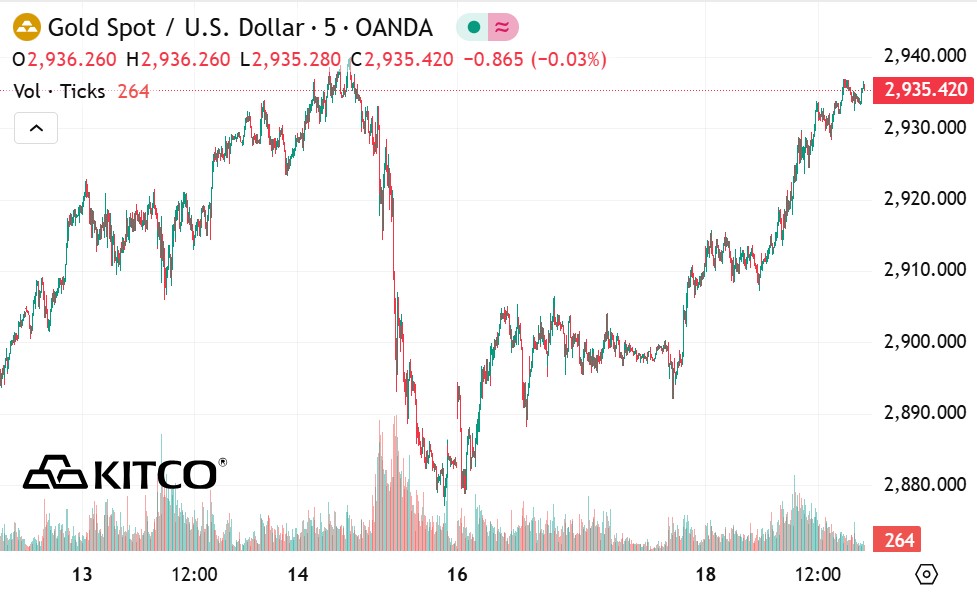

The gold market has largely recovered after a strong sell-off last Friday. Although the precious metal is expected to continue to fluctuate in the short term, an investment firm believes that the long-term uptrend of gold will remain firm.

In the latest research report, Adam turnquist - chief technical strategist at LPL Financial - said that in the short term, gold is in a state of overbought conditions and is vulnerable to new selling pressure, which could push prices to support level near 2,800 USD/ounce. However, in the long term, even if the gold price reaches 3,000 USD/ounce, this precious metal is still quite cheap.

When looking back and comparing gold with the S&P 500 over the past 30 years, gold still seems cheap compared to the general market.

This chart helps assess the strength and direction of gold against the stock market. It now shows that gold may have hit bottom and is showing signs of a stable recovery, surpassing the 12-month average. Although we do not advise investors to switch from stocks to gold, we still maintain a positive view on gold, as we have had since last spring, he said.

turnquist believes a weaker US dollar will also support gold prices. Although the USD index is currently trading around 107 points, it is still lower than the many-year high set last month.

The weakening of the US dollar last week could be another favorable factor for gold as well as a broader commodity market, he said.

At the same time, turnquist pointed out that gold continues to benefit from economic and geopolitical instability due to US President Donald Trump's tariff policies on steel and aluminum, as well as the threat to impose additional tariffs on other imported goods.

He noted that these trade policies are increasing inflation and creating obstacles for the stock market.

The newly announced tariffs, which include 25% for aluminum and steel imports, may not have a significant impact on inflation or domestic economic growth (these two metals only accounted for about 1.8% of total US imports last year, according to S&P Global), but they could have negative impacts on downstream industries such as automobiles, manufacturing, construction and construction.

These additional costs could affect business profit margins if they absorb the additional costs, or they will be transferred to end consumers through higher prices, turnquist said.

turnquist is also optimistic about gold as central banks increase their ownership of this precious metal to reduce their dependence on the USD.

The addition of gold and the decline in USD holdings have become an increasingly popular trend among global central banks.

In 2024, 81% of central bank managers said they will increase their gold reserves in the next 12 months, while only 19,9% will keep their current reserves. Moreover, 62% report that they will reduce USD reserves in the next 5 years, he said.