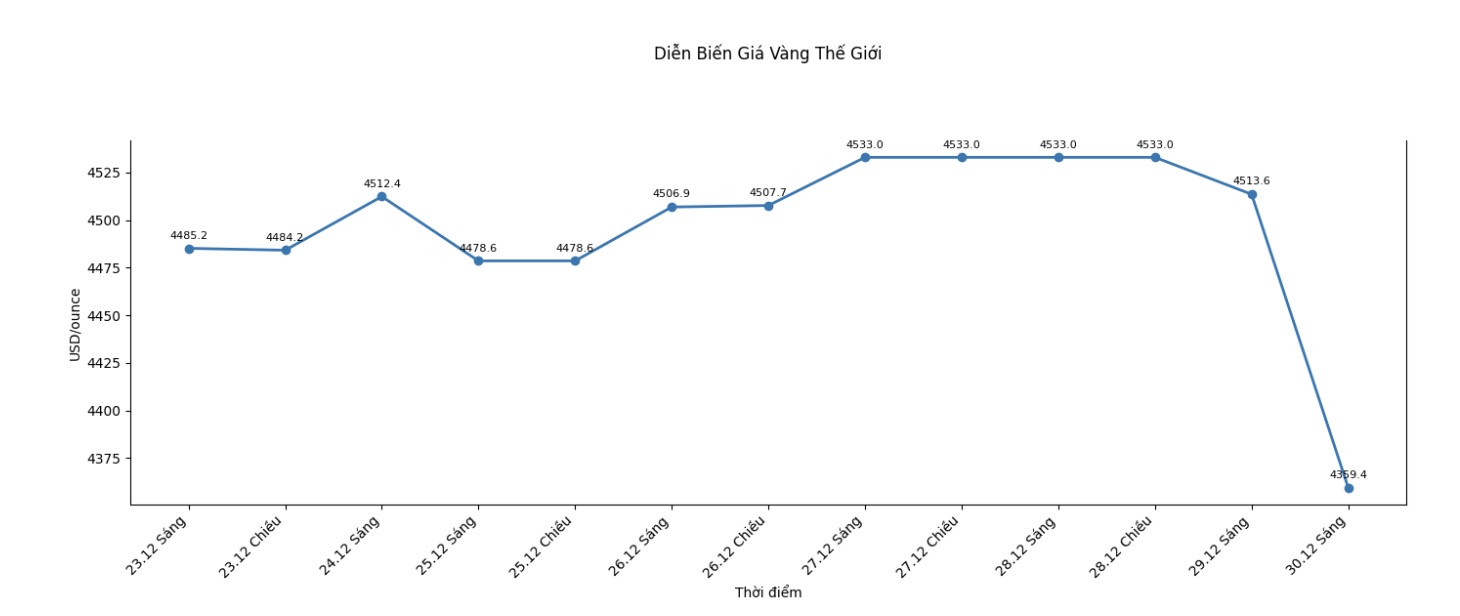

Gold prices, which peaked at $4,550 on Friday - up more than 70% since the beginning of the year - closed the session with a more modest increase, about 65% for the whole year.

Today's sell-off caused gold prices to fall by about 200 USD, equivalent to 4.43%, to 4,332 USD/ounce. Market analysts believe that the main reason is profit-taking after gold recorded the strongest year-on-year increase since 1979.

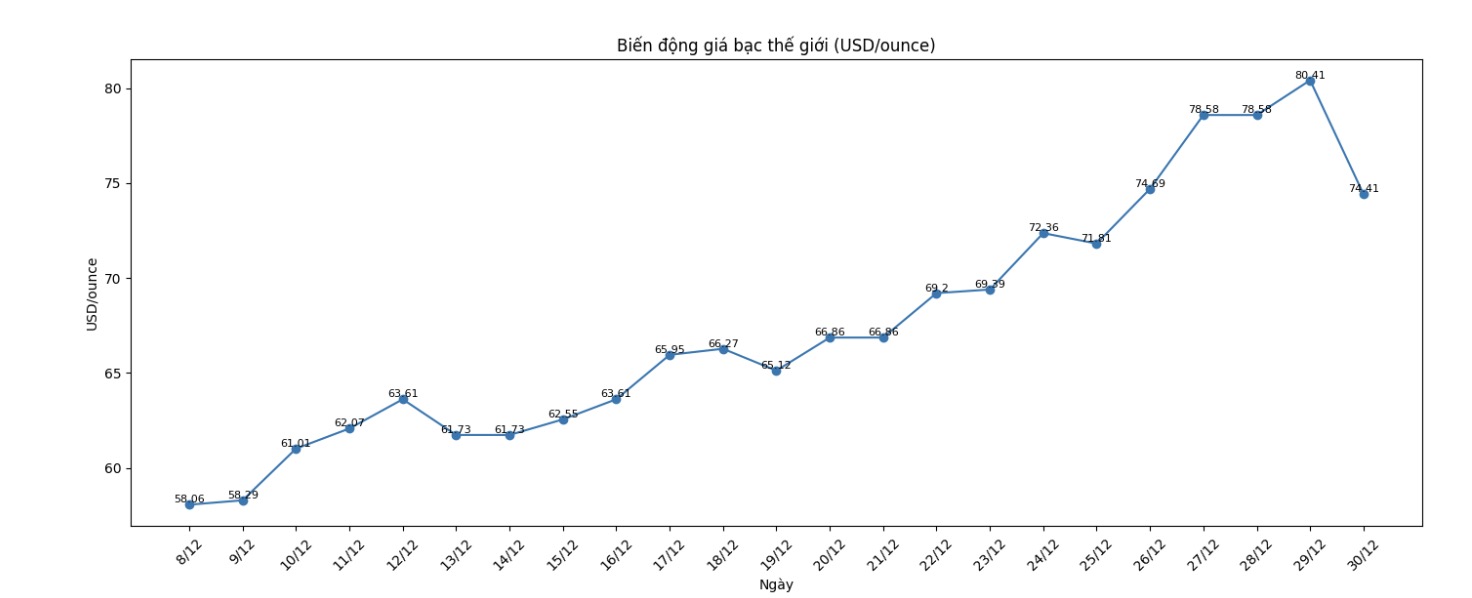

The correction momentum of silver is even stronger. This white metal decreased by 9%, equivalent to 7.2 USD on the spot market, and decreased by 8.7%, equivalent to 6.73 USD on the futures contract market.

The deep decline in silver may be amplified by the decision of the Chicago Mercantile Exchange (CME) to raise overnight deposit requirements to $25,000 - the second increase in just this month.

This move is likely to have triggered sell-offs from leverage traders, forcing them to close their positions regardless of their personal views on the market.

The entire group of precious metals also followed a similar trend, when platinum and palladium simultaneously decreased sharply after reaching the highest levels in many years at the beginning of the session. Platinum closed down 14.92%, while palladium plunged 17.71%. However, after this adjustment session, silver is still the precious metal with the strongest increase in 2025, with spot prices increasing by nearly 150% from the beginning of the year, slightly higher than the increase of 135% of platinum.

In addition to technical factors, geopolitical developments also contribute to selling pressure on gold and, to a lesser extent, silver. Some optimistic and cautious signals about the possibility of peace talks appeared after the meeting between the US President and the Ukrainian President in Mar-a-Lago.

Mixed geopolitical signals have further increased instability in a trading session that has been very volatile.

In another development, world gold prices fell sharply partly due to the sudden sharp increase in house prices in the US.

According to the latest data from the US National Association of Realtors (NAR), the home price index in the US in November increased by 3.3% compared to the previous month, more than three times higher than analysts' forecast of 1.0%. This is considered a positive sign, showing that potential home buyers are returning to the market more strongly than expected.