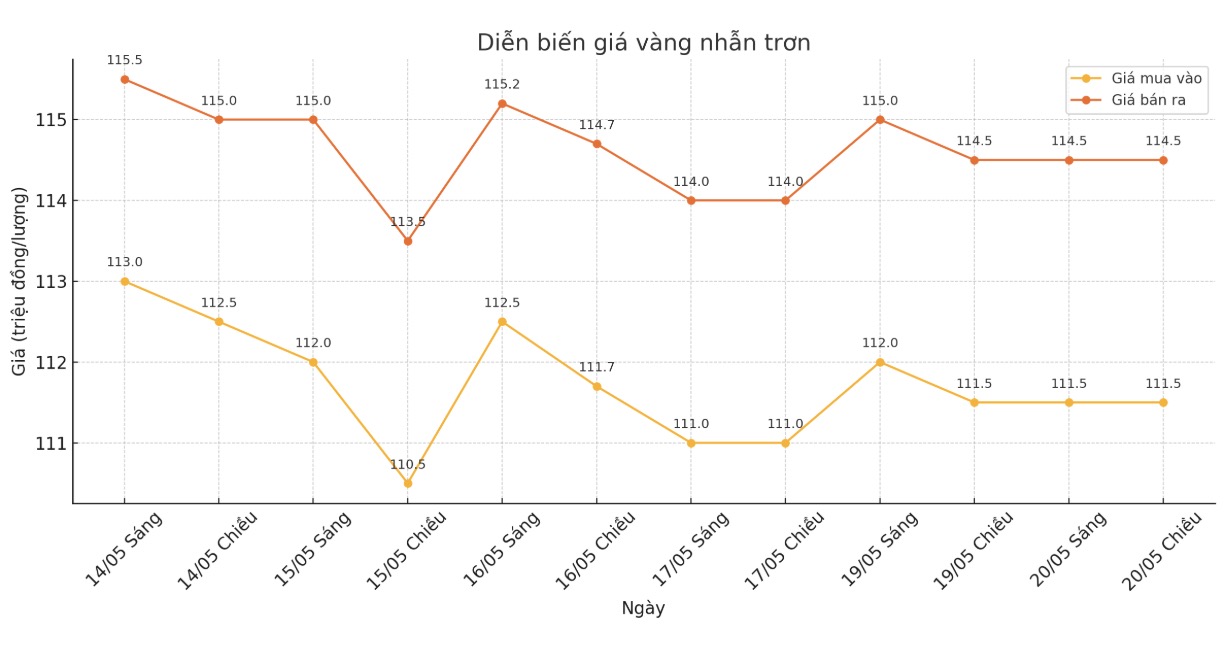

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.8-116.8 million VND/tael (buy - sell), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

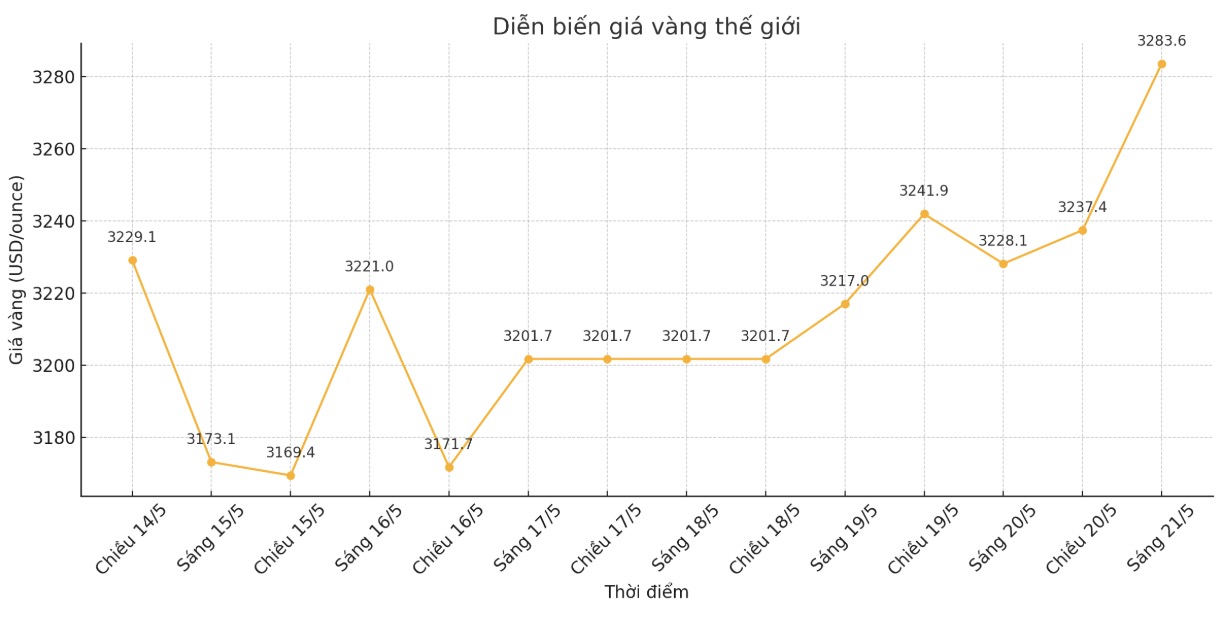

World gold price

At 0:45, the world gold price listed on Kitco was around 3,283.6 USD/ounce, up sharply by 59.1 USD.

Gold price forecast

According to Kitco, gold and silver prices both increased sharply as the valuable market was affected after Moody's' rating agency surprised everyone when it lowered the US Government debt rating last weekend.

Gold futures for June increased by 48.2 USD to 3,281.7 USD/ounce, while silver futures for July also increased by 0.518 USD to 33.025 USD/ounce.

Moody's downgrading US debt credit is considered a short-term positive signal for the gold and silver markets. The return to US fiscal and debt issues this week has put downward pressure on US stock indexes, thereby stimulating safe-haven demand for the two precious metals.

However, the impact of Moody's news is expected to quickly ease, as market attention gradually shifted to concerns about inflation and the possibility of the US Federal Reserve (FED) maintaining a stable interest rate policy in the next few weeks.

The scenario of the FED having less loose trends will be disadvantageous for gold and silver, while supporting the USD to increase in price. On a global scale, tighter monetary policies from central banks could reduce demand for precious metals.

International news shows that the People's Bank of China cut its key interest rate on Tuesday, after releasing unfavorable economic data on Monday. The Australian Central Bank also cut its key interest rate today.

In other developments, Mr. Jamie Dimon - CEO of JP Morgan - said on Monday that the comprehensive impact of the US-China trade war has not been fully felt by businesses and consumers, and warned that the stock market could continue to decline. The market is in a state of being too subjective, Dimon said.

Technically, June gold futures buyers have regained their short-term technical advantage. The next target for buyers is to close above the strong resistance level of $3,350/ounce. Meanwhile, the sellers need to push the price below 3,123.30 USD/ounce.

The first resistance level was at $3,288.9/ounce, followed by $3,300/ounce. First support was $3,250 an ounce, followed by an overnight low of $3,207.4 an ounce.

In the outside market, the USD index decreased slightly in the session, the crude oil price at Nymex was weaker, trading around 62.25 USD/barrel. The yield on the 10-year US Treasury note fluctuated at 4.45%.

See more news related to gold prices HERE...