World gold prices increased, silver prices hit a 14-year high as safe-haven demand stood out in the context of the US government's risk of closing in the middle of the week.

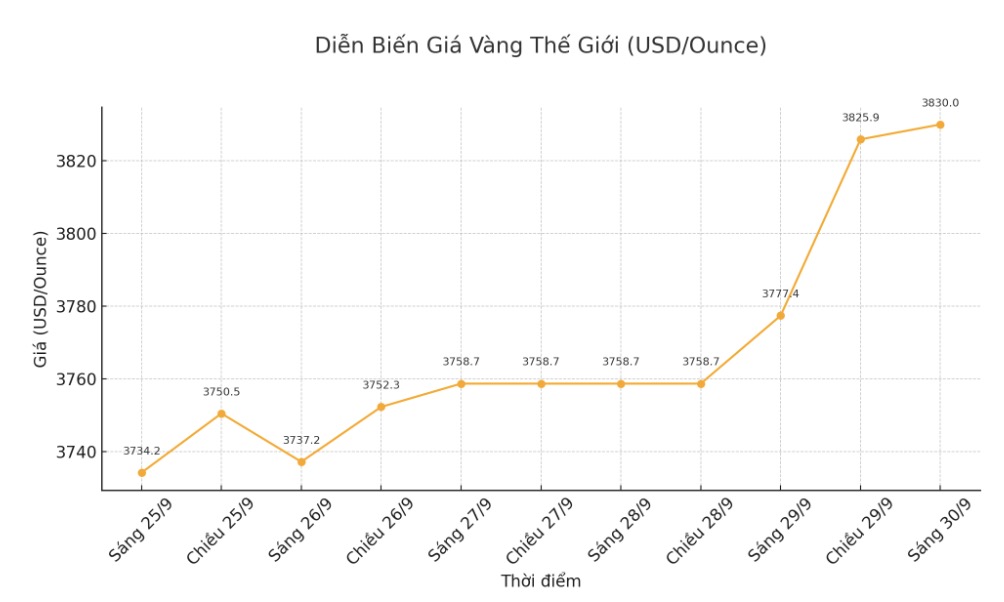

December gold contract increased by 48 USD, up to 3,856.8 USD/ounce; December silver contract increased by 0.574 USD, up to 47.23 USD/ounce.

The global stock market last night fluctuated from flat to up. The US stock index is forecast to open in the green when the New York session begins.

US congressional leaders will meet with President Donald Trump at the White House to discuss a short-term spending bill, to avoid the risk of the federal government having to close from October 1.

Democrats have demanded a bill to extend health benefits and restore health budget cuts, while Republicans say these issues could be negotiated after avoiding a closure.

The bill only provides funding until mid-November and requires some Democratic votes in favor in the Senate. President Donald Trump has also increased the pressure by threatening to permanently fire unnecessary federal employees if they are shut down, breaking decades of the practice of allowing them to return to work after the budget is resumed.

In other developments, Bloomberg reported that OPEC+ may continue to increase oil production in November to regain market share. The alliance will meet online on October 5 to discuss raising output at least equal to the October increase of 137,000 barrels/day. However, the final decision has not been made and may be changed. Nymex crude oil prices opened the week under pressure from this information, currently around 64.25 USD/barrel.

Goldman Sachs (one of the world's largest financial and investment banking groups headquartered in the US) believes that global securities could extend their rally until the end of the year thanks to a strong US economy, attractive stock valuations and the Fed's easing of monetary policy.

Good profit growth, the Fed lowering interest rates without falling into recession and loose global fiscal policy will continue to support stocks. With the risk of recession under control, we recommend buying when the market corrects," Goldman wrote.

According to Xinhua News Agency, China will hold a meeting from October 20 to 23 to review the development plan for the next 5 years (2026-2030), focusing on promoting consumption, science and technology innovation, reform and opening up.

Technically, December gold futures continue to be dominated by bulls. The next upside target is to close the session above the resistance level of 4,000 USD/ounce.

Meanwhile, the most recent support level was $3,800/ounce and then the lowest level of the past week at $3,785.5/ounce. The first resistance level was determined at 3,875 USD/ounce and then at 3,900 USD/ounce.

In outside markets, the USD index decreased slightly, the yield on the 10-year US Treasury note was at 4.15%. US economic data to be released for the waiting market includes Texas' pending home sales and manufacturing survey.

See more news related to gold prices HERE...