Full set of current Vietcombank interest rates

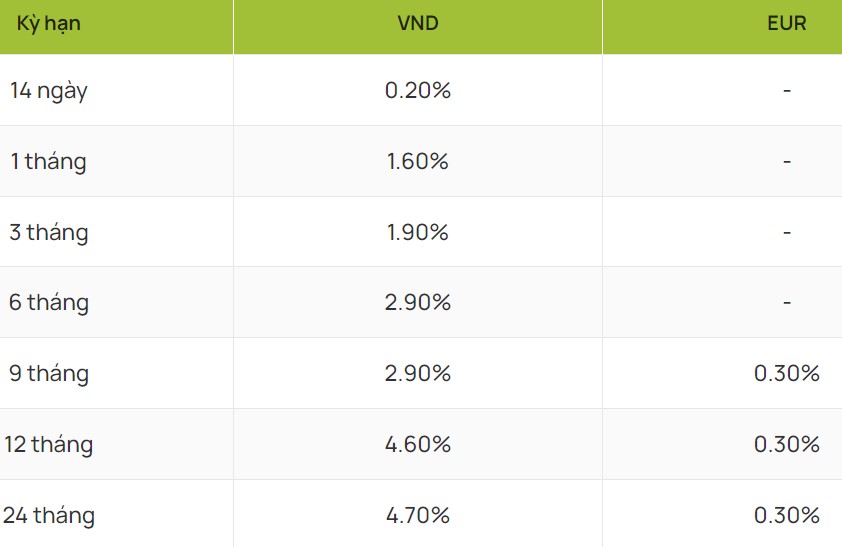

According to the latest interest rate schedule, Vietcombank applies diverse savings interest rates depending on the deposit term. Specifically:

No term: 0.1%/year.

Short term (1 month, 2 months): 1.6%/year.

3 month term: 1.9%/year.

6 month and 9 month terms: 2.9%/year.

12 month term: 4.6%/year.

Long term (24 months, 36 months, 48 months, 60 months): 4.7%/year.

This interest rate applies to savings deposits at the counter. If you deposit money online via Vietcombank's digital banking service, the interest rate may be adjusted slightly higher for some terms to encourage online transactions.

Online savings interest rates

Online savings are becoming a popular trend thanks to their convenience and more attractive interest rates than at the counter. Vietcombank often offers an additional 0.1% - 0.2%/year for term deposits of 6 months or more via digital banking applications.

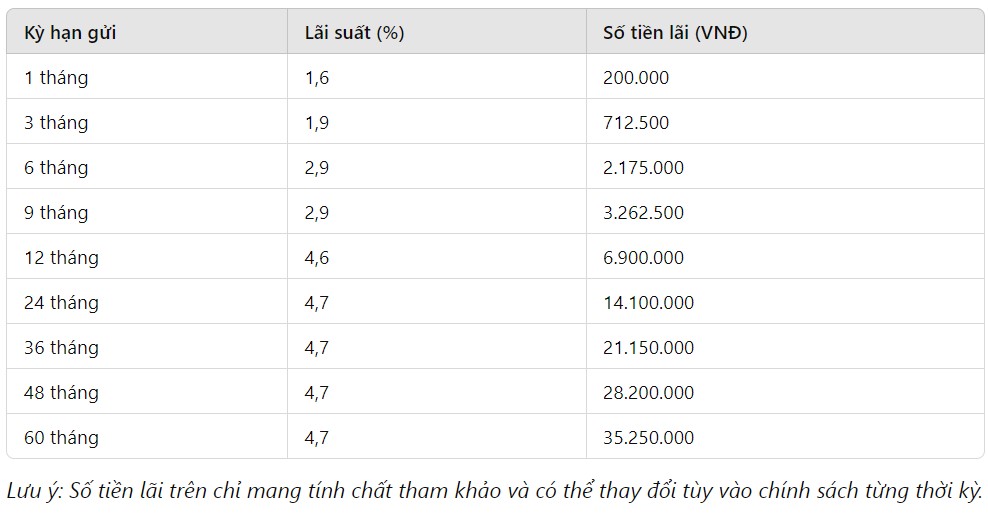

Calculate Vietcombank savings interest rate

With a deposit of 150 million VND, the amount of interest you receive will depend on the deposit term and applicable interest rate.

Although the current interest rate is somewhat lower than previous years, Vietcombank is still one of the safe and reliable choices with a diverse portfolio of savings products.

To optimize profits, you can choose the appropriate term. Longer terms of 12 months or more have higher interest rates, up to 4.7%/year. Readers can also use online services to take advantage of preferential interest rates when saving online.

In addition, you can learn about Vietcombank's preferential programs to receive higher interest rates. This bank often implements promotional programs for customers who deposit savings during holidays and Tet.

Interest rate information is for reference only and may change from time to time. Please contact the nearest bank transaction point or hotline for specific advice.