SJC gold bars: Big profits despite high differences

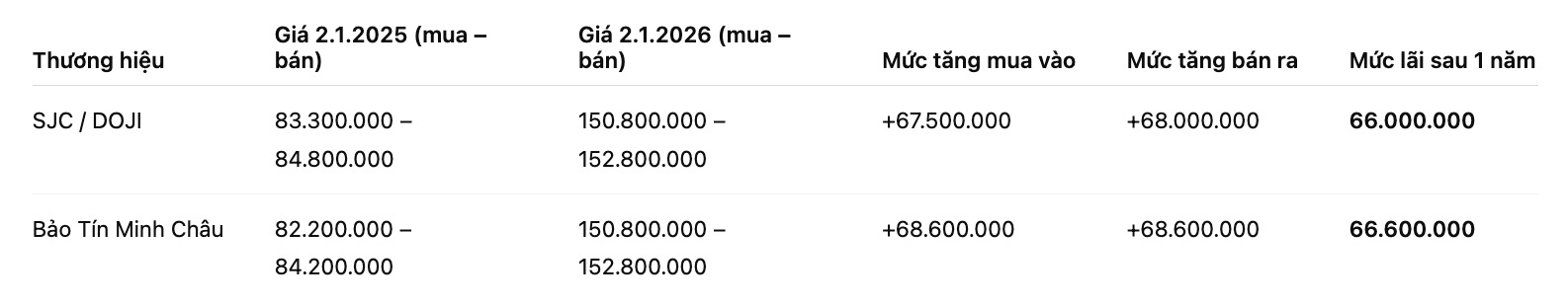

On January 2, 2025, Saigon SJC Jewelry Company and DOJI Group both listed SJC gold bar prices at 83.3 - 84.8 million VND/tael. Meanwhile, Bao Tin Minh Chau listed lower on the buying side, 82.2 - 84.2 million VND/tael.

By the morning of January 2, 2026, all three businesses simultaneously raised the price of SJC gold bars to 150.8 - 152.8 million VND/tael, with the buying - selling difference increasing to 2 million VND/tael.

Compared to a year ago, the buying price of SJC gold bars increased by about 67.5 - 68.6 million VND/tael, while the selling price increased by 68 - 68.6 million VND/tael, depending on the brand.

If people buy SJC gold bars at DOJI or SJC on January 2, 2025 and resell them to this enterprise on January 2, 2026, the profit recorded is about 66 million VND/tael. For the case of buying at Bao Tin Minh Chau, the profit recorded is about 66.6 million VND/tael.

9999 gold ring: Margin increases sharply but difference widens

In the gold ring segment, on January 2, 2025, DOJI listed Hung Thinh Vuong gold rings at 84.0 - 84.8 million VND/tael, while Bao Tin Minh Chau was at 82.6 - 84.2 million VND/tael.

By January 2, 2026, gold ring prices skyrocketed. DOJI listed 149 - 152 million VND/tael, while Bao Tin Minh Chau pushed prices up to 152 - 155 million VND/tael. Notably, the buying - selling price difference of gold rings has now increased to 3 million VND/tael, many times higher than at the beginning of 2025.

Compared to the same period last year, the buying price of gold rings at DOJI increased by about 65 million VND/tael, while at Bao Tin Minh Chau increased by 69.4 million VND/tael.

However, the actual profit of gold ring buyers is lower than the listed price increase figure. If buying DOJI gold rings a year ago and selling them today, investors will make a profit of about 64.2 million VND/tael. With Bao Tin Minh Chau gold rings, the profit is about 67.8 million VND/tael, thanks to the current buying price being significantly higher.

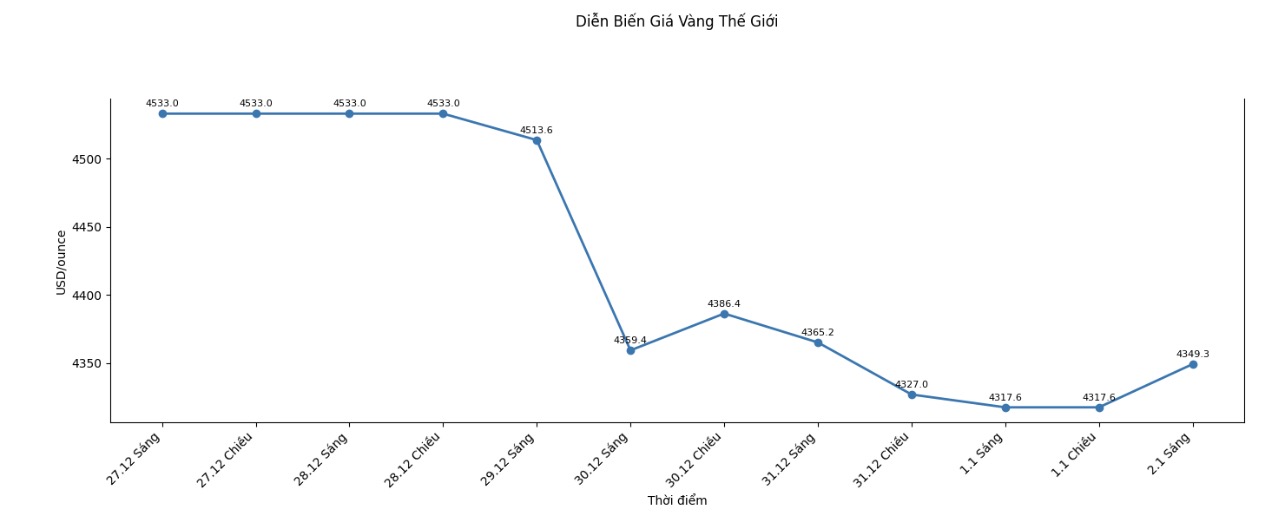

World gold prices rise sharply but risks remain

On the international market, spot gold prices have increased sharply from 2,634.4 USD/ounce on January 2, 2025 to 4,349.3 USD/ounce on January 2, 2026, creating a great push for domestic gold prices over the past time. Thus, world gold has increased by about 65% after a year.

Although gold brings high profits, people should not buy gold out of fear of missing opportunities (FOMO) when prices have increased too sharply. The buying-selling gap in the country is currently very high, which may cause investors to suffer heavy losses if gold prices turn down.

In addition, the correction momentum of world gold prices in the short term is entirely likely to lead to a deep decline in the domestic gold market, especially for those who buy at high prices.

See more news related to gold prices HERE...