HDBank's highest special interest rate is up to 8.1%/year

According to HDBank's latest deposit interest rate schedule, the bank continues to list a very high special interest rate at the counter for large deposits.

The highest interest rate for the entire system is 8.10%/year, applied to the 13-month term. In addition, the 12-month term also has a special interest rate of 7.70%/year.

However, to enjoy this "huge" interest rate, customers need to meet the condition of having a minimum savings of 500 billion VND or more and receiving interest at the end of the term. This is a preferential policy specifically for the super VIP customer segment.

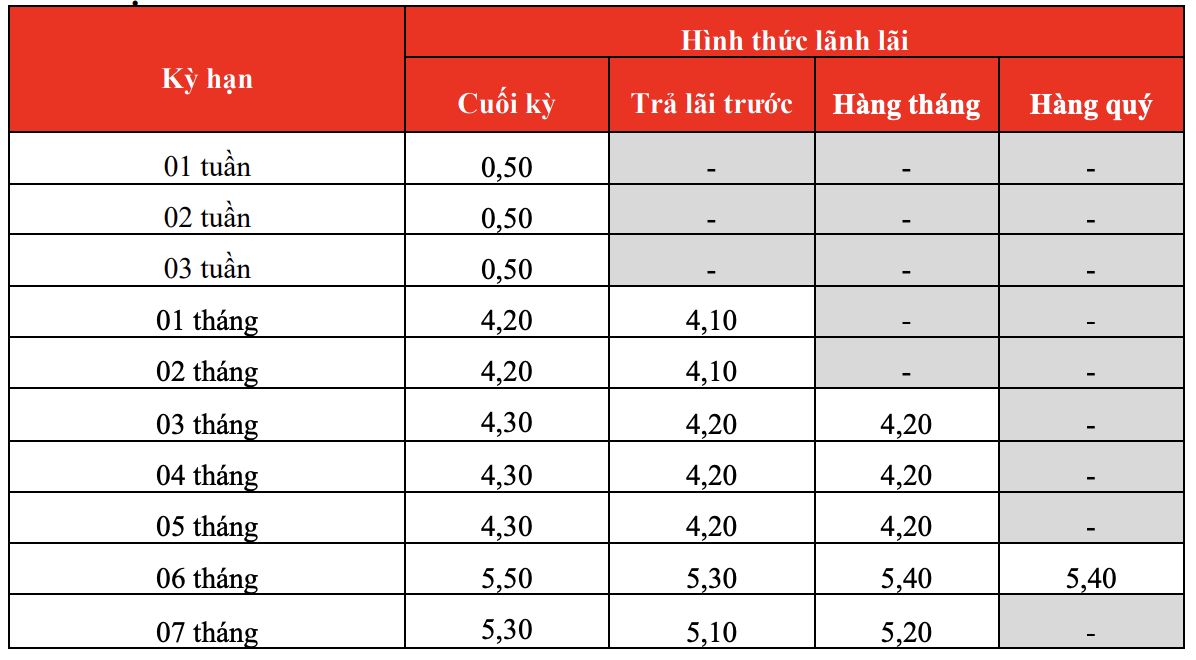

Online Savings" interest rates for individual customers

For the vast majority of individual customers, the "Online Savings" form is still the optimal choice thanks to higher interest rates compared to depositing at the counter for many terms.

According to the current interest rate schedule, interest rates for short terms are still very competitive: terms of 1-2 months are 4.20%/year; terms of 3-5 months are 4.30%/year.

Notably, the 6-month term interest rate is kept at 5.50%/year. Longer terms such as 12 months are 5.80%/year, and 13 months are 6.00%/year.

The highest annual listed interest rate for online products is 6.10%/year, for a term of 18 months.

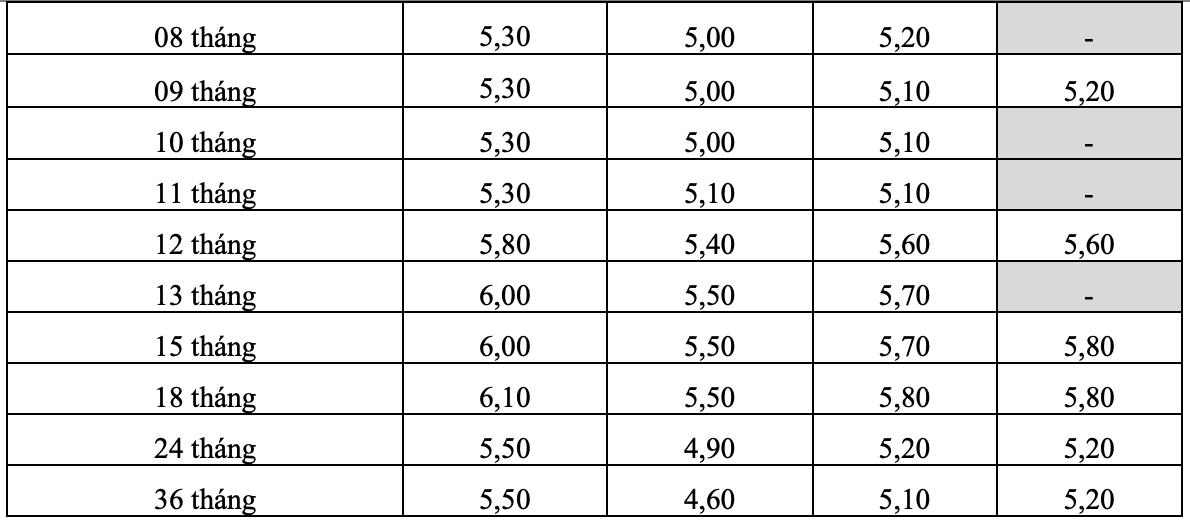

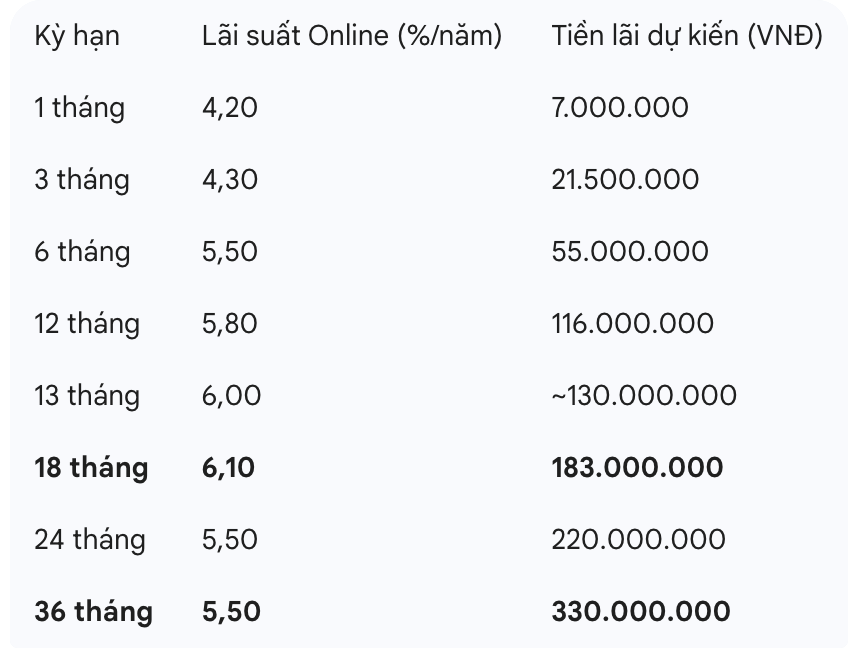

Deposit 2 billion VND online, how much interest will you receive?

When having a large amount of idle money of up to 2 billion VND in hand, choosing a deposit term is not simply about depositing for interest, but a balancing problem between Expected Profit and Liquidity.

According to HDBank's latest Online interest rate schedule, below are 3 typical profit scenarios:

Scenario 1: Prioritize flexible cash flow (Deposit for 1-6 months)

For investors who are "hiding" waiting for business opportunities or investing in other assets.

1-month term (4.20%/year): Interest received is 7,000,000 VND/month. This level is enough to cover basic living expenses while waiting.

6-month term (5.50%/year): This is the break point of short-term interest rates. Total interest received is 55,000,000 VND. This figure is significantly higher than depositing for 3 months (4.30%/year) in two rounds.

Scenario 2: Maximize profit margin (Deposit for 18 months)

This is HDBank's "lowest interest rate zone" on the Online channel.

Applied interest rate: 6.10%/year - The peak of the normal interest rate table.

Real interest received: After 18 months, customers collected 183,000,000 VND.

This is the best choice for those who want the highest return on each dollar invested in the medium term.

Scenario 3: Safe asset accumulation, long-term interest lock (Deposit for 36 months)

In the context of market interest rates potentially fluctuating, fixing fixed interest rates for 3 years is a defensive strategy.

Applied interest rate: 5.50%/year.

Real interest received: Total interest amount up to VND 330.000.000.

Although the annual interest rate is lower than the 18-month term, the total value of absolute interest is the highest, suitable for "saving" for old age or for children.

(Interest rates are for reference, calculated according to the method of receiving interest at the end of the term)

Thus, if depositing 2 billion VND, customers choosing an 18-month term will receive the best interest rate per year (6.10%), earning 183 million VND in interest.

However, if there is no need to use capital for a long time, the 36-month term will bring the highest total actual interest received, up to 330 million VND, helping to maximize profits for idle money.