HDBank's highest special interest rate is up to 8.1%/year

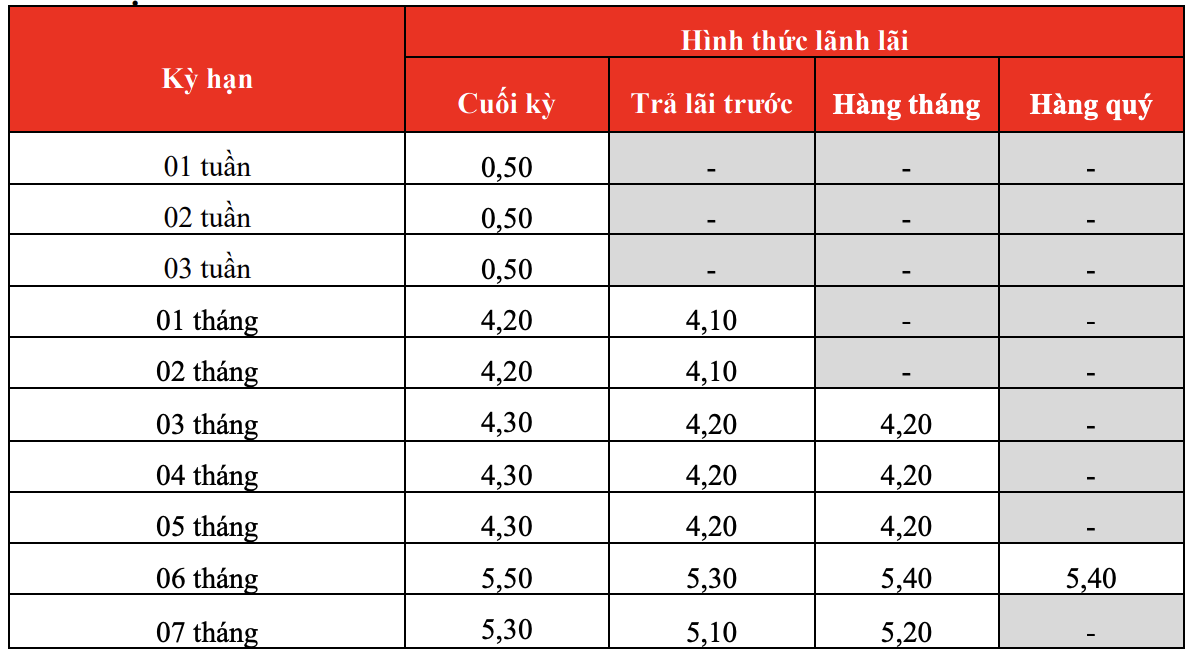

According to HDBank's current capital mobilization interest rate schedule (effective from November 6, 2025), the bank still applies a special interest rate policy at the counter.

The highest interest rate for the entire system is 8.10%/year for a 13-month term and 7.70%/year for a 12-month term.

However, this interest rate comes with quite strict conditions: It is only applied to deposits from 500 billion VND or more and interest at the end of the term. This is a policy specifically for super VIP customers.

Online Savings" interest rates for individual customers

For the majority of individual customers with deposits of 1 billion VND, the "Online Savings" form is the optimal choice in terms of profit and convenience.

In short terms, interest rates are quite competitive: Terms of 1-2 months are 4.20%/year, terms of 3-5 months are 4.30%/year.

For longer terms, interest rates increased sharply: 6-month terms are 5.50%/year, 12-month terms are 5.80%/year. In particular, 18-month terms are holding the champion position in online listed interest rates at 6.10%/year.

Below is a detailed deposit interest rate table "Online Savings" (%/year):

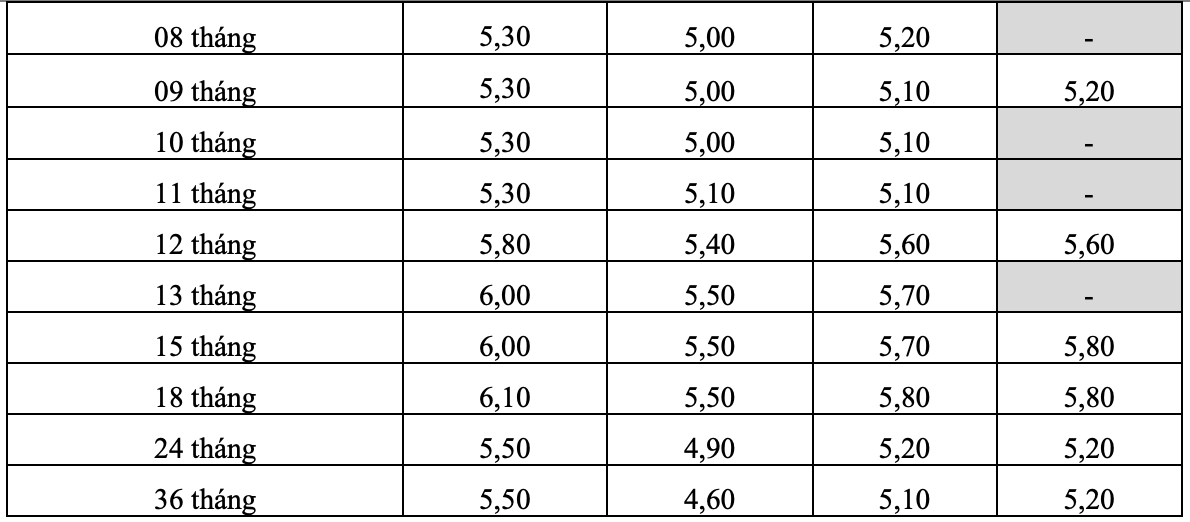

Deposit 1 billion VND online savings, how much interest will you receive?

With a capital of 1 billion VND, the interest received will be very significant depending on the term you choose. Below is a detailed calculation table:

Scenario 1: Short-term deposit to wait for an opportunity (1-5 months)

For investors who need capital flexibility or are waiting for other investment opportunities (real estate, securities), terms under 6 months are a safe option.

Currently, HDBank applies an interest rate of 4.20%/year for terms of 1-2 months and 4.30%/year for terms of 3-5 months.

Real interest received: With 1 billion VND deposited for a 3-month term, customers will receive 10,750,000 VND.

Scenario 2: Deposit medium term to enjoy the highest interest rate (12-18 months)

This is the best profitable segment currently at HDBank for the majority. The 12-month term interest rate jumped to 5.80%/year, and especially the 18-month term hit 6.10%/year - the highest listing level on the Online channel.

Real interest received: Deposit 1 billion VND for an 18-month term, total interest earned is 91,500,000 VND.

Scenario 3: Long-term accumulation (24-36 months)

For terms of 24 and 36 months, the interest rate adjusts to 5.50%/year. Although the interest rate is lower than the 18-month term, this is an option for those who want to "lock" fixed interest rates for a long time, avoiding the risk of market interest rates falling deeply in the future.

Real interest received: Depositing 1 billion VND in 36 months, customers "pocket" 165,000,000 VND.

The interest table received is for reference only.