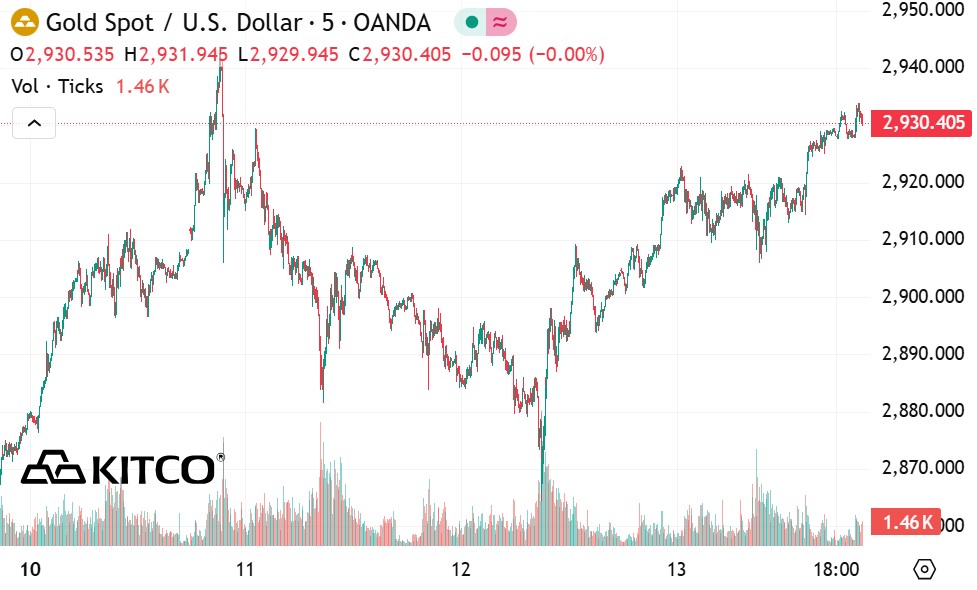

According to Kitco, gold has skyrocketed to a new all-time high today, with the busiest April futures currently trading at $2,958.4, up 1.02% after calculating a net gain of $29.7.

The weak USD is the biggest contributor to the increase in gold. The USD index is currently at 106.95, after falling 0.84% today. By deducting the percentage increase of the USD (0.84%) from today's increase of gold (1.02%), traders can only calculate 0.18% for this record close.

Although a weakening US dollar is the main driver for gold prices to move higher, this comes from two factors, including tax concerns and the January Producer Price Index (PPI) report.

Concerns continue to increase after US President Donald Trump's statement about imposing counterpart tariffs on countries that tax imports from the US.

Today, the US government released the January PPI, showing that manufacturing prices increased by 0.4% this month. Previously, the US Bureau of Labor Statistics also released the January Consumer Price Index (CPI) report, revealing that inflation increased by 0.5%, surpassing both the 0.4% increase in December and the market forecast of 0.3%.

According to Reuters, US manufacturing prices increased sharply in January, providing further evidence of rising inflation and reinforcing the financial market's view that the US Federal Reserve (FED) will not cut interest rates before the second half of this year.

The recent gold market has sometimes warded off negative signals from outside markets and unsatisfactory economic reports. The precious metal has risen despite the US inflation report being higher than expected. This reflects strong safe-haven demand, especially from central banks around the world, amid concerns that new US trade tariffs could slow down global economic growth.

Currently, those who bet on rising gold prices (by speculating prices) are dominating in the short term, as gold prices continue to trend upward on the daily chart. Their next target is to get gold prices above the important resistance level at $3,000/ounce. On the contrary, those who predict prices to fall (sell) want to pull prices below the strong support level at 2,800 USD/ounce.

Currently, the first resistance that gold needs to overcome is 2,950.3 USD/ounce, followed by a record peak of 2,968.5 USD/ounce. Meanwhile, if prices fall, the first support level is $2,925.8/ounce, followed by $2,900/ounce.