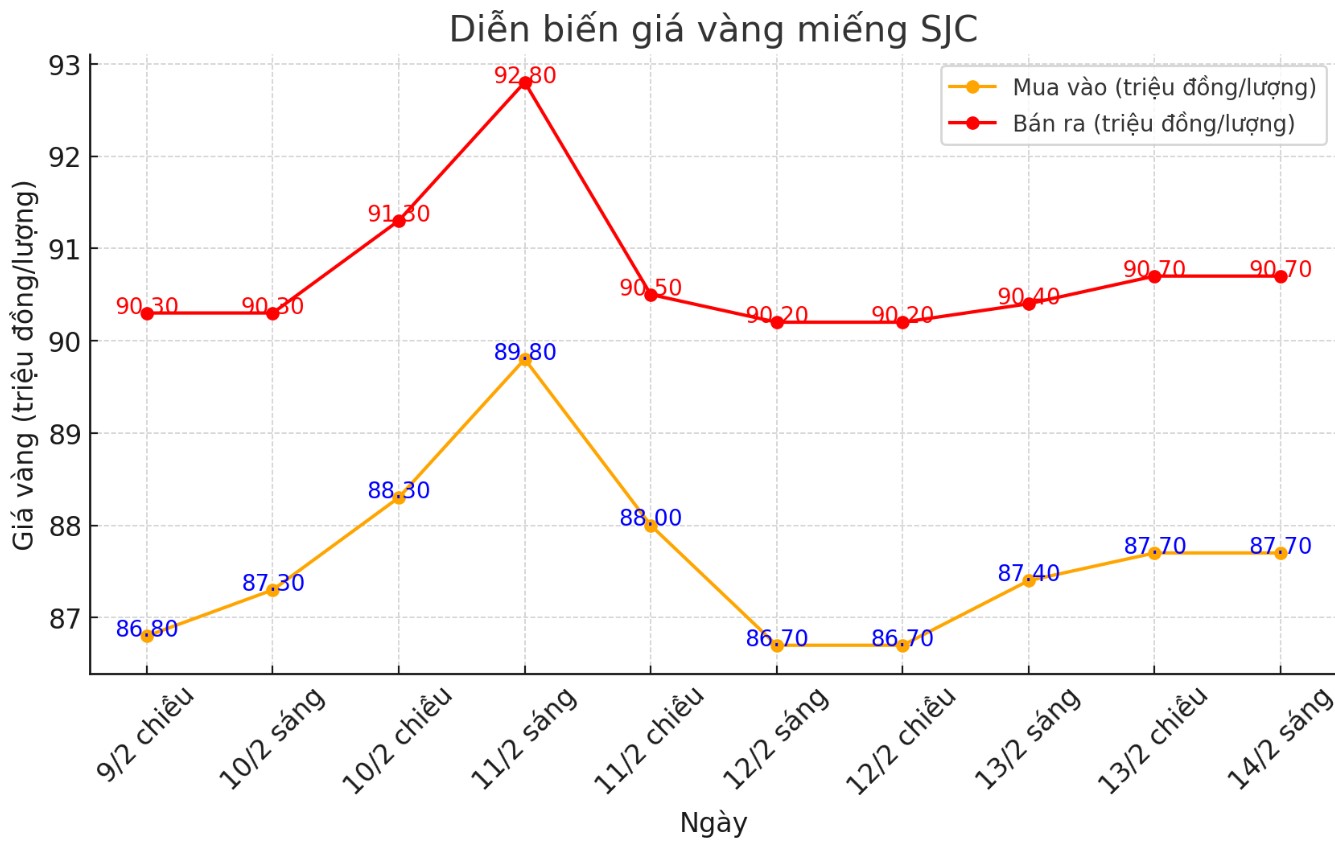

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 87.7-90.7 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 87.7-90.7 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 3 million VND/tael.

DOJI Group listed the price of SJC gold bars at 87.7-90.7 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 3 million VND/tael.

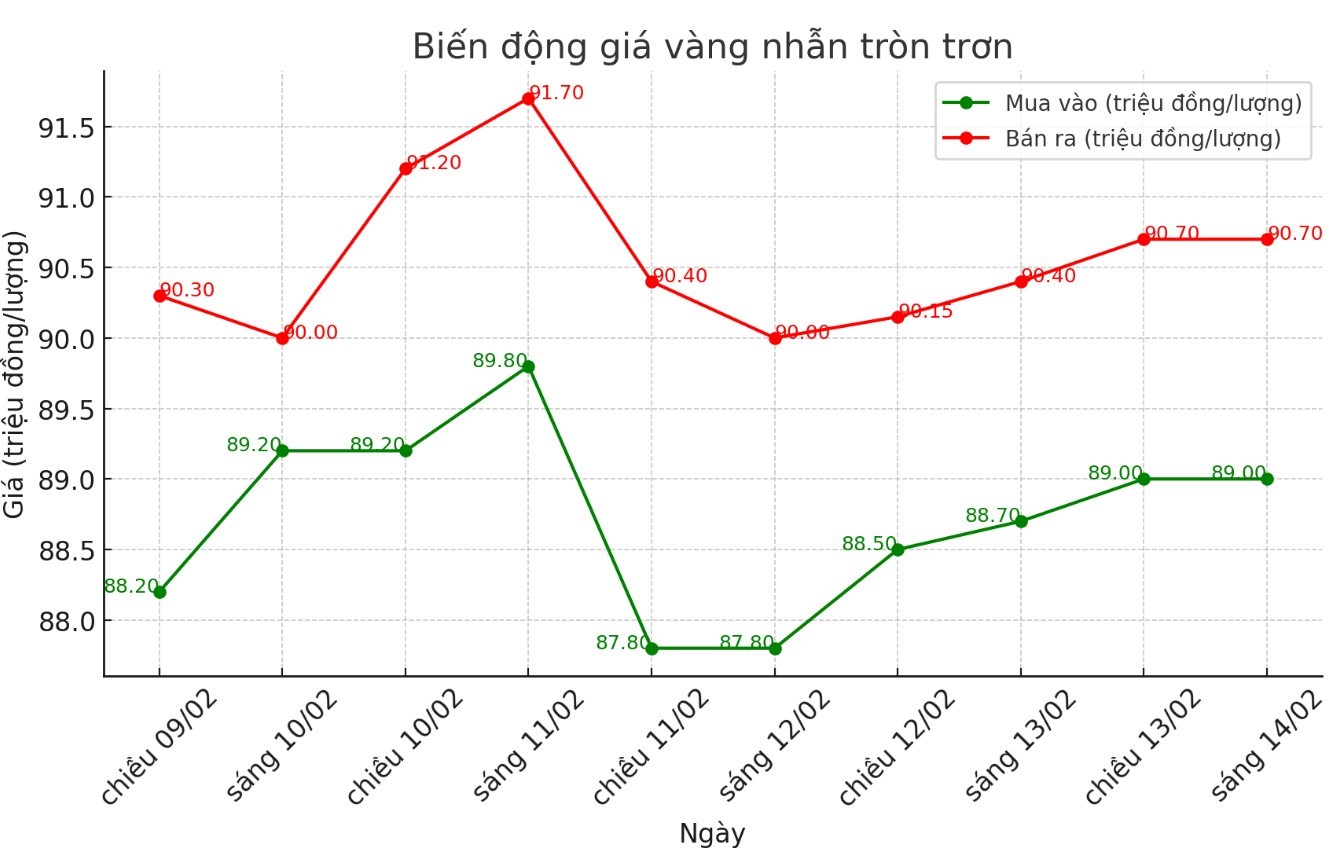

9999 round gold ring price

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 89-90.7 million VND/tael (buy - sell); increased by 500,000 VND/tael for buying and increased by 550,000 VND/tael for selling. The difference between buying and selling is listed at 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 89.1-90.7 million VND/tael (buy - sell); increased by 800,000 VND/tael for buying and increased by 550,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

World gold price

As of 5:30 a.m. on February 14, the world gold price listed on Kitco was at 2,928.3 USD/ounce, up 24.9 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices increased in the context of the USD index decreasing sharply. Recorded at 5:30 a.m. on February 14, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.970 points (down 0.8%).

Gold prices increased despite the US inflation report being higher than expected. Gold contracts in April increased by 16.2 USD, to 2,944 USD/ounce. Meanwhile, the price of silver in March fell by 0.095 USD, to 32.69 USD/ounce.

The US Producer Price Index (PPI) report for January showed a 3.4% increase compared to the same period last year, higher than the forecast of 3.2%. This report follows the revised increase to 3.5% in the December PPI report. Compared to the previous month, PPI increased by 0.4%, exceeding the forecast by 0.3%, and following the increase, it was adjusted to 0.5% in December.

The core PPI (excluding food and energy) rose 0.3% month-on-month, in line with forecasts and from 0% in the January report. This hotter PPI report follows the consumer price index (CPI) report, which was also higher than expected released on Wednesday.

The recent gold market has sometimes warded off negative signals from outside markets and unsatisfactory economic reports. This reflects strong safe-haven demand, especially from central banks around the world, amid concerns that new US trade tariffs could slow down global economic growth.

Those betting on rising gold prices are dominating in the short term, as gold prices continue to trend upward on the daily chart. Their next target is to get gold prices above the important resistance level at $3,000/ounce. On the contrary, those who predict prices to fall (sell) want to pull prices below the strong support level at 2,800 USD/ounce.

Currently, the first resistance that gold needs to overcome is 2,950.3 USD/ounce, followed by a record peak of 2,968.5 USD/ounce. Meanwhile, if prices fall, the first support level is $2,925.8/ounce, followed by $2,900/ounce.

Key outside markets today saw Nymex crude oil futures slightly lower, trading around $71.25/barrel. The yield on the 10-year US Treasury note is currently at 4.533%.

Normally, domestic gold prices move according to the world trend, although there is a certain delay. Currently, the price of SJC gold is fluctuating between 87.7 - 90.7 million VND/tael. Based on the increase of nearly 0.85% of world gold prices, it is forecasted that SJC gold bars may adjust to the range of 88.5 - 91.5 million VND/tael when the trading session reopens, corresponding to an increase of 800,000 - 1.2 million VND/tael.

It is forecasted that when the new trading session opens, the price of gold rings may also increase by 600,000 - 1 million VND/tael, fluctuating around 90 - 92 million VND/tael, depending on the increase in world gold prices and domestic gold demand.

If the world gold price continues to move towards the mark of 2,950 - 3,000 USD/ounce, the domestic gold price may increase beyond the threshold of 92 million VND/tael in the short term.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...