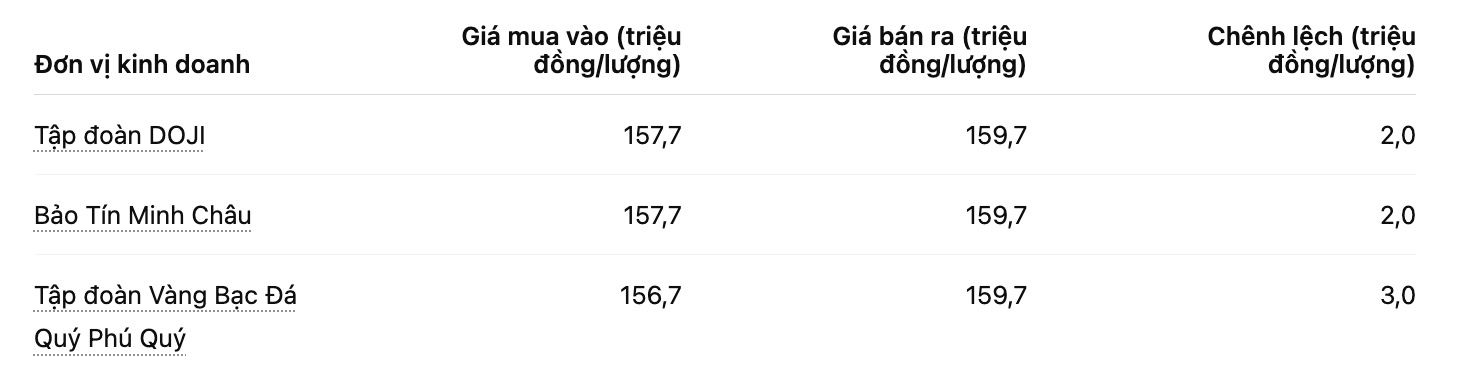

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 157.7-159.7 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at the threshold of 157.7-159.7 million VND/tael (buying - selling). The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed SJC gold bar prices at 156.7-159.7 million VND/tael (buying - selling). The difference between buying and selling prices is at 3 million VND/tael.

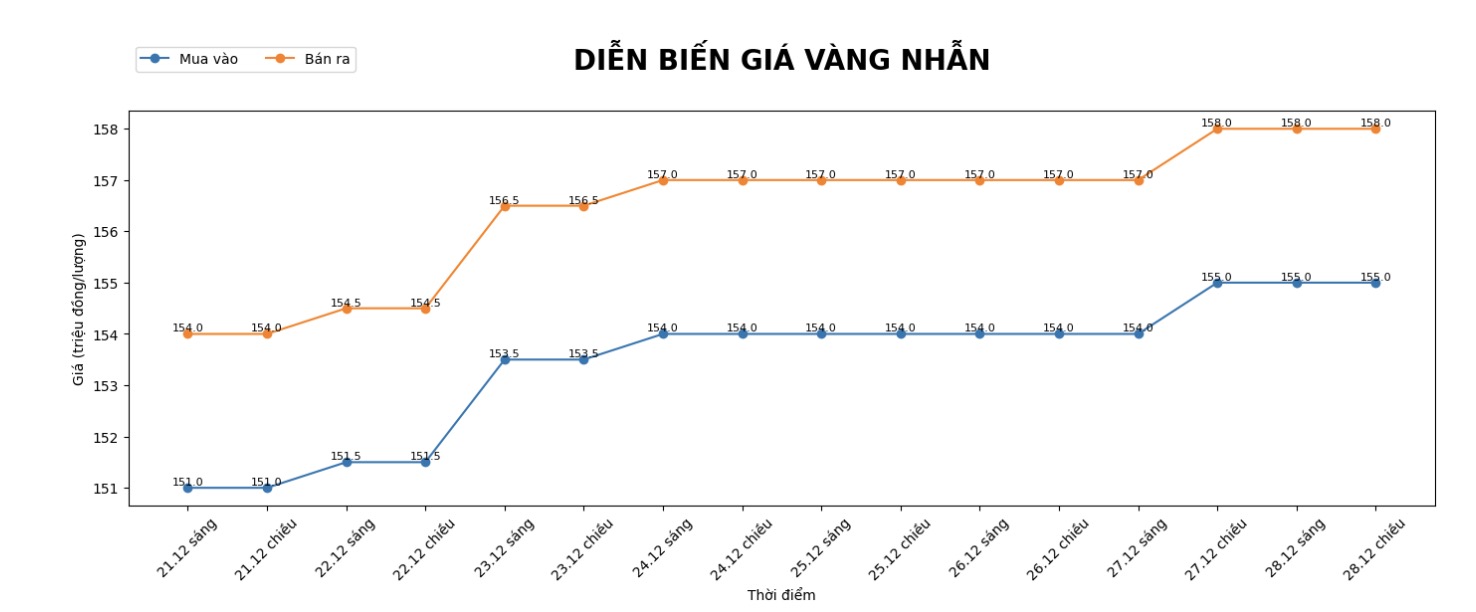

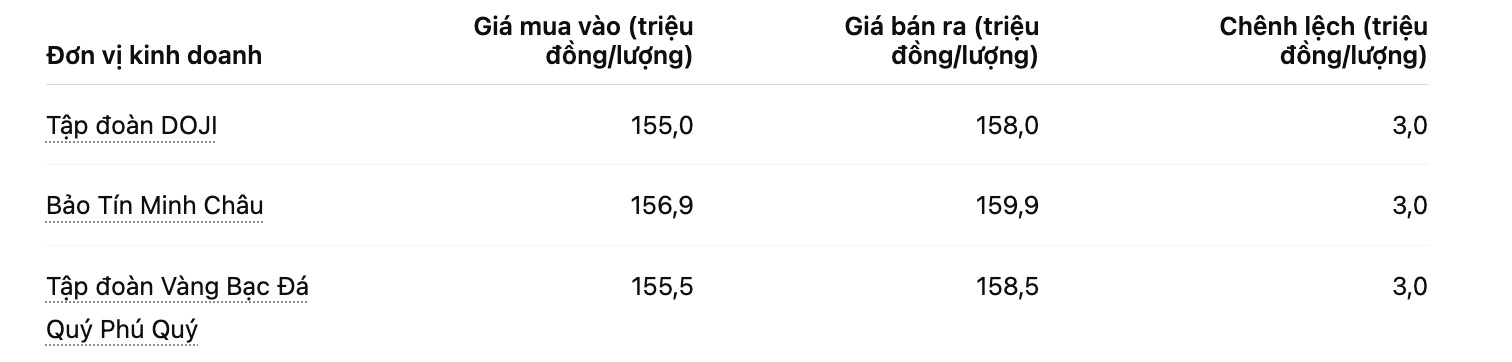

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at the threshold of 155-158 million VND/tael (buying - selling). The difference between buying and selling is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 156.9-159.9 million VND/tael (buying - selling). The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 155.5-158.5 million VND/tael (buying - selling). The difference between buying and selling is 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

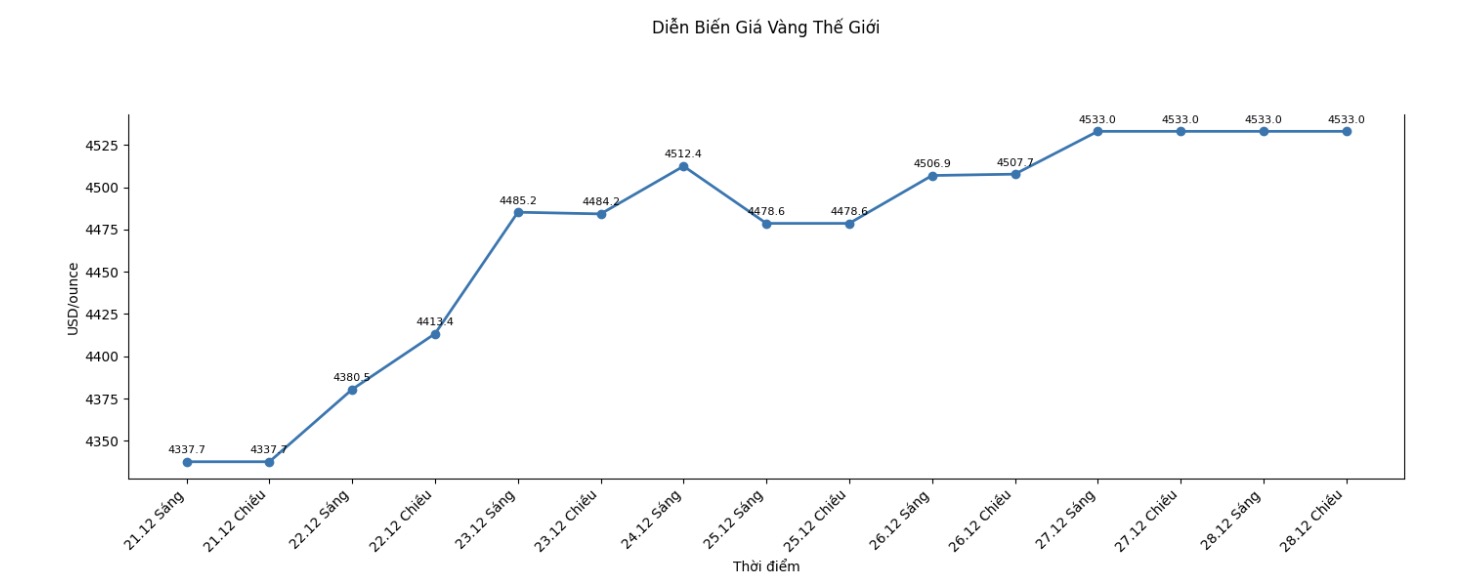

World gold price

World gold price listed at 6:00 am at the threshold of 4,533 USD/ounce.

Gold price forecast

Last week, the world and domestic gold market witnessed an unprecedented strong increase, pushing SJC gold bar prices to nearly 160 million VND/tael, while international spot gold prices stayed at 4,533 USD/ounce at the end of the last session of the week.

Precious metal prices continuously hit new peaks, causing many investors to "blink their eyes" at the volatile market developments. The main reason for the sharp increase in gold prices cannot be separated from the series of complex global geo-economic factors taking place.

First of all, expectations that the US Federal Reserve (Fed) will continue to ease monetary policy and cut interest rates next year have pushed cash flow to shift to shelter assets such as gold - which is not profitable but considered a risk hedging channel in the context of falling interest rates reducing the cost of gold ownership opportunities.

At the same time, a weaker USD also contributed to raising gold prices in foreign currency, causing global demand to increase. In addition, the context of escalating geopolitical tensions in many regions has increased investors' psychology of seeking "safe havens", pushing gold demand to a record high.

Not only individual investors, but even major central banks around the world are increasing gold reserve purchases, as part of a strategy to diversify assets and reduce dependence on the USD.

In addition, the decrease in market liquidity at the end of the year also made price fluctuations more intense, creating volatile "dance" sessions.

All these factors converged, making gold not only a risk hedging asset, but also the focus of investment capital flows, pulling prices up continuously in the past week.

According to forecasts by commodity strategists at Goldman Sachs, gold is the best choice in the entire commodity market next year, and if private investors participate in diversifying their portfolios with central banks, gold prices could completely surpass the level of 4,900 USD/ounce.

The geopolitical and artificial intelligence power race between the US and China, along with fluctuations in global energy supply, are key factors shaping our beliefs" - Goldman Sachs' 2026 Commodity Outlook report stated.

Looking ahead, Goldman Sachs said that their basic macroeconomic scenario includes strong global GDP growth and the US Federal Reserve (Fed) cutting interest rates by 50 basis points in 2026. This will strongly support gold profits once again.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...