Vietnam Foreign Trade Joint Stock Commercial Bank (Vietcombank) has just officially launched an online deposit certificate product line on a digital platform. This move opens up opportunities to enjoy better interest rates for depositors compared to ordinary savings products at the counter.

6%/year interest rate for online deposit certificates

According to records on the digital banking application VCB Digibank, Vietcombank is listing an interest rate of 6%/year for 12-month term deposit certificate (CCTG) products.

The biggest difference of this issuance is the completely "online" nature. Instead of having to go to the transaction counter and store hard copy documents as before, individual investors can perform the purchase operation right on the phone application.

Notably, the liquidity of this product has been significantly improved. Owners can proactively place orders to buy or sell deposit certificates based on personal financial needs, instead of having to wait until the expiration date to be settled like traditional deposits.

Depositing 1 billion VND online, how much interest will you receive?

With an interest rate of 6%/year, this product is leading in terms of profit margin in Vietcombank's capital mobilization portfolio.

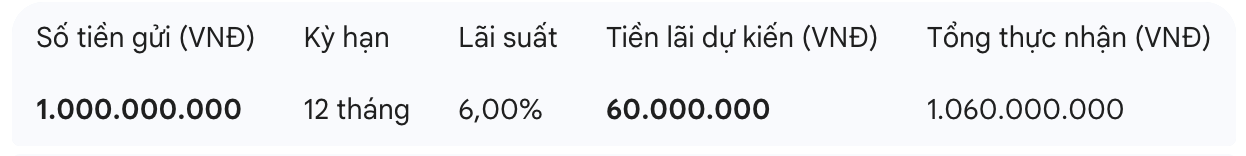

Profit calculation formula at the end of the period:

Interest = Deposit x Interest rate (%/year)

Thus, with a capital of 1 billion VND, after 1 year of holding, customers will earn 60 million VND in interest. This figure is significantly higher than regular savings deposits at the same bank (usually with lower interest rates from 1% - 1.5% depending on the time).

Vietcombank's bringing deposit certificates to digital channels (Digibank) helps users easily access high interest rates without cumbersome procedures. This is the optimal choice for idle money in the medium term (1 year).

However, users need to pay special attention to the transaction time frame (09:00 - 15:00). Due to the specificity of buying and selling valuable papers, the system will not support transactions in the evening or weekend, requiring investors to have a suitable cash flow management plan if they want to settle before the deadline.

According to Article 4 of Circular 02/2025/TT-NHNN, a deposit certificate is a form of deposit in the form of valuable papers and is evidence confirming the debt repayment obligations of credit institutions and foreign bank branches issued to deposit certificate buyers for a certain period of time, interest payment conditions and other conditions.