Gold prices fell 1% in the trading session on Monday (August 11) as the market focused on the upcoming negotiations between the US and Russia on the Ukrainian conflict, along with July inflation data that could provide more clues about the interest rate outlook of the US Federal Reserve (FED).

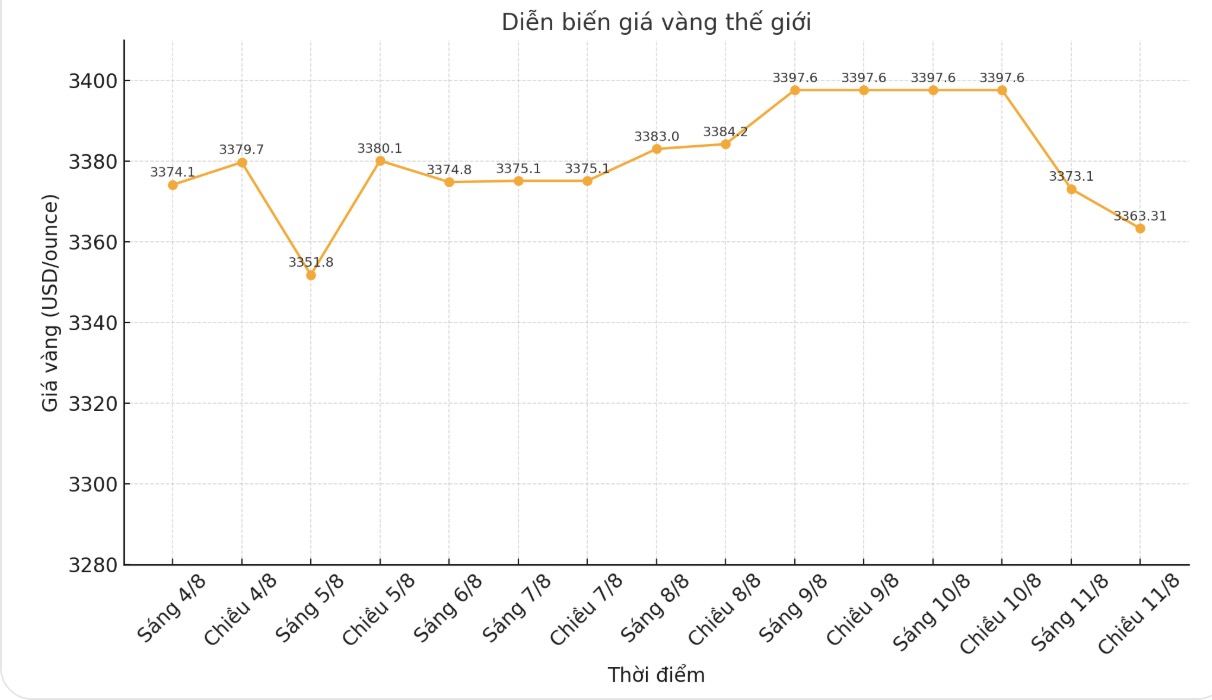

Spot gold was at $3,363.31 an ounce at 7:03 a.m. GMT, after hitting its highest level since July 23 last Friday. US December gold futures fell 2% to $3,423.10 an ounce.

geopolitical tensions over the war in Ukraine have cooled gold prices further, after US President Donald Trump announced on Friday that he would meet Russian President Vladimir Putin in the US, said Matt Simpson, senior analyst at City Index.

Mr. Trump said on Friday that he will meet Mr. Putin on August 15 in Alaska to negotiate an end to the war.

Meanwhile, US consumer price data is expected to be released on Tuesday, with newly applied tax rates forecast to push the core index up 0.3%, bringing the annual growth rate to 3%, higher than the 2% target of the US Federal Reserve (FED).

If inflation rises, the US dollar could strengthen and make it difficult for gold prices to increase. However, I think gold prices will still be supported because investors will take advantage of buying when prices fall, Trump said.

The recent weaker-than-expected US jobs report has raised expectations of a Fed rate cut in September. The market is reflecting a 90% chance of easing in September and at least one more cut before the end of the year.

Gold - non-interest-bearing assets often benefit in a low interest rate environment. The market is also watching US-China trade talks as Trump's deadline for a deal between Washington and Beijing on August 12 is approaching.

In the week ended August 5, gold speculators on the COMEX floor increased their net buying positions by 18,965 contracts, to 161,811 contracts.

Technically, spot gold could break the support level of $3,364 an ounce and fall to $3,314 - $3,342 an ounce - according to Reuters technical analyst Wang Tao.

In other precious metals, spot silver fell 0.9% to $37.97/ounce, platinum fell 1.3% to $1,314.75, and palladium fell 0.1% to $1,125.

See more news related to gold prices HERE...