Agribank increases interest rates, Big4 group remains stable

Today, Agribank unexpectedly adjusted interest rates, after BIDV adjusted the increase previously on February 5, 2025.

Agribank adjusted the interest rate to increase by 0.1%/year for 3-9 month terms. Reduced by 0.1%/year for 12-36-month terms.

Meanwhile, Vietcombank has not changed the deposit interest rate table and VietinBank since June 2024.

The Big4 group of banks often maintain stable interest rates and often attract top deposits in the system. When a bank in this group adjusts, even 0.1%/year, it attracts public attention.

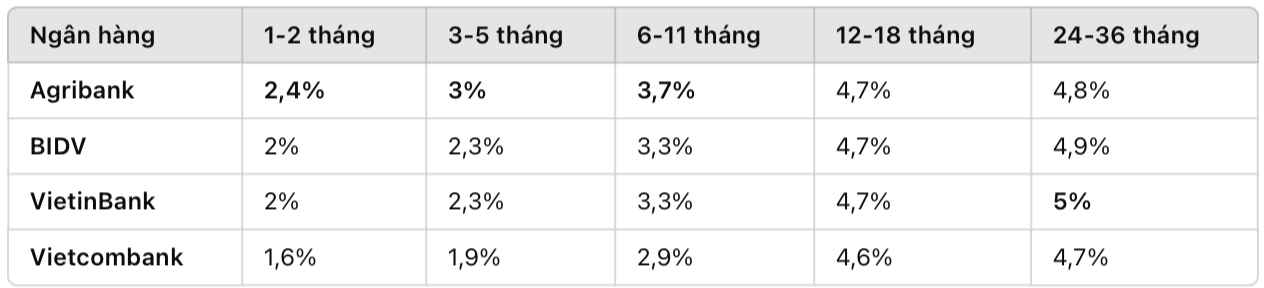

Comparison of interest rates of the Big4 group

In the Big4 group, Agribank currently has the highest short-term rate, while VietinBank has the highest long-term rate:

Commercial Joint Stock Bank maintains high interest rates

While the Big4 group maintains stable interest rates, joint stock commercial banks continue to have significantly higher interest rates:

Eximbank leads the 3-5 month term with 4.75%/year when depositing online at the weekend.

MBV, VietBank listed 4.6%/year for the 3-month term.

Nam A Bank applies 4.5%/year for a 3-month term.

For long terms, PVcomBank still has the highest interest rate at 9%/year (12-month term) for customers depositing from VND 2,000 billion.

Highest online savings interest rate today

The form of online savings deposits is being applied by many banks with higher interest rates at the counter from 0.1 - 0.3%/year, depending on the bank.

Eximbank: 6.5%/year (24 months).

BVBank: 6.45%/year (24 months).

Timo by BVBank: 6.3%/year (24 months).

Interest rate trends in the coming time

Deposit interest rates have not had many major fluctuations recently, however, some banks have still made small adjustments to attract cash flow. Experts say the interest rate level may fluctuate slightly, depending on the capital needs of each bank and financial market developments.

The flow of deposits into banks continues to increase, reflecting people's cautious psychology in the face of economic fluctuations. In the coming time, interest rates may continue to be adjusted depending on the liquidity situation and the management orientation of the State Bank.