According to Goldman Sachs, if private investors participate in asset diversification like central banks, gold prices could completely exceed the base scenario of 4,900 USD/ounce.

Among the items being considered, Goldman Sachs is most optimistic about gold, in which the buying demand from central banks is a key factor.

We expect the gold buying activity of central banks to remain high in 2026, averaging about 70 tons per month (near the average of 66 tons in the past 12 months, but 4 times higher than the average of 17 tons/month before 2022), and contribute about 14 percentage points to the price increase that we forecast until the end of 2026, for three reasons" - analysts said.

First, the freeze of Russia's reserves in 2022 created a major turning point in how reserve managers of emerging economies perceive geopolitical risks.

Second, the proportion of gold reserves of many central banks in emerging economies, such as the People's Bank of China, is still low compared to other countries in the world.

Third, surveys show that the central bank's demand for gold is at a record high" - experts added.

In fact, this trend has led to competition in gold purchases between investors and central banks, thereby contributing to the formation of a strong gold price market in recent years.

Gold ETF funds currently account for only about 0.17% of the private sector's financial portfolio in the US, 6 basis points lower than the 2012 peak" - experts said - "We estimate that every time the proportion of gold in the US financial portfolio increases by 1 basis point - driven by new net buying cash flow from investors rather than price increases - gold prices will increase by about 1.4%".

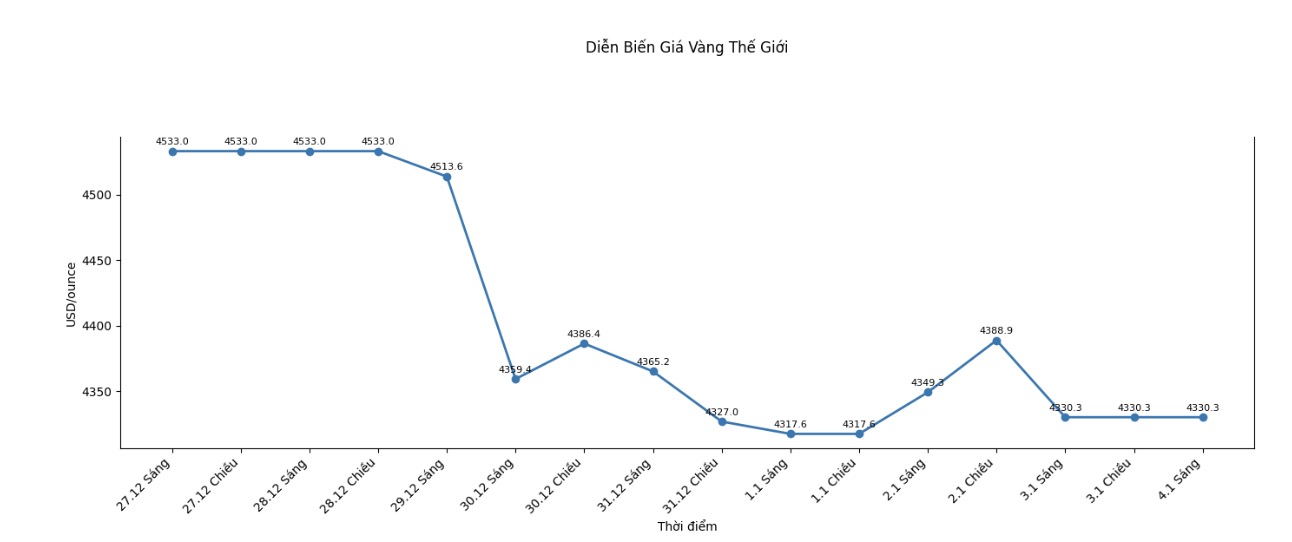

Goldman Sachs forecasts that gold prices will adjust down to a low of 4,200 USD/ounce in the first quarter of 2026, then increase back above the 4,400 USD/ounce mark in the second quarter, before setting a new historical peak around 4,630 USD/ounce in the third quarter and possibly increasing to 4,900 USD/ounce at the end of the fourth quarter.

See more news related to gold prices HERE...