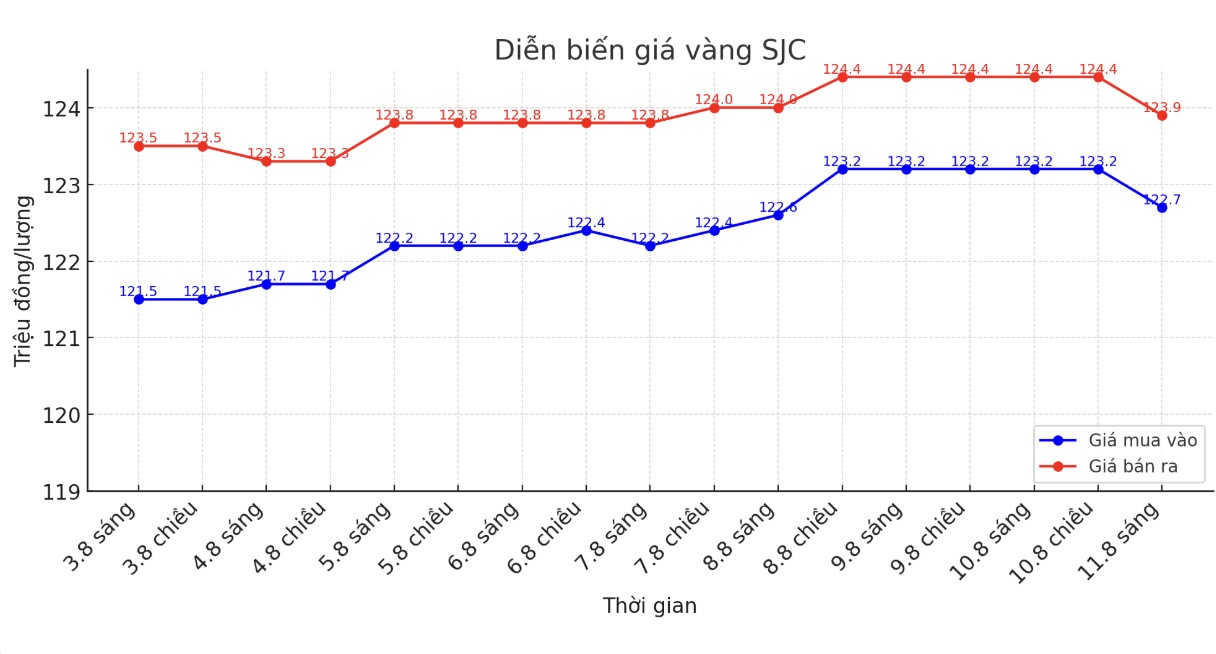

Updated SJC gold price

As of 9:30 a.m., DOJI Group listed the price of SJC gold bars at VND122.7-123.9 million/tael (buy in - sell out), down VND500,000/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.7-123.9 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 121.9-123.9 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 500,000 VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

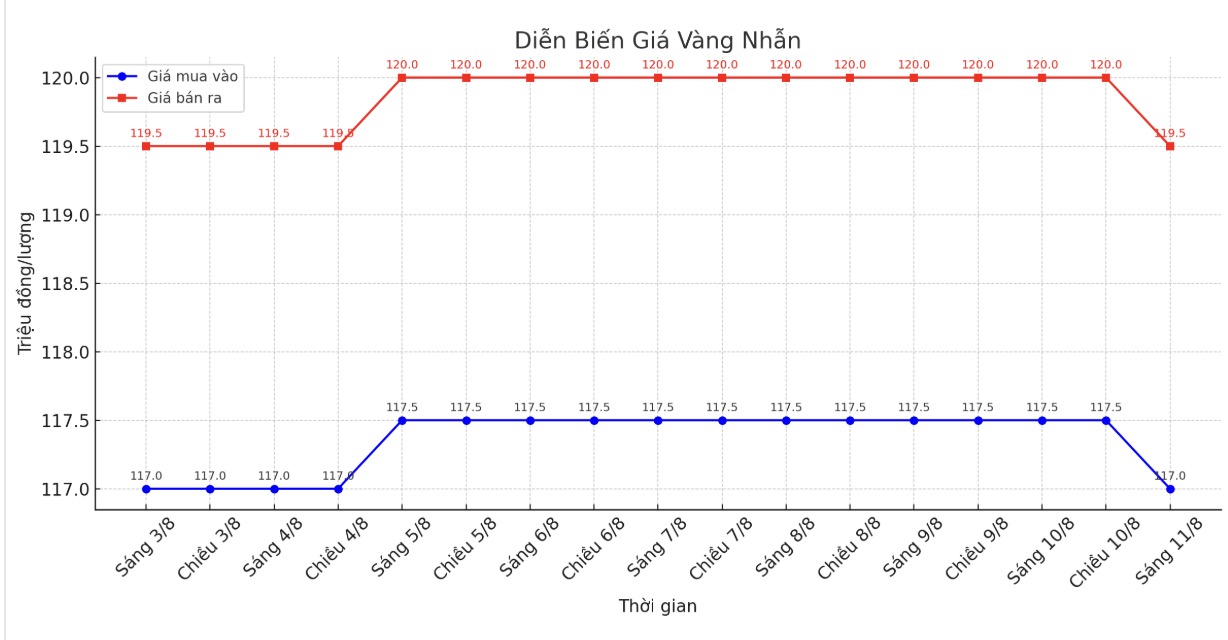

9999 round gold ring price

As of 9:30 a.m., DOJI Group listed the price of gold rings at 117-119.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.3-120.3 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.5-119 7.7 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

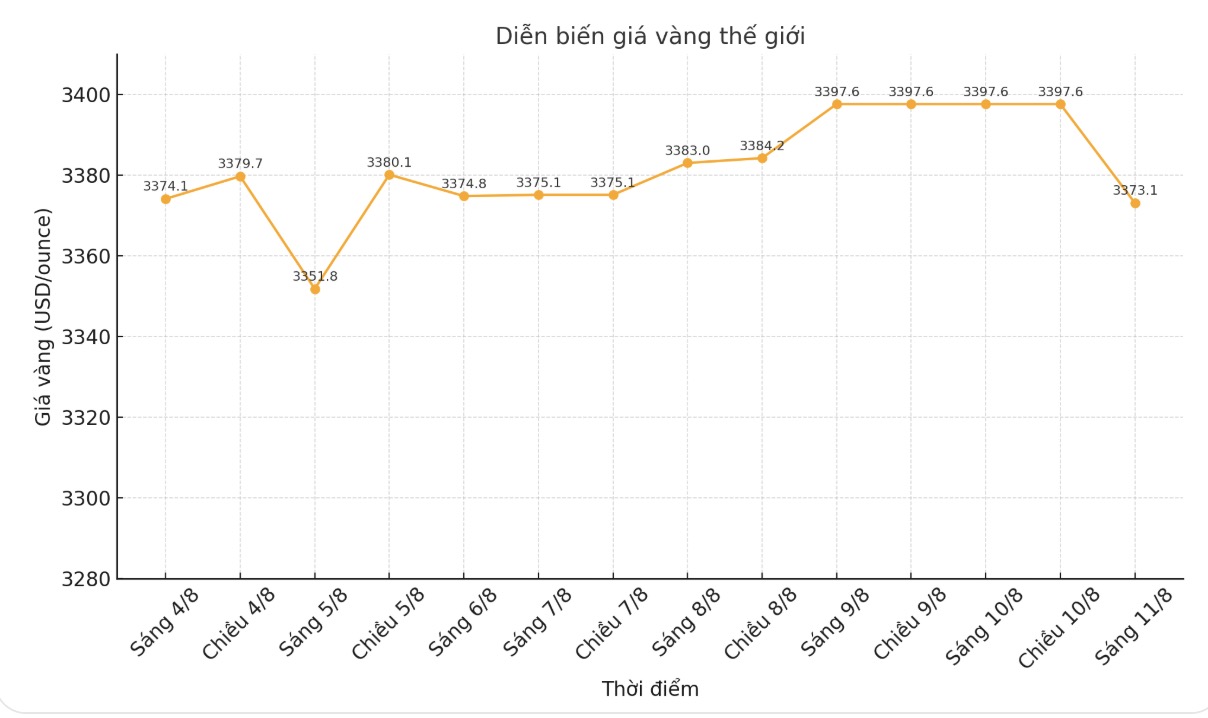

World gold price

At 9:30 a.m., the world gold price was listed around 3,373.1 USD/ounce, down 24.5 USD compared to a day ago.

Gold price forecast

Gold prices fell due to profit-taking after a strong increase last weekend. In addition, the precious metal was also affected after the White House rejected shocking information that the US had imposed import tariffs on gold bars from Switzerland.

A spokesperson for the Donald Trump administration told media outlets on Friday that they will issue a new policy to clarify that gold bullion imports will not be subject to tax.

Previously, some sources reported that a letter dated July 31 from the US Customs and Border Protection Agency to a Swiss refiner said that the 1-kg and 100-ounce gold bar would have to pay a high tax with the 39% tax that Switzerland had just announced as being in the highest group ever applied by the Trump administration caused a panic in the precious metals market.

This information has pushed the price of gold futures on the Comex exchange to a new record high of $3,534.1/ounce, while causing spot gold prices to break out of $3,400/ounce.

Industry experts quickly commented that, although the initial reaction of the market was very strong, the long-term impact of this tax ruling will reshape the entire global gold bar market.

However, by Friday afternoon, the White House said the above information was false and reassured the market that gold would not be taxed. Although gold prices then had a strong sell-off, in the short term, this precious metal still maintained almost all of the week's increase.

Economic data to watch this week

Economic news will be bustling again next week, with key indicators of inflation and consumer health on the watch list.

Early Tuesday morning, the Reserve Bank of Australia will have an interest rate decision, with the market predicting a 25 basis point cut, from 3.85% to 3.60%. Traders will then turn their attention to the US CPI report for July, which is expected to show core inflation rising slightly to 0.3% from 0.2% in June.

Wednesday is expected to be quite quiet, highlighted by the statements of FED Governors Goolsbee and Bostic. However, data will be bustling again on Thursday with the US PPI report on core inflation expected to increase by 0.2% after June's zero level along with weekly jobless claims.

The week will end with a deeper look at US consumers, as July retail sales are expected to decline slightly from 0.6% to 0.5%, while core retail sales are expected to decrease from 0.6% to 0.3% compared to June.

Then in the morning, the University of Michigan's preliminary consumer confidence index for August will let the market know what consumers expect in the coming time.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...