Update SJC gold price

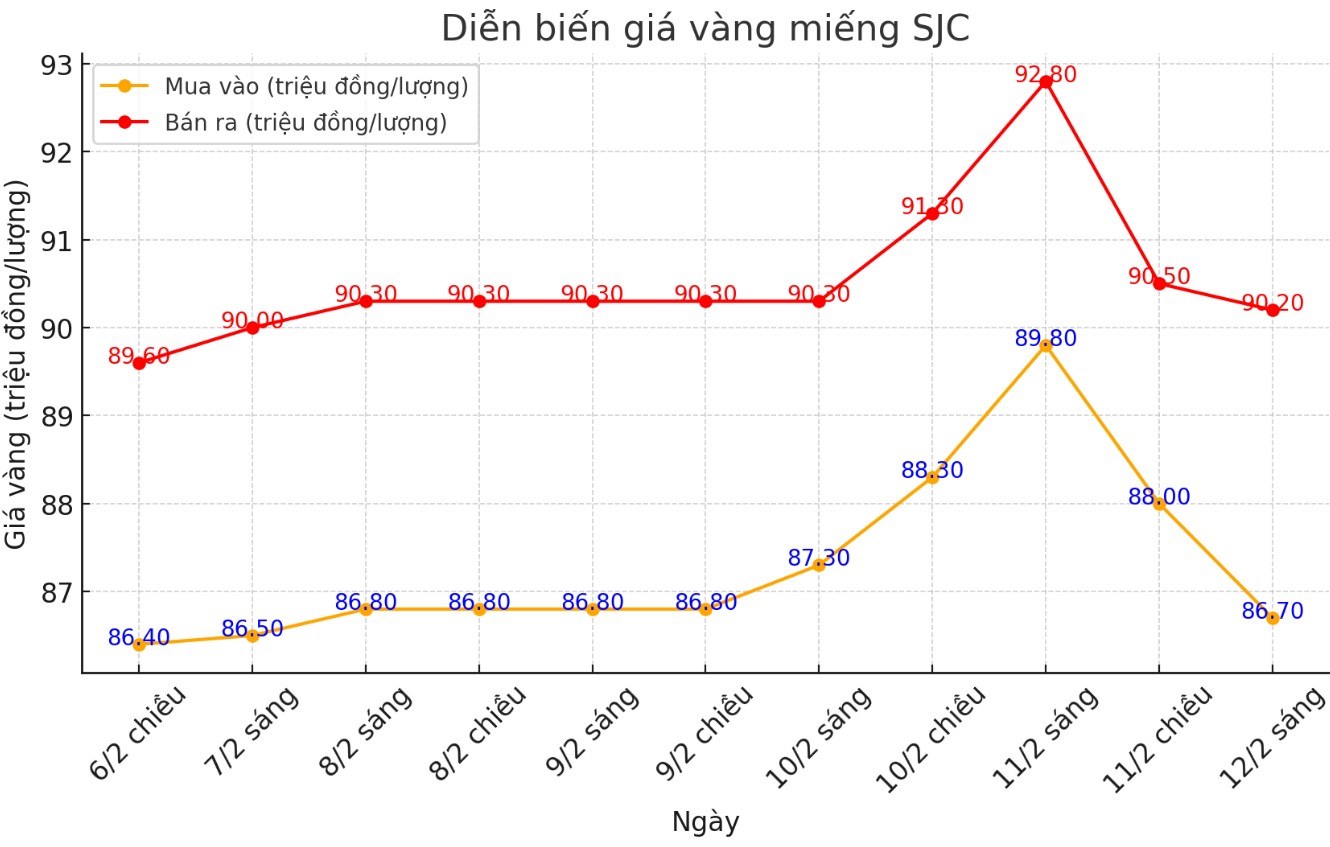

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.7-90.2 million/tael (buy - sell); down VND3.4/tael for buying and down VND2.9 million/tael for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3.5 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 86.7-90.2 million VND/tael (buy - sell); down 3.4 VND/tael for buying and down 2.9 million VND/tael for selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 88.4-90.45 million VND/tael. The difference between buying and selling SJC gold at Bao Tin Minh Chau was at 2.05 million VND/tael.

Price of round gold ring 9999

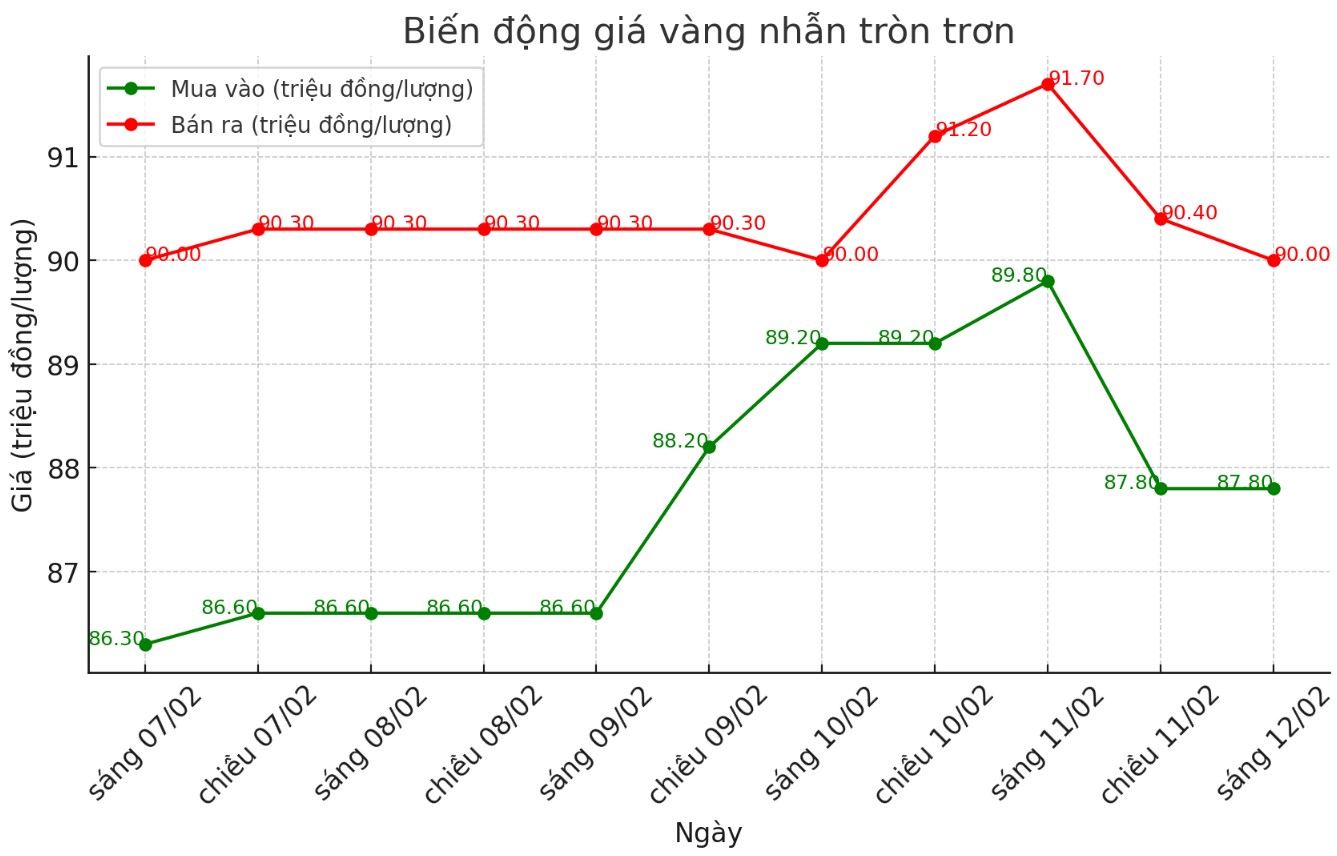

As of 9:38 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 87.8-90 million VND/tael (buy - sell); down 2 million VND/tael for buying and down 1.7 VND/tael for selling compared to early this morning.

The difference between buying and selling prices increased to 2.2 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 88.4-90.45 million VND/tael (buy - sell), down 700,000 VND/tael for buying and down 2.6 million VND/tael for selling compared to early this morning.

The difference between buying and selling prices increased sharply to 2.05 million VND/tael.

World gold price

As of 9:30 a.m., the world gold price listed on Kitco was at 2,894.5 USD/ounce, down 45.3 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell amid a stronger US dollar. At 9:00 a.m. on February 12, the US Dollar Index, which measures the greenback's movements against six major currencies, stood at 107.875 points (up 0.08%).

Gold prices fell from historic levels as investors assessed congressional testimony from Fed Chairman Jerome Powell and new trade policy statements from US President Donald Trump.

Market sentiment was largely driven by two key developments. First, President Donald Trump’s announcement on Sunday that he would impose a 25% tariff on imported steel and aluminum, without exceptions or exemptions, has raised concerns about potential trade conflicts.

The protectionist measures are intended to support struggling domestic industries, but also increase the risk of retaliation from trading partners, potentially leading to a broader trade war.

Second, the testimony of Fed Chairman Jerome Powell also had a big impact on market developments. In his opening remarks, Mr. Powell emphasized that the Fed remains cautious about cutting interest rates, citing a strong economy and inflation that has consistently exceeded the Fed's 2% target.

Investors are closely watching Powell’s two-day testimony for clues on upcoming monetary policy, especially with consumer price index (CPI) data due out. If inflation is higher than expected, market expectations for two rate cuts this year could be challenged.

The pullback from record highs also reflects profit-taking after a sharp rally since mid-December, when gold rose about $370, or 14.25%. The pullback suggests investors are taking advantage of the opportunity to lock in profits while reassessing the outlook for monetary policy and trade risks.

FXTM senior research analyst Lukman Otunuga said the uncertainty and unpredictability surrounding President Donald Trump's term could increase demand for gold.

Meanwhile, Kitco Metals senior market analyst Jim Wyckoff said that ahead of any new statements from President Donald Trump, the potential uncertainty could sustain prices and profit-taking scenarios like the current one, could be viewed by bullish traders as a buying opportunity on dips.

See more news related to gold prices HERE...