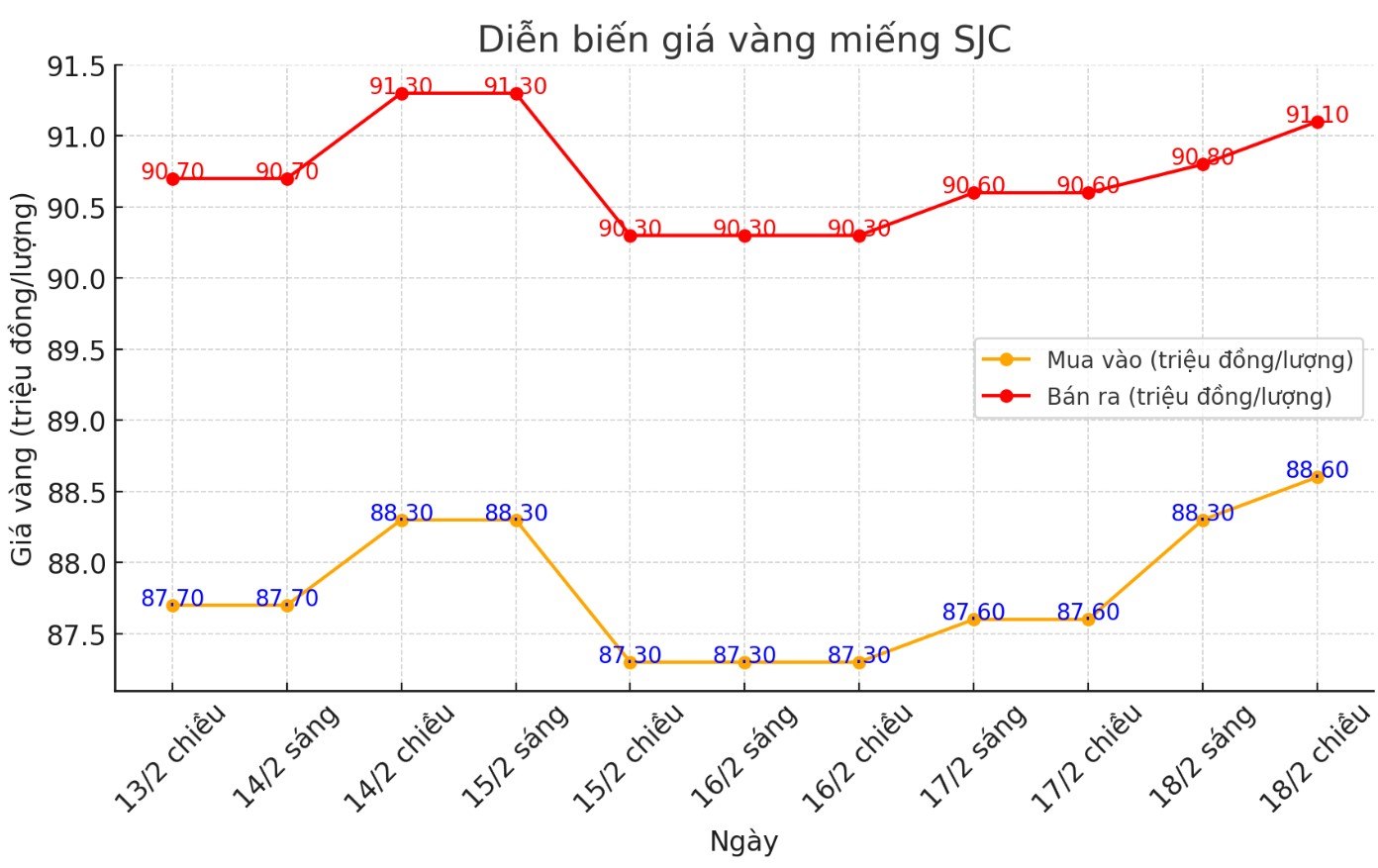

Updated SJC gold price

As of 7:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 88.6-91.1 million/tael (buy - sell), an increase of VND 1 million/tael for buying and VND 500,000/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 88.6-91.1 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2.5 million VND/tael.

DOJI Group listed the price of SJC gold bars at 88.6-91.1 million VND/tael (buy - sell), an increase of 1 million VND/tael for buying and an increase of 500,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2.5 million VND/tael.

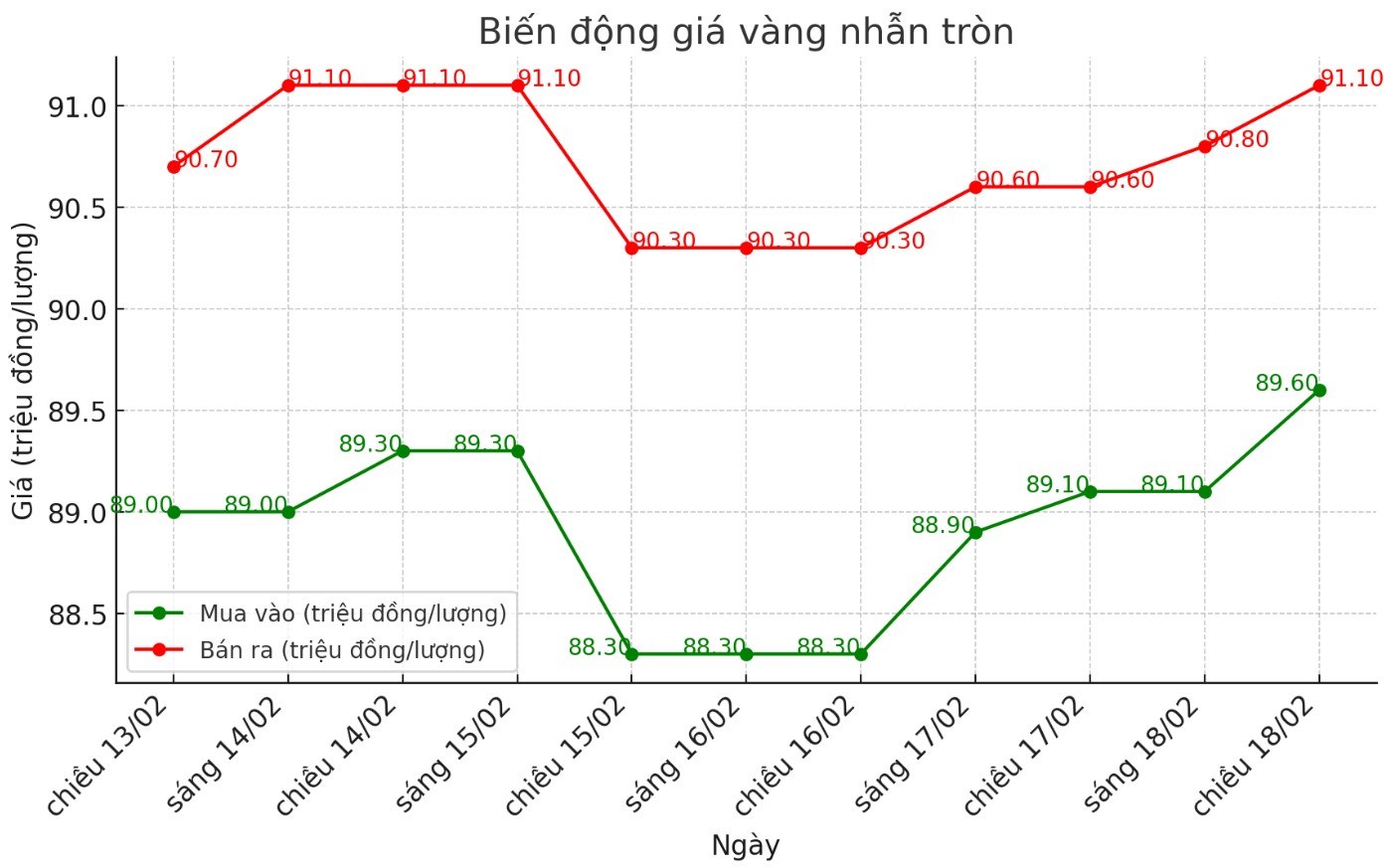

9999 round gold ring price

As of 7:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND89.6-91.1 million/tael (buy in - sell out); increased by VND500,000/tael for both buying and selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 89.6-91.1 million VND/tael (buy - sell); increased by 450,000 VND/tael for buying and increased by 500,000 VND/tael for selling. The difference between buying and selling is 1.5 million VND/tael.

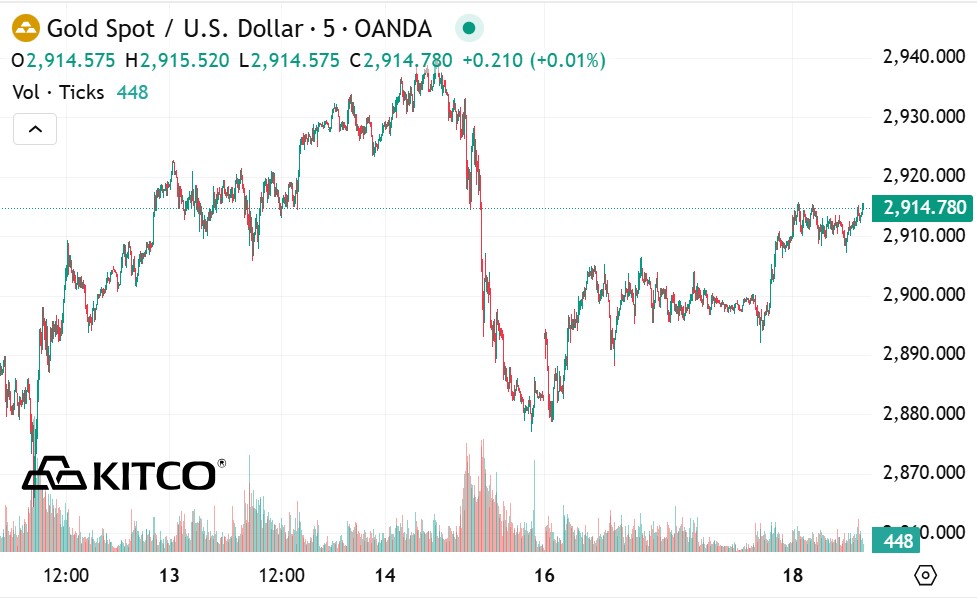

World gold price

As of 7:30 p.m., the world gold price listed on Kitco was at 2,914.7 USD/ounce, up 15.9 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices increased despite the increase of the USD. Recorded at 7:30 p.m. on February 18, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.870 points (up 0.28%).

According to Kitco - cash flow from China increases investment demand for gold. A group of 10 major Chinese insurance companies has been approved to invest up to 1% of total assets (~27.4 billion USD) in gold bars.

According to current gold prices, this investment is equivalent to about 295 tons, accounting for 34% of the total demand for gold bars in 2024. Over the past year, investment demand for gold bars has increased by 10% over the same period, reaching 1,185 tons.

Analysts at Heraeus predict that if these insurance companies carry out the planned investment, gold investment demand in 2025 could increase by at least 25%. This could maintain gold's upward momentum. Especially since 2024, this precious metal has reached a new record high 39 times. Since the beginning of 2025, gold prices have peaked eight times.

The trading volume on the Shanghai Gold Exchange also showed strong interest from Chinese investors. Last week, the total trading volume reached 44,000 tons, accounting for more than 95% of the average weekly volume over the past four years. This shows the positive sentiment of investors even though gold prices are constantly reaching new peaks.

ActivTrades analyst Ricardo Evangelista said that gold is likely to remain above $2,900/ounce thanks to its role as a safe-haven asset. Investors are looking to gold to protect their portfolios from the risk of US tariffs, which could lead to a multilateral trade war and negatively impact the global economy. In addition, gold prices are also supported by geopolitical instability.

UBS expert Joni Teves said that gold has witnessed "unprecedented market volatility" and will peak in 2024. However, the growth trend may not stop this year.

The latest forecast from UBS shows that gold prices could reach $3,200/ounce by the end of 2025 before falling slightly and ending the year still above $3,000/ounce.

UBS also pointed out that investors are not fully interested in gold, which means that the precious metal still has a lot of room to increase in price.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...