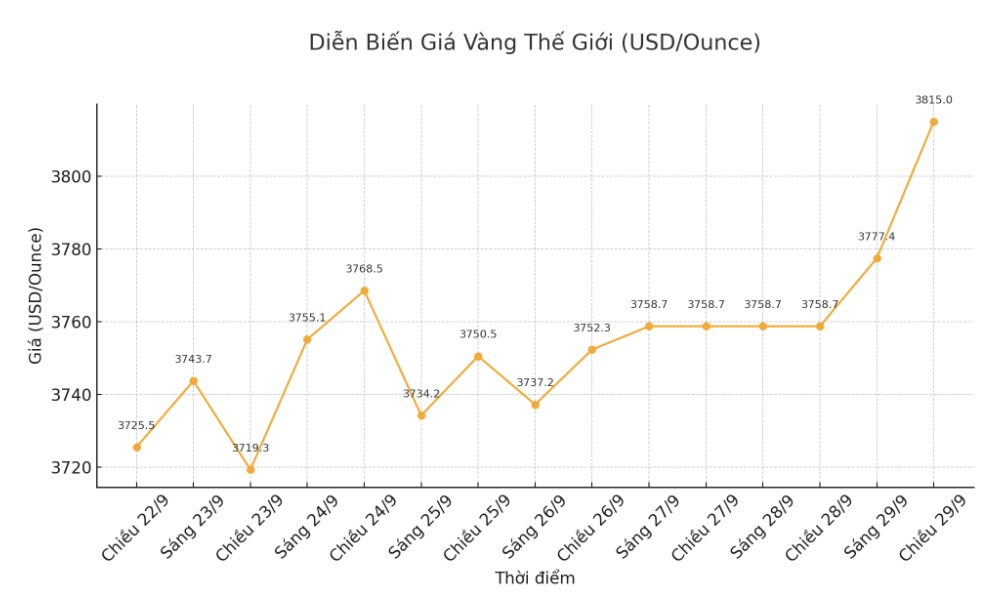

Gold prices soared above $3,800/ounce for the first time in the September 29 trading session, supported by expectations that the US Federal Reserve (FED) will continue to cut interest rates - a factor that weakens the USD - along with concerns about the risk of the US government closing down, boosting safe-haven demand.

At 11:27 GMT, the US December gold futures increased by 0.9% to $3,842.20/ounce. The USD index fell 0.2%, making gold which is priced in USD cheaper for international buyers.

US President Donald Trump is expected to meet with bipartisan leaders during the day to discuss a budget extension, avoiding the risk of the government having to close from October 2.

UBS expert Giovanni Staunovo commented: "With the Fed cutting interest rates further in the next 6 months, I think gold still has room to increase, towards the mark of 3,900 USD/ounce".

He said concerns about the possibility of a US government shutdown are also boosting demand for safe-haven assets such as gold.

Previously, the personal consumption expenditure (PCE) index released last weekend was in line with forecasts, reinforcing expectations that the Fed will cut interest rates further. According to the CME FedWatch tool, traders are assessing a 90% chance of a 0.25 percentage point Fed cut in October and a 65% chance of a further cut in December.

Since the beginning of the year, gold has increased by more than 45% thanks to the benefits of low interest rates and the context of economic - geopolitical instability. Many securities companies also raised their gold price prospects. The world's largest gold ETF SPDR Gold Trust said its holdings increased by 0.89% to 1,005.72 tons last weekend.

" spending on official buying and capital flows into ETFs plays a key role in gold's strength, while demand for jewelry and recycled supply are factors that hold back," notes Deutsche Bank.

Independent analyst Ross Norman said that silver and platinum are driven by increased industrial activity thanks to lower interest rates and higher storage demand as countries want to ensure supply amid uncertainty in the global supply chain.

Other precious metals markets also increased strongly: spot silver increased 1.8% to 46.84 USD/ounce - the highest in more than 14 years; platinum increased 2.8% to 1,612.3 USD/ounce - the highest in 12 years; palladium increased 0.5% to 1,276.94 USD/ounce.

See more news related to gold prices HERE...