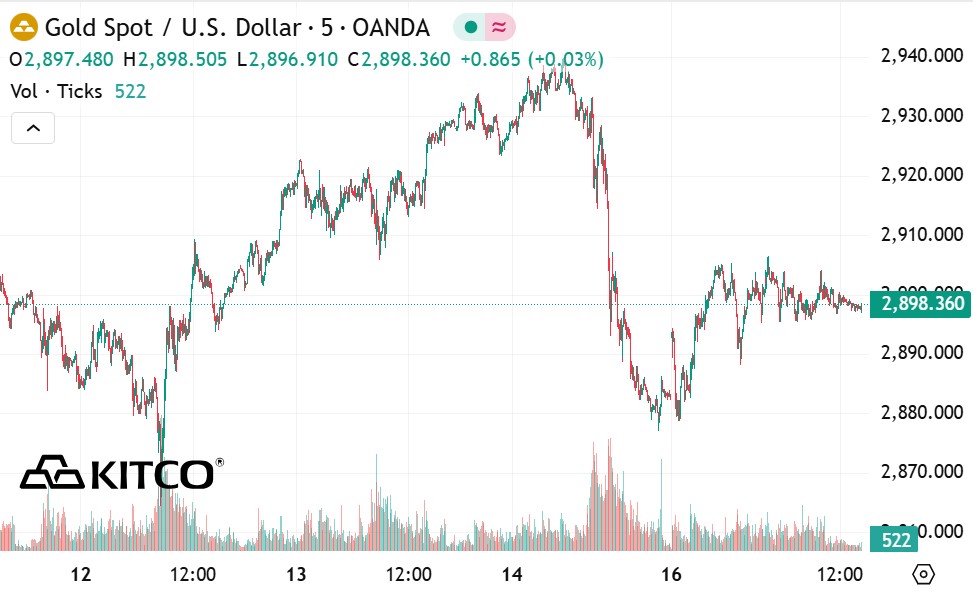

According to Kitco, although gold and silver had a disappointing trading session last Friday, recording the strongest day's decline since mid-December, some analysts said that this decline did not have a big impact on the broader uptrend.

The gold market opened the week with initial support around $2,880/ounce. The last spot gold price was recorded at 2,896.5 USD/ounce, up 0.50% on the day.

Silver is also finding a solid support level as it recovers from its lowest level of the night, just below 32 USD/ounce. The price of silver for the last spot was recorded at 32.2 USD/ounce, up 0.2% on the day.

Some analysts said that silver is facing a more difficult challenge when the $34/ounce level was strongly rejected on Friday.

However, looking beyond short-term fluctuations, many experts still believe that both gold and silver are buying opportunities when prices adjust.

Analyst Haresh Menghani from FXStreet.com commented that technical indicators on the daily chart show that silver prices (XAG/USD) are still likely to continue to increase. However, he said it is necessary to wait for prices to overcome the resistance level of 32.55 USD to confirm a stronger uptrend.

FxPro analyst Alex Kuptsikevich said gold prices are becoming more unpredictable after Friday's sell-off, as investors become more cautious.

He explained that on the daily chart, gold is in the "overbuy" zone according to the RSI index, meaning prices have increased sharply in a short time. Normally, this does not lead to an immediate reversal but only causes prices to temporarily stagnate.

However, on the weekly chart, the trend is still in favor of buyers. The fact that gold prices have been adjusted in the past two months helps create conditions for prices to continue to increase without being overbought.

Despite the sell-off on Friday, many analysts still expect gold prices to maintain good support levels in the context of increasing geopolitical instability.

ActivTrades analyst Ricardo Evangelista said that gold is likely to remain above $2,900/ounce thanks to its role as a safe-haven asset. Investors are looking to gold to protect their portfolios from the risk of US tariffs, which could lead to a multilateral trade war and negatively impact the global economy.

In addition, gold prices are also supported by geopolitical instability, especially when the US shows signs of wanting to weaken the transatlantic alliance - an important factor ensuring security for Europe over the years.

In addition to geopolitical fluctuations, some analysts believe that gold could receive further support if economic data this week shows slowing economic activity and rising inflationary pressures.

Although the US Federal Reserve (FED) will release the minutes of last month's monetary policy meeting on Wednesday, economists are not expecting any new signals about the interest rate path.

Last week, in a two-day hearing before the National Assembly, Fed Chairman Jerome Powell reaffirmed the central bank's neutral stance, stressing that it is not in a hurry to cut interest rates as inflation remains a threat and the labor market remains stable.

Tomorrow (February 19), the minutes of the Federal Open Market Committee (FOMC) meeting will reveal the Fed's monetary policy outlook. Because the market is very sensitive to interest rates, this minutes play an important role in determining whether the FED will continue to tighten or loosen monetary policy in the coming months.

If the FOMC report shows a tougher view, suggesting that the Fed could continue raising interest rates to control inflation, gold prices could be under downward pressure. Higher interest rates often support the US dollar, making uninterest-bearing assets less attractive.

In case the minutes show a more dovish view or signal of delay in interest rate increase due to economic concerns or inflationary pressure, gold prices may increase sharply. In this case, investors can turn to gold as a hedge against inflation or a safe-haven asset.