According to the US Commerce Department report on Friday, the core personal consumption expenditure (PCE) index - a favorite inflation measure of the US Federal Reserve (FED), excluding food and energy prices, increased by 0.4% last month, higher than the increase of 0.3% in January.

This increase is hotter than economists predicted, who expect the PCE index to continue to increase by 0.3%.

Over the past 12 months, core inflation has risen 2.8%, up from January's 2.7% (adjusted). Economists had previously forecast an annual growth rate of 2.7%.

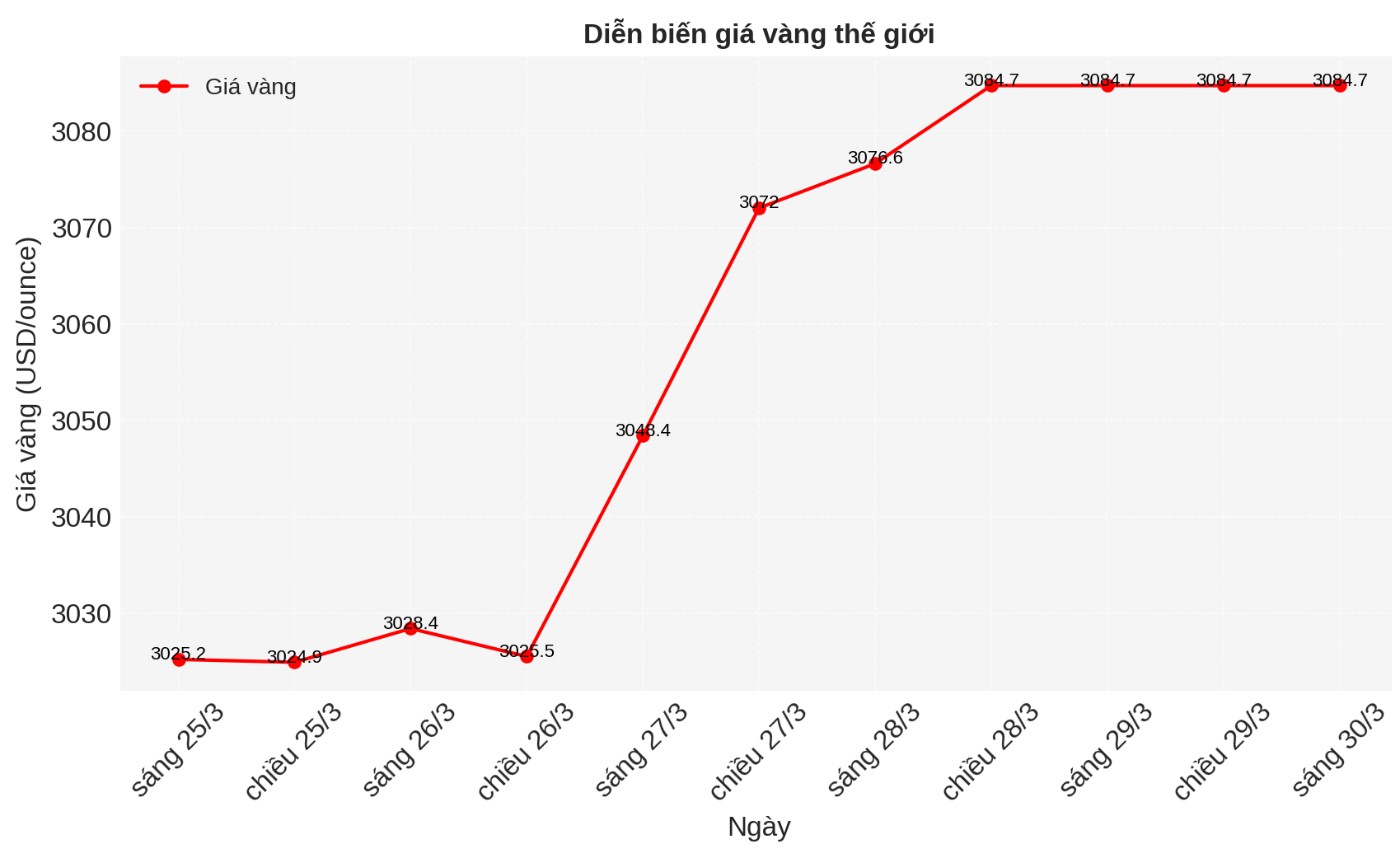

Gold prices remained strong after higher-than-expected inflation data was released. At the end of the trading session of the week, the spot gold price listed on Kitco was at 3,084.7 USD/ounce.

The report shows that inflation is eating deep into the economy, even as inflation remains largely stable. Full-ends rose 0.3% last month, unchanged from January. Over the past 12 months, inflation has increased by 2.5%, in line with experts' forecasts.

US consumers are tightening spending and saving more under inflationary pressures. Personal income increased by 0.8% last month, significantly higher than the forecast of 0.4%. However, personal spending increased by only 0.4%, lower than expected.

Some economic experts believe that the latest inflation and consumer data will put the Fed in a difficult position as inflationary pressures increase while economic growth slows down.

In addition, some economists warn that inflationary pressures may continue to increase due to the impact of import tariffs imposed by US President Donald Trump, leading to the risk of a global trade war.

T hotter-than-expected inflation report today has helped ease concerns about tariffs and their impact on the US economy, said Damian McIntyre, vice president, portfolio manager and senior qualified analyst at Federated Hermes.

While a few months have not been able to form a trend, the recent inflation momentum, right before the retaliatory tariffs take effect next week, is worrying and could affect Jerome Powell's rate cut roadmap this year.

Last week, the Fed maintained a neutral monetary policy stance, stressing that it was in no rush to ease interest rates even as inflationary pressures increased. At the same time, the FED maintains its view of only cutting interest rates twice this year, while the market is expecting three interest rate cuts.

See more news related to gold prices HERE...