According to Kitco News' annual silver survey, most individual investors continue to bet on the long-term uptrend of silver. Among more than 370 survey participants, up to 57% predict silver prices will exceed the 100 USD/ounce mark in 2026.

Another 27% believes that the price will remain in a high range of 80–100 USD/ounce. Only a very small percentage, about 5%, predicts silver may return to a price range lower than 60 USD/ounce.

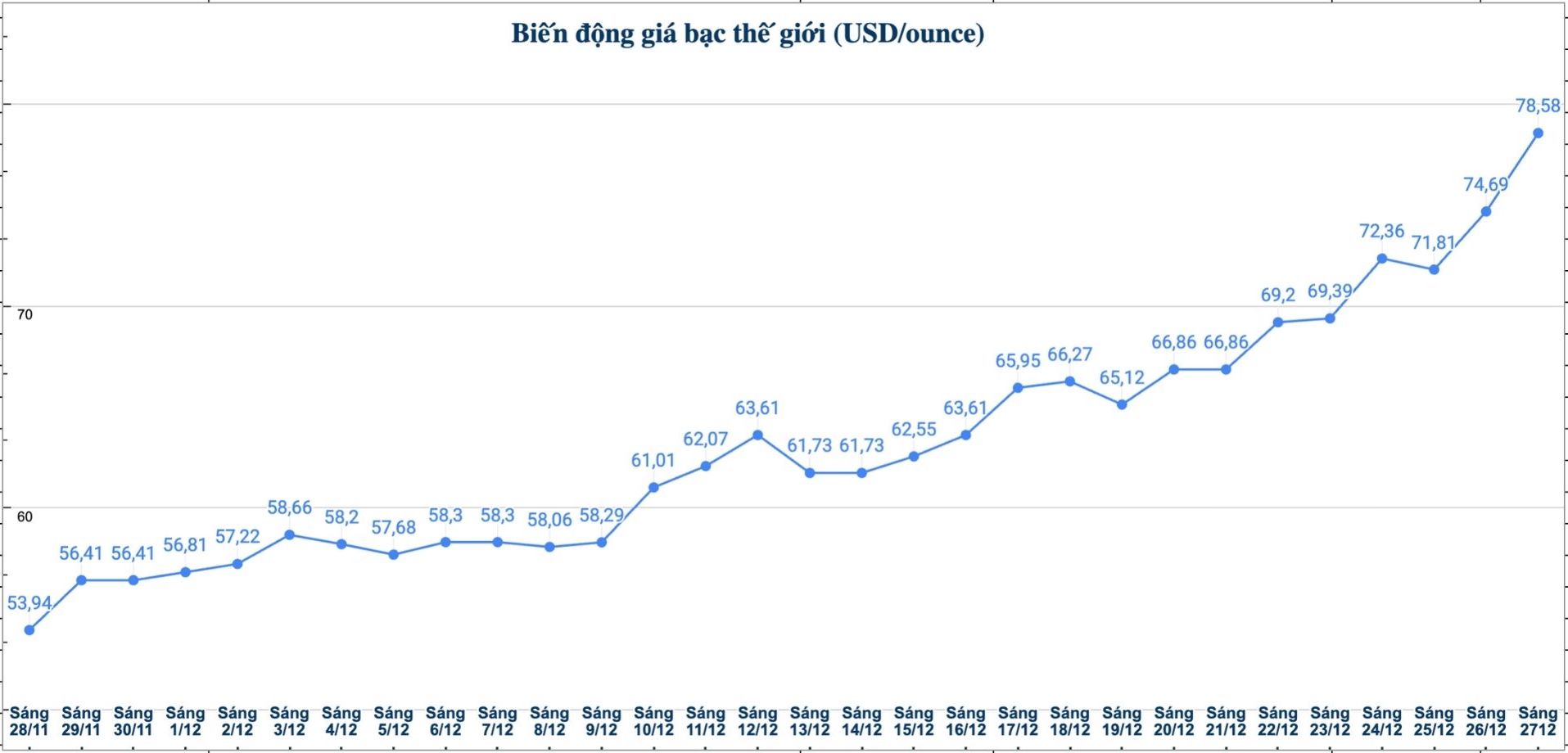

This result shows that the confidence of individual investors is almost unshakable, even when silver has experienced a year of "sky-high" price increases with an increase of more than 170%.

For many investors, the developments in 2025 are just the beginning of a larger upward cycle, driven by structural supply-demand factors, rather than just a short-term speculation.

This optimistic view is also shared by many independent experts. Ms. Maria Smirnova - Operating Partner and Investment Director at Sprott Inc., said that the core issues of the silver market have not yet been resolved.

According to her, global physical silver supply continues to be in a tense state, while investment demand has increased sharply throughout 2025.

Notably, Ms. Smirnova emphasized the shift of material silver shortages from traditional warehouses in London to Asia, especially China. This is considered an important signal because silver is not only held as an investment asset, but also as an essential raw material for industrial production.

The solar energy sector alone consumes more than 200 million ounces of silver each year, equivalent to about 20% of total global supply, of which most of the production takes place in China.

In addition, investment capital is also pouring strongly into silver ETF funds. According to data tracked in 2025, more than 100 million ounces of silver have been added to ETF funds in the West. With the material supply already thin, the rapid increase in investment demand further increases the pressure of shortage, creating a basis for price expectations to continue to rise.

Michele Schneider - Chief Strategy Officer at MarketGauge, also appeared very positive when assessing that silver is still undervalued compared to other assets, especially gold.

She believes that, from a historical perspective, the gold/silver price ratio still has room to decrease further. When this ratio narrows, silver tends to increase faster and stronger than gold, opening up the possibility of a significant price breakthrough.

Many independent experts even believe that the 100 USD/ounce mark is not too far-fetched a scenario. Some technical analysts believe that after breaking a series of important resistance levels in 2025, silver is entering a stage that is likened to "the cat out of the pocket", when market sentiment changes strongly and speculative and long-term investment cash flows simultaneously enter the game.

However, even within the optimistic group, there is a certain caution. Many opinions admit that the silver market may experience strong corrections in the upward process.

However, the common point is that these adjustments are seen as buying opportunities, instead of signs that the upward trend has ended.

Summarizing the views shows that, while major financial institutions are concerned that silver has increased too sharply, retail investors and independent analysts still place their trust in the medium and long-term prospects of this metal.

For them, the story of silver lies not only in short-term price fluctuations, but in a long-term supply-demand imbalance, enough to support a new upward cycle in 2026 and beyond.