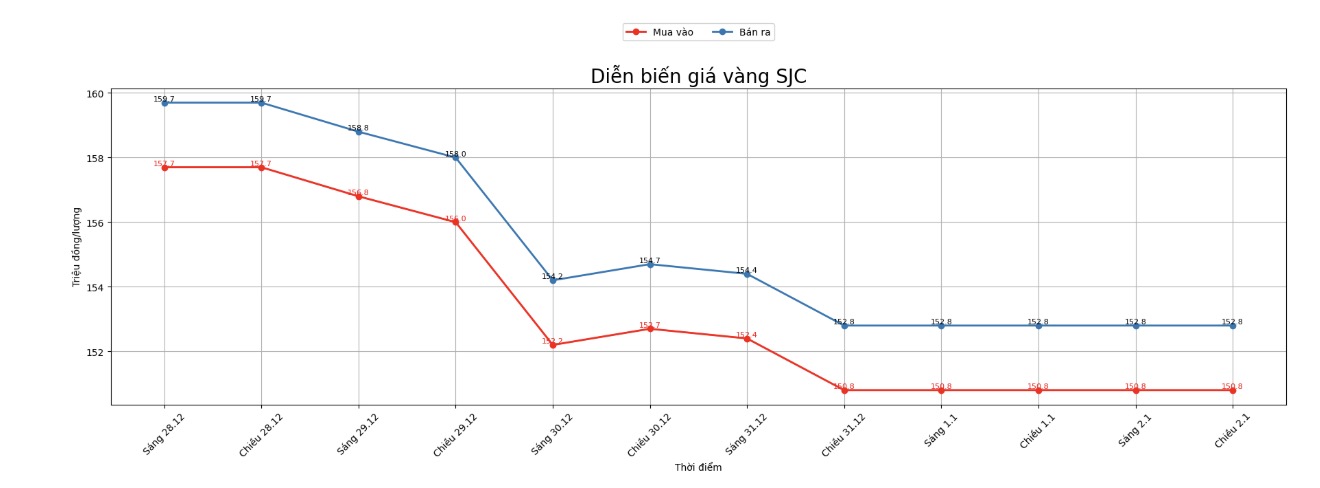

SJC gold bar price

As of 5:40 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 150.8-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at the threshold of 150.3-152.8 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling prices is at the threshold of 2.5 million VND/tael.

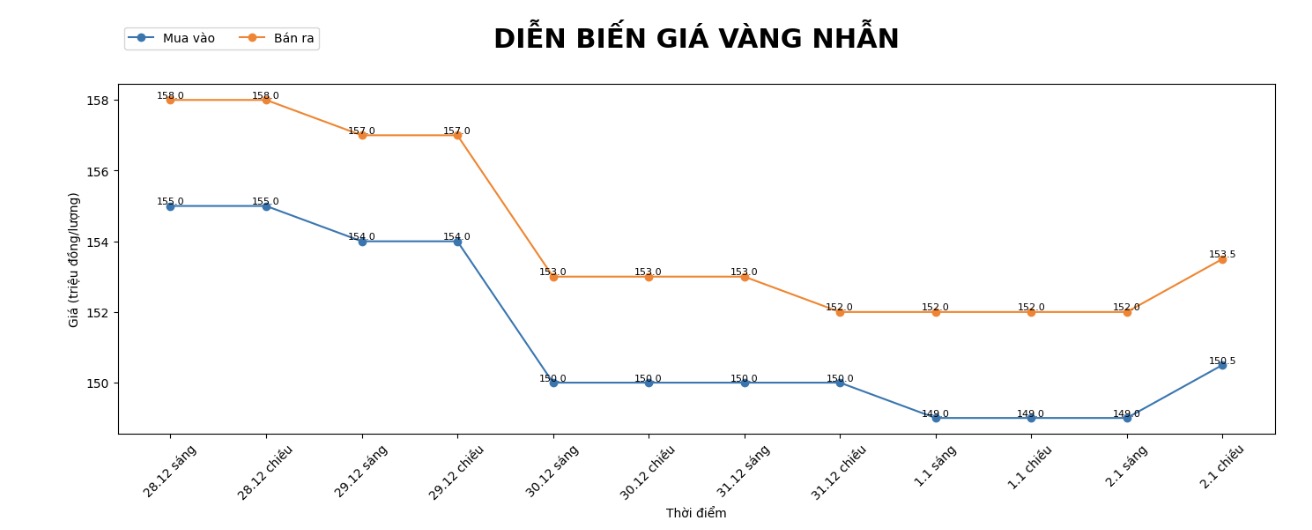

9999 gold ring price

As of 5:40 PM, DOJI Group listed the price of gold rings at 150.5-153.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both buying and selling directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling), going sideways in both directions. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 150.5-153.5 million VND/tael (buying - selling), an increase of 700,000 VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

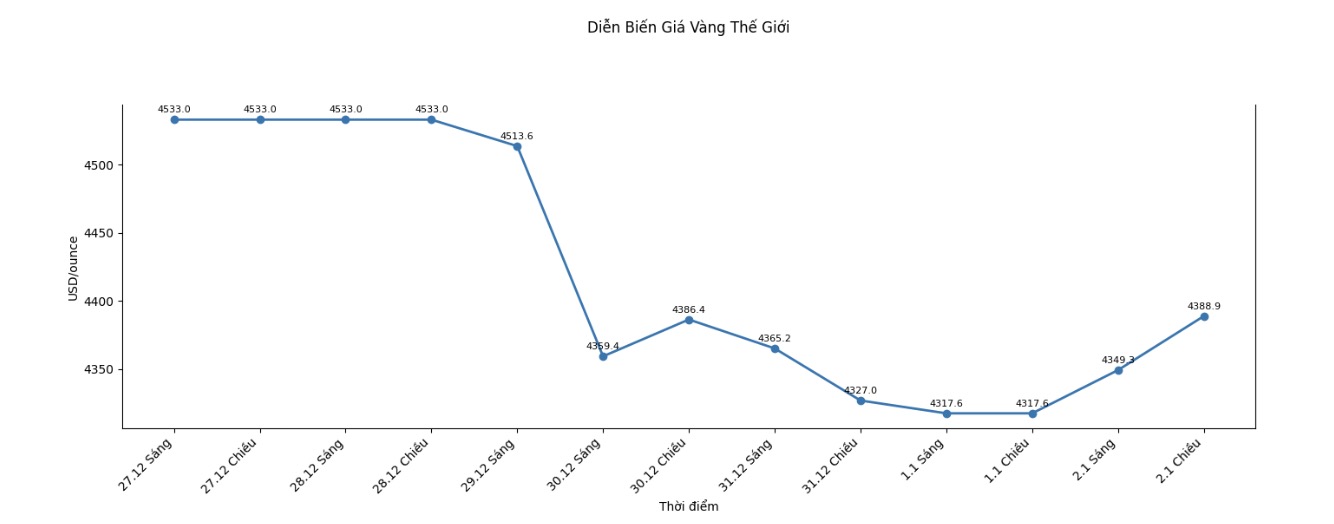

World gold price

World gold prices listed at 5:30 PM were at the threshold of 4,388.9 USD/ounce, up 71.3 USD compared to the previous day.

Gold price forecast

The world gold market started in 2026 in a positive state, extending the strong upward momentum that has formed throughout 2025. However, alongside expectations of higher price levels are concerns related to short-term fluctuations, as investor sentiment is still quite cautious after a prolonged period of hot increases.

Analysts believe that the fundamental factors supporting gold prices are currently showing no signs of weakening. Expectations that the US Federal Reserve (Fed) will continue its interest rate reduction roadmap, the USD will maintain its weakening trend, and stable gold buying demand from central banks are still important drivers supporting the market. In addition, geopolitical instability and trade conflict risk continue to drive cash flow to safe haven assets.

Notably, the demand for physical gold in major consumption markets such as India and China is showing clear signs of recovery. The adjustment of gold prices from historical peaks has stimulated retail buying and selling activities, causing gold bars in many areas to switch to trading with a positive difference compared to world prices. This development is considered a factor helping gold prices maintain a fairly good foundation in correction phases.

However, many experts still warn about the possibility of strong fluctuations in the short term. After a year of breakthrough growth, profit-taking pressure may increase, especially when the market enters a period where liquidity is not really abundant. Strong fluctuations may make investor sentiment more cautious, especially for short-term speculative market participants.

Regarding medium and long-term prospects, many major financial institutions still maintain a positive view of the precious metal. Some forecasts suggest that gold prices may continue to move towards new peaks if the low interest rate environment is maintained and global macroeconomic risks have not cooled down. In that context, gold is still considered an important value-preserving channel.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...